A Mobile check deposit allows you to deposit your checks without running to your bank and can remotely cash your check simply by snapping a picture of the front and back of the check from your smartphone.

To Cash Check in Cash App – Use the Mobile Check Capture provided by Cash App and take a picture of the endorsed check with your smartphone with all hardware and operating permissions that it requests. After your transmission, Cash App will review and accept or decline your Electronic Check.

If you are paid by check or have a check to cash, you can do so without running to your bank every time.

What is Mobile Check Capture Cash App?

Mobile Deposit Capture on Cash App is a convenient way to deposit your checks into your savings or checking deposit account quickly and easily without going to your bank from just your mobile devices.

Cash a Check service in the Cash app allows you to cash checks and have them credited to your Cash App account,

Is Mobile Check Deposit on Cash App Safe?

Mobile check capture and deposit are as secure as your other online and mobile banking features. This means if your Cash App and the bank is taking steps to protect your information, such as encryption and enhanced security measures, then their mobile check capture functions should be protected in the same ways.

However, that doesn’t necessarily mean it is foul-proof.

For instance, it is entirely possible to be targeted with a remote deposit capture scam, where you are asked to deposit a fraudulent check using a mobile deposit. You can keep and protect yourself against this type of fraud by only accepting paper checks from the people that you trust.

This won’t be a problem if you are issued the check by your employer or people you know.

How Does Mobile check capture Cash App Work?

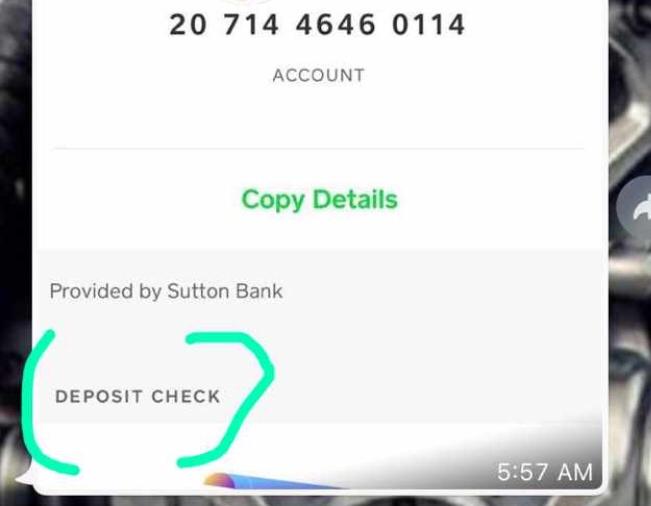

You need to submit your Electronic Check on Cash App with the Deposit Check Feature to capture and retain various information from the mobile device.

To perform Mobile Check Capture, you need to provide and give Cash App permission with all the hardware and operating permissions – the device’s camera, files, time, and geolocation data.

After providing your check, Cash App will review and they have the right to accept or decline your Electronic Check.

How long does Cash App mobile check deposit take?

When you deposit a check from your mobile device, it may take a bit longer for your funds to be credited based on what time of day the deposit was made.

Every day is a business day for the mobile check except on Saturdays, Sundays, and federal holidays

For example, mobile check deposits made before 4:00 p.m. Pacific Time on a business day, will be Successfully Submitted on that day.

If you Submit an Electronic Check after 4:00 pm Pacific Time or on a day that is not a business day, it will be successfully submitted on the next business day.

What happens if you do a mobile check deposit a fake check?

Going to jail for just depositing a fake check may sound severe, but Cash App will decline your Check.

In the case that you are a victim of a scam and do indeed try to deposit a fake check in good faith, you will not get any criminal charges as it is not necessarily your fault.

But if you do knowingly deposit a fake check, it might not be legal.

However, if you do try mobile check capture on Cash App, they will decline your check if it is fake.

Are mobile check Capture available immediately on Cash App?

As mentioned above, deposits are subject to verification of your electronic check and the funds will not be available immediately.

Once the check has been received, they will review and if it is eligible, the Checks received on a business day are usually available in your account in the next few business days.

In most cases for banks in the US, the Mobile deposited checks are available on the day after the deposit credit date, unless there is a hold required on the check.

For Money deposits to your bank account, Standard deposits are free and will get credited within 1-3 business days. Instant Deposits charge a 1.5% fee and will get credited instantly to your account or card.

However, note that the bank can hold a mobile check deposit for many of the reasons below:

- They can delay if you are depositing a large check

- If there are frequent overdrafts in your account

- Deposited unpaid checks in the past.

Why would a mobile Check Deposit be declined?

Your Mobile check capture on Cash App can be rejected for any of the following reasons:

- The check must be written by the person to which the check was made payable

- The check is in your possession and control;

- The client which is the payee must be an owner of the account

- It must be drawn on or payable by a bank, or credit union in the United States;

- The check is payable in United States Dollars;

- The check needs to be properly signed or similarly authenticated.

Can you mobile Check Capture a check twice?

Sure, you can do it with a different check on Cash App but we do recommend doing it after the initial check has been deposited.

But you can’t deposit the same check twice.

However, If you are depositing in person, the teller may keep the check that can’t deposit again. Banks should have systems in place in order to prevent it from being deposited twice using a mobile deposit.

Conclusion:

Cash a Check or Mobile Check Capture service in the Cash app allows you to cash your checks and have them credited to your Cash App Cash account and wallet, using the Cash app on your mobile device. You just simply take a picture of the check you want to cash and send it to them for review.

Depending on the eligibility and if it fits the requirements, they will get cashed and deposited, If not they are rejected. But you can still visit your bank and cash it if Cash App for some reason doesn’t allow it.

Also, don’t put the paper check immediately in the bin as If something goes wrong with your mobile check deposit, you may still need to deposit the paper check instead in a bank.

Hold on to the check and once the mobile check deposit is deposited, you can safely destroy the paper check or throw it in the bin.