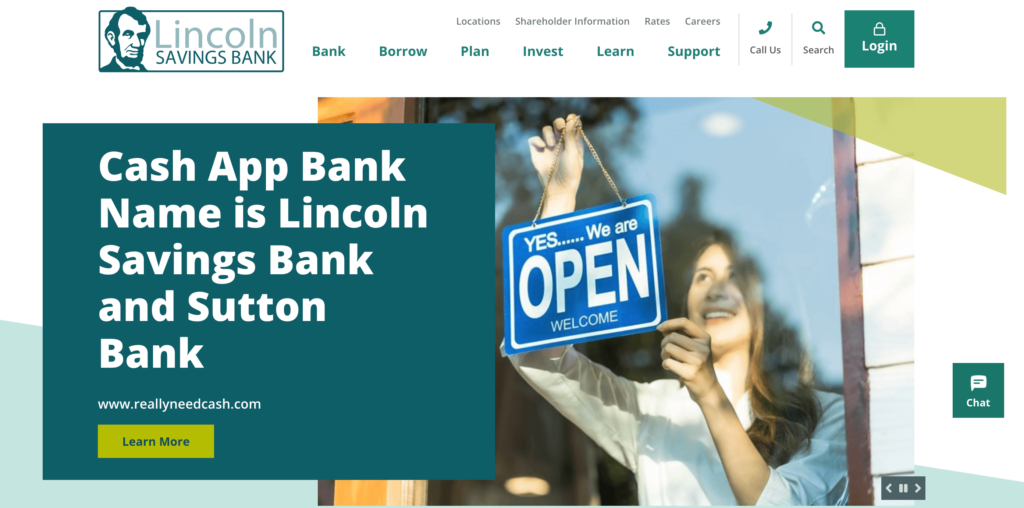

What is Cash App Bank Name?

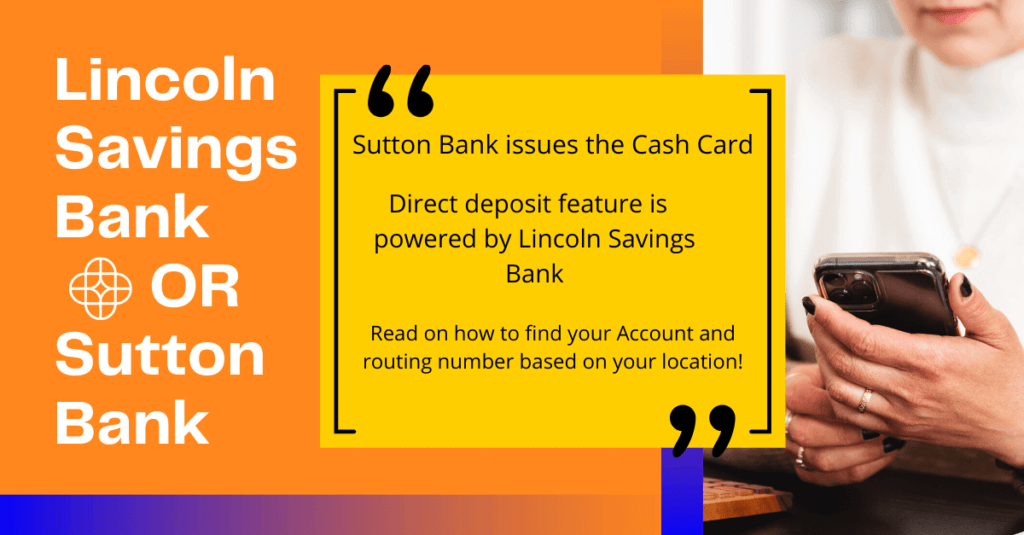

Cash App Bank is a partnership with Lincoln Savings Bank and Sutton Bank, offering users direct deposits, tax refunds, and FDIC-insured Cash VISA Debit Cards, safeguarding deposits up to $250,000.

Cash App doesn’t have its own bank. Instead, it partners with banks that are members of the Federal Deposit Insurance Corporation (FDIC).

This means that your money is insured by the FDIC, which is a good thing.

Cash App Bank Partnership

- Sutton Bank: It manages the Cash Card and provides a range of other banking services.

- Lincoln Savings Bank: They handle direct deposits.

Is Cash App a Bank?

No, Cash App isn’t a bank in itself. It collaborates with two FDIC-insured bank partners, namely Lincoln Savings Bank and Sutton Bank, to offer financial services to its users providing debit cards, direct deposits, and more.

Lincoln Savings Bank manages the Direct Deposit feature of Cash App, allowing users to receive their paychecks directly in their Cash App account.

I use their direct deposits for my paychecks and almost every week with the Cash Card here and there for my grocery and gas bills.

Fake Cash App Screenshot and Verify Cash App Account

What Bank Does Cash App Use?

While Cash App is not a bank itself, it operates in collaboration with the Bank to provide secure and reliable money transfer services.

1. Lincoln Savings Bank

- It Processes direct deposits for Cash App users, enabling convenient paycheck and payment transfers.

- Provides support for Cash App’s direct deposit feature, enhancing users’ financial experience.

2. Sutton Bank

- Offers Cash App users the ability to issue the Visa-powered Cash Card.

- Facilitates the issuance of the Cash Card, which can be used for purchases both online and in stores.

Cash App Bank Address

To find your Cash App bank name, account number, and routing number:

- Open Cash App on your Phone

- Tap the Banking tab

- Look under your current balance

- Tap the numbers if they’re partially obscured

At the moment, Cash App is only available in the US and UK. So, you will be only allowed to send money from one US or British bank account to another.

International transactions are limited at the moment.

How to Locate Your Cash App Bank?

| Bank Name | Address | Routing Number | Account Number | Account Type |

|---|---|---|---|---|

| Lincoln Savings Bank | 508 Main, PO Box E Reinbeck, IA 50669 | 073 902 422 | Your Cash App account number | Checking |

| Sutton Bank | 1 S Main St, Attica, OH 44807 | 041 215 663 | Your Cash App account number | Checking |

What is Cash App Bank Name for Tax Refund?

Cash App bank name for tax refund is Lincoln Savings Bank. For tax refund purposes and direct deposit, Lincoln Savings Bank is the bank name that you need to use with Cash App.

When it comes to tax refunds and setting up direct deposit with Cash App, you should use the bank information for Lincoln Savings Bank rather than Sutton Bank.

Lincoln Savings Bank vs. Sutton Bank

| Feature | Lincoln Savings Bank | Sutton Bank |

|---|---|---|

| FDIC Insured | Yes | Yes |

| Cash App Support | Yes | Yes |

| Services Offered | Direct deposit processing | Checking and savings accounts, loans, credit cards |

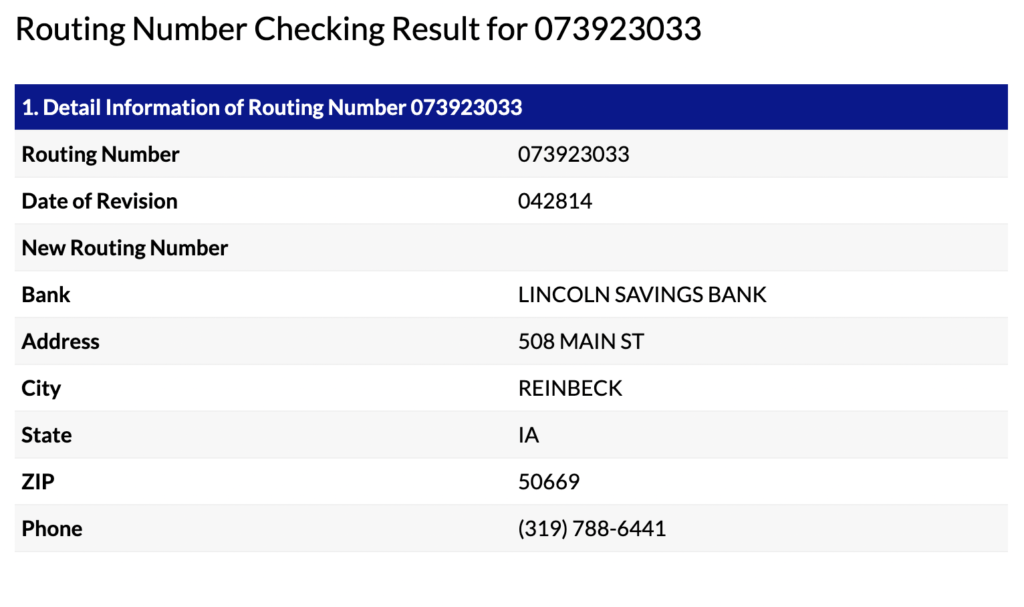

Lincoln Saving Bank Routing Number

Routing Number: 073923033

Date of Revision: 042814

Bank: LINCOLN SAVINGS BANK

Address: 508 MAIN ST

City: REINBECK

State: IA

ZIP: 50669

Phone: (319) 788-6441

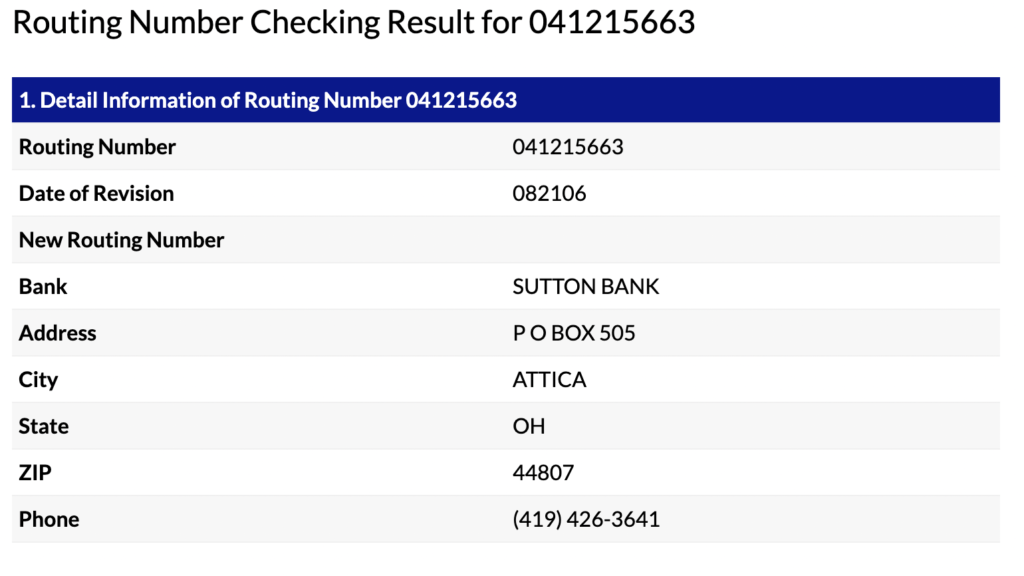

Sutton Bank Routing Number

- Routing Number: 041215663

- Date of Revision: 082106

- Bank: SUTTON BANK

- Address: P O BOX 505

- City: ATTICA

- State: OH

- ZIP: 44807

- Phone: (419) 426-3641

- Address: 1 S Main St, Attica, OH 44807.

I feel like the app is quite secure and I will say I have used tons of P2P apps and other banking services, but Cash App is just as easygoing and also quite secure.

How to Find Your Branch Cash App Bank Name: Step-By-Step

In order to set up direct deposit on Cash App, you need to know your bank’s information. This includes your bank’s name, address, routing number, and account number.

Total Time: 2 minutes

Step 1: Open Cash App

Launch the Cash App on your device.

Step 2: Navigate to the Profile Section

Tap the profile icon located in the top left corner of the screen to access the Profile section.

Step 3: Tap on the “Cash” icon

Under the “Cash” section, you will see your Cash App balance and a button that says “Add Cash.” Below that, you will see your account and routing number.

Step 4: View your Cash App Bank Details

To see your bank name, tap on the account number. A pop-up will appear that shows your bank name, routing number, and account number.

Read: What Kind of Account Is Cash App?

Do You Need a Bank Account to Use Cash App?

No, you don’t need a bank account to use Cash App, and even if you have one, you don’t need to link it to Cash App if you don’t want to.

You can add money by depositing cash at a retailer or setting up direct deposits to your Cash App balance.

You don’t need a bank account to use Cash App, but having one can make it easier to access your funds.

I found and experienced that having one is better because it will give more access to other features which are limited if you don’t link your account.

Cash App Bank Address Zip Code?

Cash App Bank’s Address Zip Code is 50669 – Lincoln Savings Bank 508 Main Street Reinbeck, IA 50669.

How to Transfer Money from Cash App Without a Bank Account?

So you want to transfer money from Cash App but you don’t have a bank account? Simply follow these steps:

Step 1: Order a Cash Card

The first thing you gotta do is download a Cash Card. It’s basically a virtual debit card that you can use to withdraw money from an ATM or make purchases online. You can order one for free from the Cash App.

Step 2: Add Funds to Your Cash Card

Once you have your Cash Card, you need to add funds to it. You can do this by linking your debit card or credit card to your Cash App account.

Just tap on the “Add Cash” button and enter the amount you want to add.

Step 3: Send Money to a Friend

Now that you have funds on your Cash Card, you can send money to a friend.

Just open the Cash App and enter the amount you want to send. Instead of selecting a bank account, choose the option to send it to a friend.

Enter your friend’s phone number or email address and hit send.

Step 4: Have Your Friend Withdraw the Money

Your friend will receive a notification that you sent them money.

They can then use their own Cash App account to withdraw the money from an ATM or transfer it to their own bank account.

How to Get a Direct Deposit Form?

I will walk you through the process of setting up direct deposits to making payments:

- Open Cash App

- Tap the “Banking tab”

- Click on “Direct Deposit”

- Select “Get Direct Deposit Form”

- Fill out your employer’s information

- Enter the amount you want to deposit from each paycheck

- Select “Email Form”

- Enter the recipient’s address

- Tap “Send”

How to Set Up Cash App Direct Deposit: Tutorials

Here is a step-by-step guide to help you set up Cash App Direct Deposit from $25,000 to $50,000.

Step 1: Tap the Money Tab

Open your Cash App and tap on the “Money” tab located in the bottom left-hand corner of your screen.

Step 2: Select Direct Deposit

Next, select “Direct Deposit” and tap on “Get Started” under the “Automatic Setup” option.

Step 3: Search for Your Employer

Enter the name of your employer or payroll provider, and select it from the search results.

If you cannot find your employer, you can manually enter your employer’s routing and account numbers.

Step 4: Enter Your Employer’s Information

Enter your employer’s username and password when prompted. This information is used to verify your employment and set up your direct deposit.

Step 5: Confirm Your Information

Review your information and confirm that it is accurate. Once you have confirmed your information, your direct deposit will be set up and ready to use.

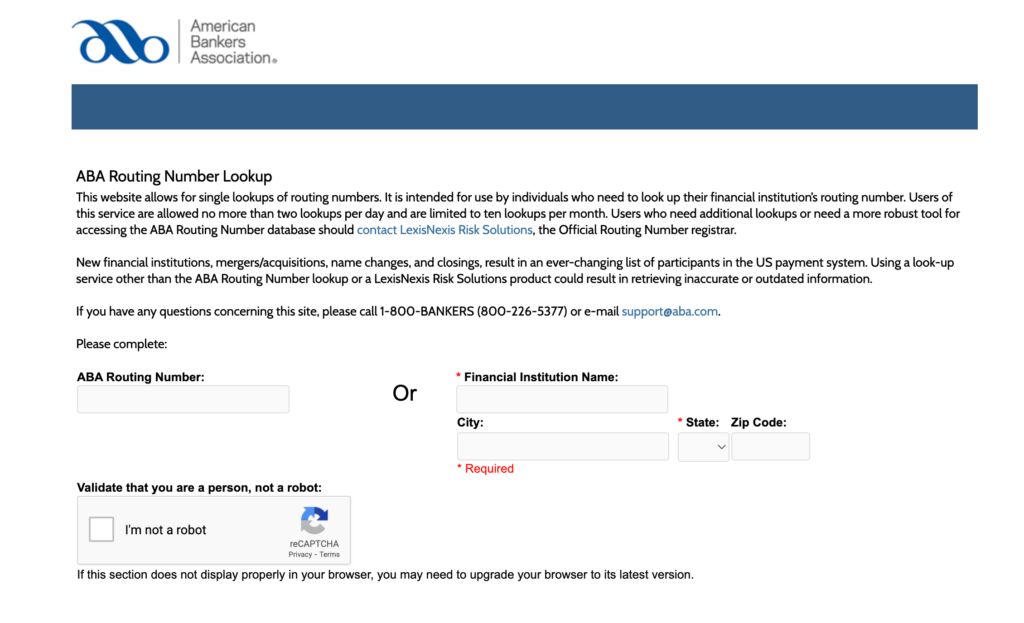

How to Find a Cash App Bank from Your Routing Number?

To look up your bank name and other info via its routing number, you can search on the ABA’s website.

- Visit the ABA Routing Number Lookup Website.

- Accept their terms of conditions.

- Enter your Routing number and Validate that you are a person, not a robot

- Click on the search to find your Cash App bank name.

Users can also earn $100 from Cash App by doing surveys and participating in other promotions.

Does Cash App Bank Offer a Debit Card?

Yes, Cash App offers a free Visa debit card called the “Cash Card.” It’s linked to your Cash App balance and can be used online and in stores where Visa is accepted.

User Testimonials

Note: These user testimonials are from Reddit users about their experiences and knowledge regarding Cash App’s bank information.

My Personal Experience with Cash App Bank

Here are some unique tips, tricks, and insights for using Cash App, along with my explanations of why they can be beneficial:

- Cash Boosts for Discounts

- Bitcoin Investment

- Instant Transfer

- Customized Cash Card

- Direct Deposit Setup

- Cash App for Business

- Cash App Cash Card for Teens

- Cash App Investing

- Cash App Debit Card Control

- Cash App Boost Partners

I will say they are helpful and beneficial because they all add up to the unique experience of using the app and not just for sending and receiving money.

Last week, I got a Boost for Starbucks and my wife got a Chic-Fil-A Boost. I know it’s not a big deal, but like I said it’s the small things like this, that personally make me love the app.

Cash App Account Number Benefits

- Set up direct deposit for your paycheck, tax return, or other checks

- Deposit money

- Make payments

- Attach your bank routing number to your account

More Cash App FAQs

What is Cash App Bank Name for Direct Deposit?

Cash App Bank’s name for Direct Deposit is Lincoln Savings Bank.

What is the routing number for Cash App direct deposit?

The routing number for Cash App direct deposit is 073923033. This routing number is associated with Lincoln Savings Bank, which is Cash App’s partner bank for direct deposit services.

What is Cash App bank name on Plaid?

Cash App Bank name for Plaid is Lincoln Savings Bank. When you link your bank account to Cash App using Plaid, you will see the name of the bank that you are linking to.

Is Cash App Free to Use?

Yes, Cash App is totally free to use for most of their services. However, there are fees associated with certain features such as instant deposit transfers and ATM withdrawals, Bitcoin investments.

Is Cash App FDIC-Insured?

Yes, Cash App balances are FDIC-insured only when they are stored on the Cash Card, which is a debit card issued by Cash App. In other words, the FDIC (Federal Deposit Insurance Corporation) insurance coverage applies to the funds on your Cash Card if the partner bank where your funds are held were to face financial difficulties.

Are There Transfer Limits With Cash App?

Yes, Cash App has a transfer limit of $250 in 7 days and receives up to $1,000 in 30 days for Unverified accounts. After verification, you will be able to send $7,500 in 30 days with no inbound transfer limits.

Is Your Cash App Activity Publicly Available?

No, your Cash App activity is private. Transactions are locked and only accessible by you with your login details.

More Cash App Tutorials

- Buy Verified Cash App Accounts

- AprilCash55.com: Review

- What Bank is Cash App on Plaid?

- Is Cash App Anonymous?

- I Got Scammed On Cash App: What Do I Do Now

- Cash App Direct Deposit Unemployment Benefits Guide

- How To Verify My Identity on Cash App Verify Account

- How To Order a Cash App Card For a Friend or Someone Else

- How to Remove a Family Account on Cash App

- Is the $750 Shein Gift Card Real from Flash Rewards

- 400+ Best Cash App Names $Cashtag Examples

- How Do You Order a Cash App Card Tutorials