Cash App Fee Calculator

Cash App Fee Calculator: Use our Cash App Instant Transfer fee calculator to quickly determine fees when sending or receiving money via Cash Balance, Credit Card, and Bank Transfers Updated regularly.

Cash App Fee Calculator

Disclaimer: We try our best to keep up-to-date with the Cash App Fees. Any updates and changes in fee structure will be made accordingly in the calculator.

Cash App Instant Transfer Fee

Cash App Instant Transfer fee ranges from 0.5% to 1.75% of the transfer amount, with a minimum fee of $0.25. These deposits arrive instantly on your linked debit card.

For example, for a $1500 transaction, the instant transfer fee is 1.5%.

So, for a $1500 transaction, the instant transfer fee would be $22.50.

Note: Receiving/withdrawing money into your Cash App account or using the standard transfer to your bank account. Cash App also has no monthly or annual fees.

Cash App Fees (Updated ON JANUARY 19, 2024)

Here are the latest Cash App fees:

- Send money via a bank account:

- Fee: $0

- Instant transfer via a debit card:

- Fee: 0.5%-1.75% (minimum of 25 cents)

- Send money via a credit card:

- Fee: 3%

- Investing:

- Fee: $0 commission fees from Cash App, but government agencies could charge fees for trades

- Buying/selling cryptocurrency:

- Fee: May range between 2% to 3%, but it varies

- ATM withdrawals:

- Fee: $2.50 per withdrawal without direct deposit (additional operator fees may apply at out-of-network ATMs)

- $0 per withdrawal for customers who receive $300 or more in qualifying direct deposits per month

- Fee for instant deposit to a linked debit card:

- Fee: 0.5%-1.75% (minimum of 25 cents)

- Fee for using a credit card to send money:

- Fee: 3%

These fees cover various transactions and services offered by Cash App, from standard transfers to investing and cryptocurrency transactions.

How much is Cash app fee for $500?

Cash App fee for $500 (Instant transfer via a debit card): $5.00

- Fee: 0.5%-1.75% (let's assume 1% for simplicity)

- Calculation: $500 * 1% = $5

How Much Does Cash App Charge to Cash Out $300?

Cash App charge to cash out $300 (ATM withdrawal without direct deposit) is $2.50

- Fee: $2.50 per withdrawal

- Calculation: $2.50

How Much Does Cash App Charge for $1000 instant deposit?

Cash App fee to cash out $100 (Instant deposit to a linked debit card) is $1.00

Cash App fee for $60 (Instant transfer via a debit card):

- Fee: $0.60

Cash App instant fee for $500 (Instant transfer via a debit card):

- Fee: $5.00

Cash App instant fee for $300 (Instant transfer via a debit card):

- Fee: $3.00

Cash App fee for $600 (Instant transfer via a debit card):

- Fee: $6.00

Cash App fee for $20 (Instant transfer via a debit card):

- Fee: $0.20

Square Fee Calculator

Cash App Instant Deposit Fee Calculator - Learn how to calculate Square fees with our free Cash App fee calculator.

Most of the Cash App transactions with others are free, however, there are a few ways in which you may be charged a small fee for a transaction.

There is no charge for sending or receiving money or any inactivity fees. Users can withdraw and make money transactions directly deducted from or added to their Cash App account.

When you make a payment using your credit card on Cash App, Square charges a 3% fee for the transaction but making payments with your debit card or bank account is free.

Read: What Percentage Does Cash App Take?

How Much is Cash App Instant Transfer Fee?

Cash App Fee Calculator: The cash App instant transfer fee is 1.5% for the Instant Transfer of money from your Cash App account to your linked debit card. For example, for an Instant Transfer of $1000, Cash App will charge a $15 fee, and the recipient will receive $985. Standard Bank transfers are free.

For online merchants who use Square's merchant services, you can use the Square Fees Calculator below to calculate the exact amount that Cash App charges for each transaction.

Enter the amount below, and the Square Cash App Fee Calculator will show you your total transaction fees.

CALCULATE VENMO FEES HERE

Does Cash app charge a Fee?

Cash App doesn't charge fees to send or receive money with Cash App Balance and Debit Card. However, Cash App has a 3% fee for making payments with a credit card. Users had to pay a 1.5% fee if they opted for Instant Deposits to their linked debit card.

As mentioned above, at the moment, Cash App does not charge any fee to send money from your debit card or bank account but charges a 3% charge from a credit card and a 1.5% charge for instant deposits.

However, Cash App charges a 2.75% fee for each payment you receive on your business accounts.

The above-mentioned are the Standard fees, but high volume, bitcoin, and other transactions have different types of fees.

>> Read: How to Set up and Use Cash App on Apple Watch?

Cash App charges two kinds of Bitcoin fees: a service fee for each transaction and, based on the market activity, an additional fee depending on the price volatility across U.S. exchanges. The fees are decent and just as important withdrawals from CashApp are instant and free (if you have completed KYC documents).

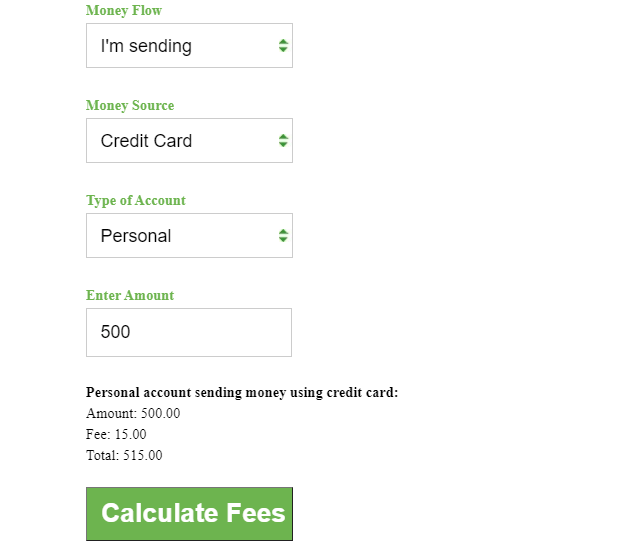

How to Use Cash App Fee Calculator: Step-By-Step

How to Use Cash App Calculator

Total Time: 2 minutes

Step 1: Select Money Flow.

Step 2: Choose your Money Source - Credit or Debit Card, Cash App balance, or Bank.

Step 3: Select the Type of Account - Personal or Business.

Step 4: Enter the amount.

Step 5: Click the "Calculate Fees" button.

Step 6: After clicking the calculate button, your total fees will appear below it.

Step 7: The tool also shows the money to receive after deductions. The amount, Fee, and the total.

Always make sure to double-check the amounts and payment methods to avoid any errors in the calculating process.

That's it! The Fee Calculator makes the process of calculating your payments easy. You just enter the amount in question, you can figure out how much you'll have to either receive or pay.

The Cash App fee calculator is quick and easy to use. It quickly calculates deductions while sending or receiving money through Cash App.

What is Cash App Fee for Sending $500 with a Credit Card?

If you wanna send $500 to your friend with a Credit Card, your total charges will come out as:

Personal account sending money using a credit card:

Amount: 500.00

Fee: 15.00

Total: 515.00

How much does Cash App Charge for $1000 instant Deposit?

Cash App charges $15 for an instant deposit of $1000 from your Bank account, debit/ credit card, and Cash App balance. Personal account instant deposit to bank from Cash App balance:

- Amount: $1000.00

- Fee: $15.00

- You Get: $985

Cash App Fee for 1000 is $15.00 for instant deposit. However, a Personal account sending money using a credit card for an Amount: of $1000 has a Fee: of $30.

What is the Cash App fee of $50?

Cash App fee for sending $50 with a credit card is $1.50 which will total $51.50 from the sender's end. Sending $50 with an Instant deposit has a fee of $0.75 and you will get $49.25.

However, the Cash App fee can always change in the future and can always fluctuate. So, it's better to use the actual Calculator and check the fee before sending it.

How to Calculate Square Cash App Fees?

Use the above calculator to calculate how much to pay for each cash app transaction.

However, if you wanna calculate it manually, you can follow the below method and calculate the fees (i.e based on individual payments).

The fees are based on 2.9 percent + 0.3 for every transaction.

The square fee is the total amount that is equal to the amount multiplied by 0.029 and an addition of 0.3.

Square Fees = amount*0.029 + 0.3

Again, a reminder, the fees are based on individual payments. For more complex calculations, use the above calculator.

Final Thoughts: Square Fee Calculator

Cash App Fee calculator allows you to calculate the amount that is deducted for each transaction depending on your Account type - Personal or Business, Money Flow - Sending, Receiving, Instant or Standard Deposit, your fund's source - Credit or Debit Card, Cash App balance and Bank account.

Also, note that how much can you send on Cash App depends on whether your account is verified or not.

Cash App Fee Calculator

Use our Cash App fee calculator for seamless money transfers – accurate, transparent, and always up-to-date. Manage your finances with confidence.

Product SKU: Unlimited

Product Brand: Cash App

Product Currency: USD

Product In-Stock: InStock

4.8