Want a more convenient way to perform your financial transactions? Or have you recently heard of Cash App and want to know better? Read on to learn more.

To Use Cash App: 1. Open Cash app 2. Enter your registered phone number or email address 3. Enter the code in the provided space 4. Enter your debit card 5. Select a unique username—$Cashtag 6. Enter your ZIP code, find your contacts, and start using Cash App.

If you just installed Cash App, congrats. You’ve just joined about 36 million other users on this financial network and the company grossed $385 million in 2020.

And if you’re wondering how Cash App works or unsure whether to install it or not, or you just want to know how to navigate your way through its services, you’re reading the right article.

What Is Cash App?

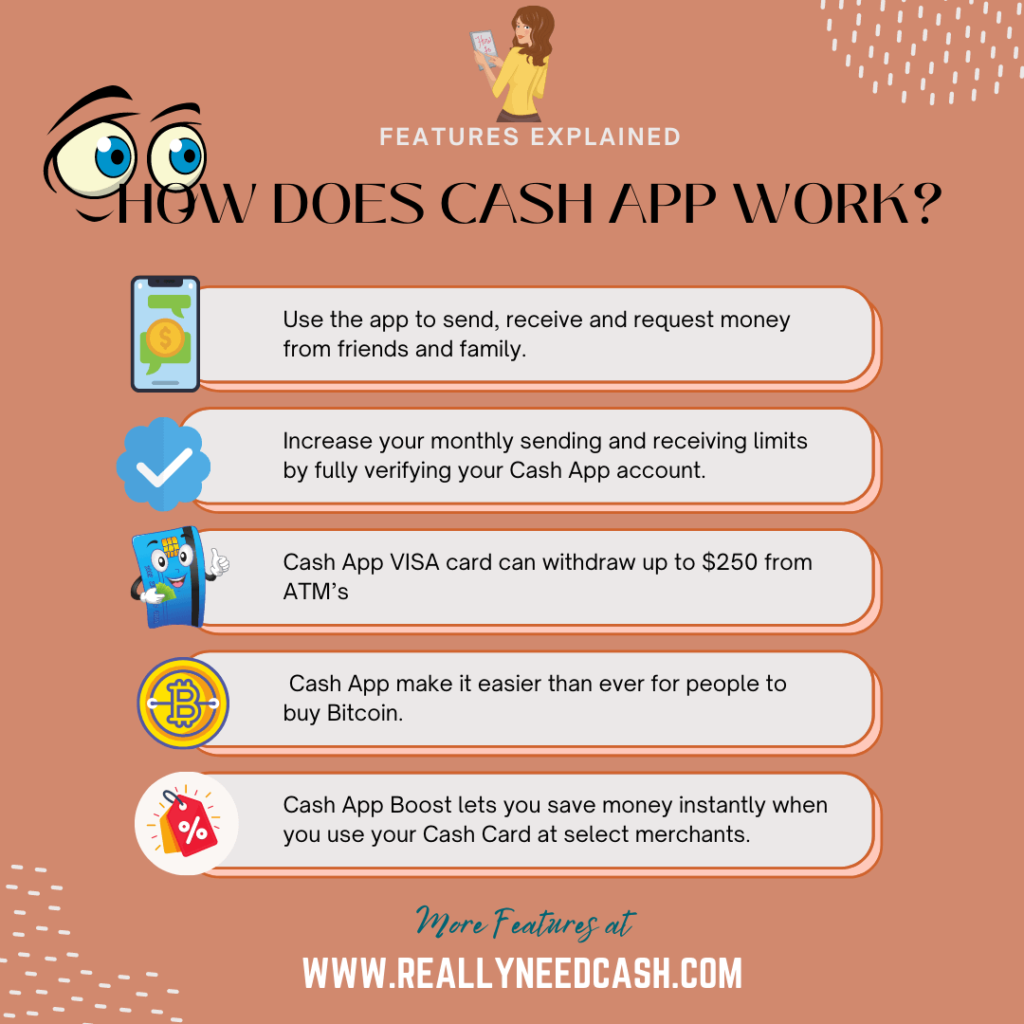

Cash App, originally called Square Cash, is an online financial platform that allows you to send and receive money.

The app, like many others, allows you to create a free account as a new user. You also have the opportunity to make cashless and direct peer-to-peer transactions across the United States and the United Kingdom.

Setting up as a newbie is easy on Cash App. You can simply download the application onto your device, browse and select a unique username, and fill in your valid contact details. However, keep in mind that you’ll need an active bank account linked to the app on your device to perform fund transfers.

When compared to other financial apps, Cash App is unique. This is because you can request a Visa-verified debit card, mostly known as the Cash card.

This card can be used at any retail outlet hosting the Cash App service and even at traditional ATMs. And yes, all at no cost!

Read: What is Cash App Bank Name for Direct Deposit?

Setting up on Cash App

Cash App is focused on giving you maximum convenience in making and receiving payments, investing money, and saving it. The app makes it simple to have an account with just a few clicks and begin immediate and real-time transactions.

Besides the general payment and receiving funds, you can invest in stocks and mine bitcoins on Cash App. You’ll have all these options once you complete your setup. Now, let’s show you how.

Accessing the App

With good internet connectivity, you can download Cash App onto your mobile device from Google Play or the Apple App Store. You’d also be able to use the app directly from your computer’s web browser.

Creating an Account

These steps will guide you in creating a Cash App account:

- Open Cash app

- Enter your registered phone number or an email address.

- You’ll receive a secret verification code as a text or email. Enter the code in the provided space. There’s also an option to invite friends to sign up; this gives you some advanced cash.

- Enter details of your debit card to link your bank account to Cash App.

- Select a unique username—$Cashtag, which you’d use for transactions.

- Enter your ZIP code, find your contacts, and start using Cash App.

Verifying Your Identity

On Cash App, you’ll have to verify your identity and prove you’re the account owner when you’re making or receiving payments that exceed the allowed weekly limits.

You can send up to $250 within seven days and receive up to $1000 within 30 days. To increase these limits, you’ll be asked for further verification, such as your full legal name, date of birth, and the last four digits of your social security number.

Now that you’ve set up and verified your account, let’s explore the other features that Cash App offers.

Applying for a Cash App Card

You can order a Cash Card after verifying your account identity. This is a Visa debit card linked to your Cash App account that you could have for your convenience. Having the Cash Card gives you discounts, known as boosts, for patronizing products and services.

You can choose to customize your card with special colors or other designs, and all come at no additional cost. You’ll get your card in 10 business days, after which you can start using it immediately. And in applying for a Cash Card:

- On your Cash App home screen, select the “Cash Card” tab.

- Tap “Get Cash Card” and select “Continue.”

- Follow the remaining steps by submitting your postal address and other details.

Keep in mind that you may also have to verify your Cash App identity when requesting a Cash Card. So you’ll need to provide your full name, date of birth, address, and the last four digits of your SSN.

Crediting and Adding Your Bank Account

To perform any form of transaction on Cash App, your account has to be credited with the money. And you can add money to your Cash App account in two ways. You can always change your Bank info later on after setting it up.

Let’s take a look at them.

Adding a Bank to Your Cash App

To connect your bank account to your Cash App account, you can use the following steps:

- Select “Profile” on your Cash App home screen.

- Tap on “Linked Banks.”

- Select “Link Bank” and select the name of the bank from the list.

- Submit the remaining details to successfully link your account.

Adding Cash to Your Cash App Balance

To add cash to your Cash App balance, follow the steps below:

- Tap the “Banking” tab on your Cash App home screen.

- Press “Add Cash.”

- Choose an amount.

- Tap “Add.”

- Use Touch ID or enter your PIN to confirm.

Sending and Receiving Money on Cash App

So far, we’ve seen that you can fund your Cash App account through an external bank account. We’ve also looked at how to add cash to your Cash App balance.

But that’s not all. You can also send and receive money on Cash App. So let’s look at how you can do that.

To send a payment, do the following:

- Tap to open Cash App on your phone.

- Add the amount you intend to send.

- Select “Pay.”

- Fill out the details of the receiver (phone number, email address, or the person’s username in the app).

- Enter what the payment is intended for.

- Select “Pay.”

You can send and receive money instantly on the app. Although adding money to your Cash App account can take a few days, you can make instant deposits to your bank account instead. These deposits are immediate but have a 1.5% fee.

Refer Cash App Fee Calculator to check more accurate results.

If you received payment and would like to see the details, click on the “Activity” button. To view the amount added to your account, tap on the “My Cash” button. You’ll see a roundup of your deposited funds.

Also, for an overview of your account details, check your account transaction statement by following this process:

- Signing in to Cash App’s website.

- Click the “Statements” button in the top-right corner.

- Then, select which month’s statement you’d like to view.

Note that the monthly statements will be available to you within five business days of the month’s end.

Canceled Payments on Cash App

Cash App monitors your account to prevent it from fraud. If a potential fraudulent payment occurs, Cash App immediately cancels it so that you’re not charged.

In that case, your funds will be returned to your Cash App balance or your linked bank account. Depending on your bank, the funds should be available within 1-3 business days.

To avoid canceled payments, we advise that you only send payments to and receive payments from people you know and other trusted institutions. In addition, always confirm the recipient’s phone number or $Cashtag before sending payments.

It’s important to note that you need to use your Cash App regularly to build a healthy transaction history.

Cashing Out on Cash App

Now that you know how to send and receive money on Cash App, let’s learn how to withdraw your funds from your account. You’ll need your linked bank account to successfully cash out money. The steps below will guide you:

- Select the “Balance” tab on your Cash App home screen.

- Tap “Cash Out.”

- Enter your preferred amount and select “Cash Out.”

- Select a deposit speed.

- Enter your PIN or use your touch ID to confirm.

The funds will be transferred into your bank account depending on your selected deposit speed.

Cashing Checks on Cash App

If you received a check from someone and are wondering if you can deposit the money into your Cash App, the answer is yes, you can. Cash App accepts electronic checks, which is the electronic image of the paper check.

To cash a check means to convert a paper check to cash. This way, you don’t have to go to the ATMs and bank offices. Instead, you can just load your check to your online account or a card. To withdraw a check in the app, you’ll have to use a feature known as the “Mobile Check Capture.”

All you have to do is to use your phone to take a snapshot. For this feature to work, you’ll have to ensure that you’ve given the app access to your camera and the pictures and videos on your phone.

The “Mobile Deposit Capture” on Cash App provides an easy means to deposit your checks into your savings. You can also check your deposit account smoothly without the need to go to the bank. This can be done conveniently on your mobile phone by simply taking a picture of both sides of the check.

After the Cash App receives your transmission, it’ll be reviewed. It has the full right to accept or decline your electronic check. So you must keep the original check in a secure place, as Cash App can reverse its decision to accept or decline your electronic check.

You’ll be notified of whatever decision it takes. If your electronic check is successfully submitted, you’ll receive a confirmation from Cash App in that regard.

So by using this feature, you can cash a check or make a deposit without going to the bank.

Keep in mind that when you deposit a check from your mobile phone, your account will be credited on the first business day after submission.

Benefits of Using Cash App

As a Cash App user, you enjoy several benefits. Let’s take a look at some of them.

- You won’t be charged monthly fees on Cash App. Plus, there are no inactivity fees, foreign transaction fees, or sending and receiving money fees.

- You’ll receive an optional free debit card.

- With your Cash Card, you can easily perform transactions and use money in your Cash App account.

- With the Cash Card, you can pick a particular boost on your account. Then, while purchasing an item from a vendor, you can have a discount using these boosts.

- If you send your friends a referral code, you’ll receive a cash bonus of $5. They have to sign up using your link, though.

- You can sell, buy, and know the value of bitcoins on Cash App. You can also invest or buy stocks from prominent companies.

- You enjoy cashless transactions with additional features.

Imagine a service that can help you pay utilities with your roommates, split lunch expenses, or do any other task that requires sending and receiving money. What’s more?

The service also functions similarly to a bank account.

Last Words

All in all, we’ve provided you with everything you need to know about using Cash App. Follow this guide, and you’ll make the most out of the application.

To recap, we walked you through setting up your account, adding your bank accounts, sending and receiving money, cashing checks, verifying your account, and down to the several benefits you enjoy from using Cash App. So it’s time to start enjoying cashless transactions on your mobile.

Also, if you face any issues while using the app, you can contact Cash App support.