Wondering if you can Cash out without a Bank Account on Cash App? How to Get Money from Cash App without Bank Account?

To Get Money From Cash App Without Bank Account: Use a Cash App Debit card and withdraw at an ATM. You can send it to another Cash App member and withdraw it using their Card. Alternatively, Spend it online using the virtual card after loading from Cash App.

Now, if for some reason you don’t have a bank account or don’t wanna link it to your Cash App account, Can you still cash out and get money from Cash App without a bank account?

How to Cash out without a Bank Account on Cash App?

You can Cash out without a Bank Account on Cash App through:

- Cash App VISA Debit Card.

- Withdraw from ATMs.

- Bank Transfers.

- Spend it online using the virtual card.

- Send to another Cash App user

The easiest way is to Cash out with the Cash App debit card. The Cash card is a VISA debit card that gives you access to all of the features of a regular debit card, including online purchases and cash withdrawals at ATMs.

The debit card is linked directly to your Cash App balance. Whatever you have on your Cash App balance is the amount that you have on the card.

The Cash Card doesn’t only let you spend from your account balance; you can also get enticing discounts also known as Cash App Boosts which allows you to save money instantly when you use your Cash App Card at coffee shops, restaurants, Doordash Boost, and other merchants.

Cash App debit card is cool and all, but how do you get your hands on one? Well, you will need to verify your account with your full name, date of birth, and address and link your bank account.

Can I use Cash App without a bank account? Yes, you can as Cash App does not rely on an account number to identify you as a traditional bank account would, and According to the latest policies of the Square Cash App, getting verified users is not mandatory.

Instead, you are identified solely through your email address or your phone number and Anyone who is in the US & has an American phone number and valid bank account can avail of the fast, safe, and reliable money transfer services.

However, as we are specifically talking about Cashing out without a Bank Account, our options are limited.

>> Read: Why is my Cash App Balance Negative?

How to Cash Out on Cash App with ATM Withdrawals?

You cannot Cash out at the ATM as you will require the Cash Card for that to work. But, you cannot get one as it will ask you to link your Bank/ Debit Card and verify your Cash App account to apply for the Card.

If you do link your Bank account and verify your account, you can order yourself a “Cash Card” which is basically a debit card that you can use to pay for products like a normal bank account, using the funds in your Cash App wallet.

After you have activated your Cash App Card and have set up ATM withdrawals, you can start withdrawing money from your Cash App account with an ATM fee of $2.

Cash Out on Cash App with Bank Transfer

Onto the next options, you cannot process Cash App account to Bank transfers as it will require you to add a bank account which is not what you are looking for if you are on this page.

Cash App charges a 1.5 percent fee for an Instant fund Transfer from your Cash App wallet to your linked debit card. However, it is free for a standard transfer from Cash App to your bank account — however, it takes 1-3 business days to be completed.

Spend it Online

Unless the merchant you are shopping online has a $Cashtag that you can pay to, it will require your Cash Card to shop.

If you have a Cash Card, you can shop both online and in-store that accept VISA and can be used in stores, gas stations, restaurants, doctor’s offices, and online sites… nearly everywhere.

There are literally thousands of merchant sites worldwide that will accept the Visa Cash card.

Can you use Green Greendot Unlimited Black Card to Cash Out?

Cash App reportedly is not compatible with any Prepaid Card or Gift Card, but the Greendot Unlimited “black” prepaid card used to be compatible to link to your Cash App account along with MoneyPak but it is only for loading into Cash App and not Cashing out.

The Unlimited Debit Card from Green Dot Bank is pursuant to a license from Visa U.S.A Inc.

However, I just did a quick check-up on the card and Black Unlimited is not even being listed anymore on their products page which is quite weird as it has always been there and is one of their best-selling Card.

Send to Another Cash App user (Working Method)

For now, there is no method to go around the Cash App rules to Cash out unless you verify your account and link your card or bank account.

So, your only option, for now, is to transfer your money to another verified Cash App user and Cash Out using their Cash Card.

Steps to send money on Cash App:

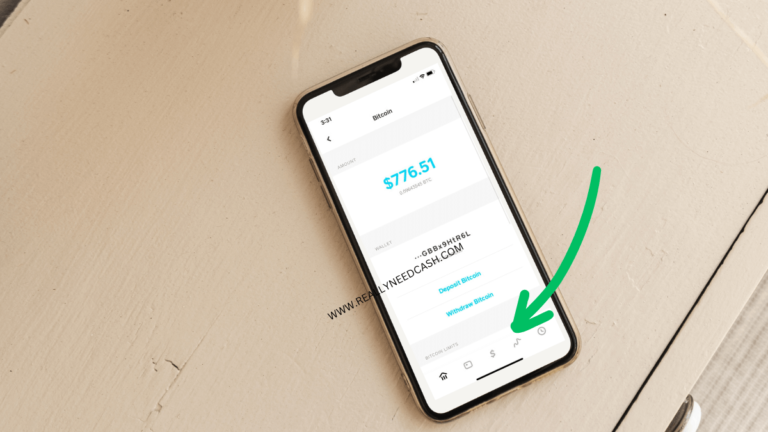

- Open Cash App on your iPhone or Android.

- Click the dollar “$” symbol in the bottom center of the screen.

- Enter the amount.

- Tap the Pay button in the bottom-right corner.

- Enter an email address, phone number, or $Cashtag or allow Cash App to access your contact list.

- Enter what the payment is for in the “For” field,

- Tap Pay.

Your funds are instantly credited to the recipient’s account.

Since your account is not verified, (I’m assuming that is the case, since you are looking to not link your Bank account) Cash App allows you to send $250 per week and receive $1,000 a month.

Of course, you can increase these limits by verifying your Cash App account and identity using your full name, date of birth, and the last 4 digits of your SSN.

Final Thoughts:

Cash App is a P2P payment app that allows users to send and receive money right from the app with friends and family without the hassle of the traditional old banking system.

For now, the only option is to send it to another Cash App member. If you did verify your account, you can withdraw from ATMs, Or spend it online using the virtual card.

You can Cash out using an approved debit card, usually excluding prepaid or a suitable bank Routing# + Acct#, although not all of them work.

Did you find this article helpful? Let us know in the comments below!