Looking to reload or add money to your Cash App Card at any Walgreens Store? Is it even possible to fund your Cash Card?

Can I Load my Cash App Card at Walgreens?

Yes, to add Money to Cash App Card at Walgreens: 1. Visit any Walgreens store 2. Open the Cash App 3. Visit the Paper Money Option 4. Choose Location 5. Click Show Barcode 7. Show it to the Cashier 8. Pay the total amount + Fees from $1 to $5.

How to Add Money to Cash App Card at Walgreens: Step-By-Step

Here’s a Step-By-Step Guide to Add Money to Cash App Card at Walgreens:

Total Time: 5 minutes

Step 1: Visit the Nearest Walgreens Store

Go to your nearest Walgreens store to add money to your Cash App Card.

Step 2: Open your Barcode

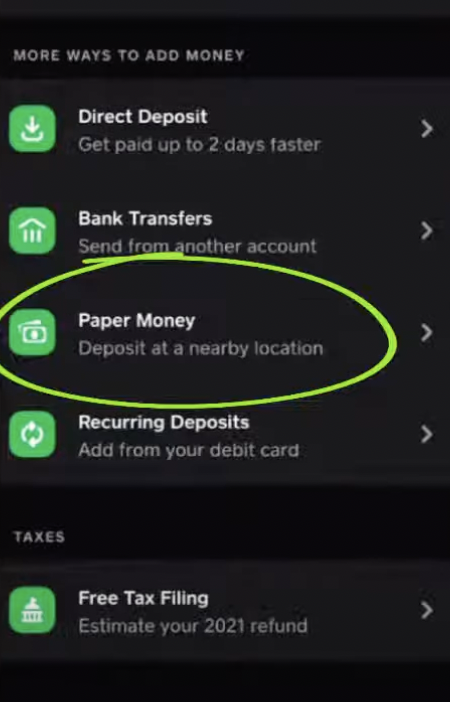

To find the barcode in your Cash App, follow these steps:

1. Open the Cash App on your device.

2. Visit the Paper Money Option

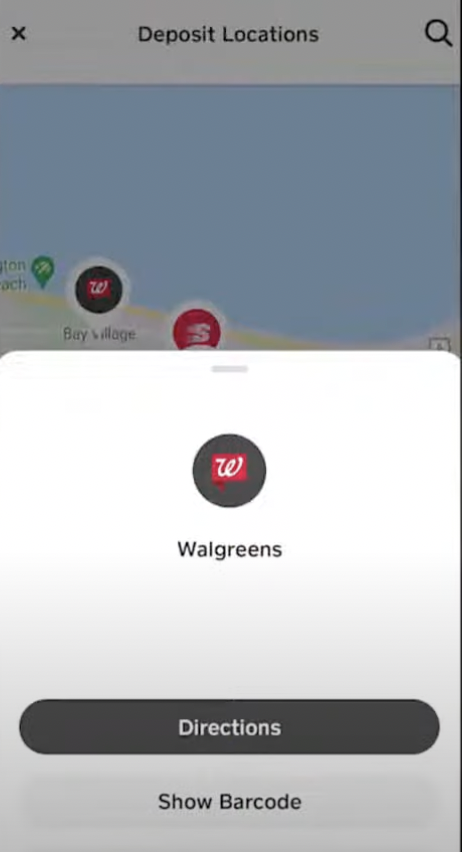

3. Choose Location

4. Select Barcode

Step 3: Click on Show Barcode

Select the Cash App View Barcode menu.

Step 4: Show Your Cash App Barcode to the Cashier

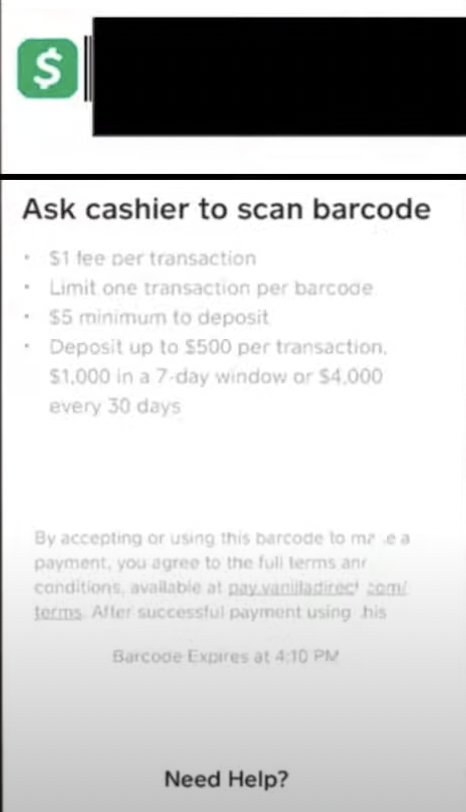

Give your Cash App barcode to the cashier for scanning. They will need to scan the barcode to initiate the money transfer.

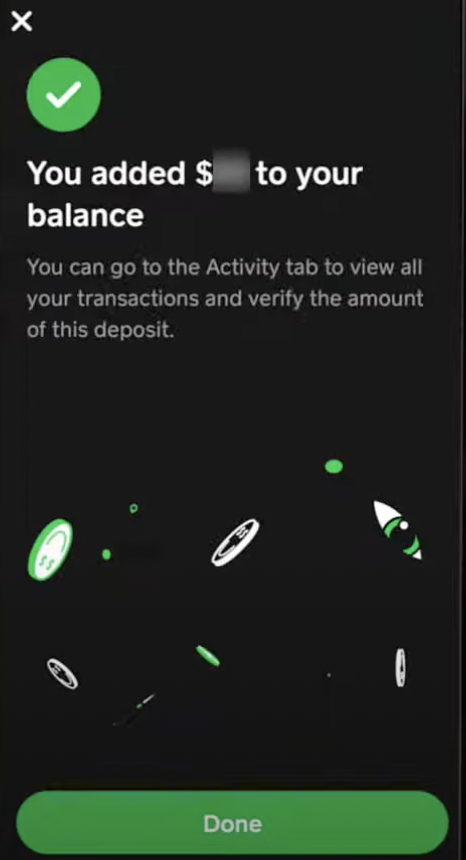

Step 5: Wait for Notification Confirmation

After the cashier scans your barcode, wait for a few seconds. You should receive a notification on your device confirming that the money has been added to your Cash App Card.

Step 6: Pay the Amount With Walgreens Fees

Once the money has been successfully added, pay the required amount at the Walgreens cashier with fees. Follow their instructions regarding the payment method (e.g., cash, card).

How Much Does Walgreens Charge to Load Cash App Card?

Walgreens charges a fee of between $1 and $5 to load a Cash App card. To load cash directly from your Cash App at Walgreens, you will be subject to this fee.

To complete the process, you can visit a Walgreens store and follow the necessary steps to add money to your Cash App card.

What is Cash App?

Established by Square Inc. and co-founded by Jack Dorsey of Twitter, Cash App is a money-transfer service that allows you to send and receive funds directly. You can also have a bank account and a debit card to use an ATM. Furthermore, you can use Bitcoins as well as invest in stocks.

On the downside, Cash App isn’t FDIC-insured, so there is a small risk involved with using it for large transactions.

Read: How to Add Money to Cash App Card at Walmart?

Brief Introduction of Walgreens

Boasting a staggering 9,021 stores across the United States, Walgreens is the largest and the oldest chain of pharmacies in the country with its roots tracing back to Chicago in 1901.

It was established by Charles R Walgreen, who bought out his employer and set it up under his name in Chicago’s prosperous south side. As a registered pharmacist, he mixed and packaged his drugs, thus ensuring their quality and affordability.

With more than 65 stores by 1925, Walgreens was expanded to Milwaukee, St. Louis, and Minneapolis. Charles Walgreen took the company public two years later and had more than 500 stores from New York to Florida at the time of the Great Depression.

By offering their brand, using radio advertising, and selling bootleg whisky, Walgreens managed to survive the economic downturn.

By 1984, 45 years after Walgreen’s death in 1939, the business opened its 1,000th store. With a net worth of more than $42 billion, Walgreens only continues to grow.

As a Cash App card is virtually the same as a Visa debit card, you can reload your Cash App card as many times as you want. However, the maximum amount you can withdraw per month is up to $25,000.

Additionally, you can only withdraw a maximum of $1,000.00 per transaction at an ATM or a POS device.

Read: Can I Load my Cash App Card at 711?

How to Use Cash App: Tutorials

The Cash App interface is user-friendly and very simple to navigate through. You just need to sign up for a Cash App account.

You will need your name, zip code, and email/phone number. By verifying your Cash App account or linking to your bank account, you can unlock many additional features. After opening your account, you will get a username for transactions and a free debit card.

The Cash App debit card can be used anywhere that accepts Visa. You will be charged a $2 fee if you use an ATM. However, Cash App reimburses this fee if you have direct deposits of at least $300 monthly.

You can also reload at CVS and Rite Aid.

Sending Money

To send money, you need the name, phone number, or cashtag of the receiver. The recipient then receives a text or an email notifying them of the transaction.

Requesting Money

When it comes to receiving money, you simply put in the sender’s name, cashtag, email, or phone number. You will be notified via the app after receiving the money, and you can either deposit it to your debit card instantly or to your bank account, which can take up to three days.

Note that an instant deposit can cost you 1.5 percent of the total amount with a minimum fee of 25 cents.

Make Payments

Making payments is easy by following these simple steps through your Cash App:

- Open the Cash App

- Enter the amount you want to pay

- Tap Pay

- Enter an email address, phone number, or $cashtag of the recipient

- Enter the payment purpose

- Tap Pay

Any refunded payments are sent back to your Cash App account. Cash App also supports international transactions between the US and the UK with no additional fees. You can also view your monthly account statements at your discretion.

Pros and Cons

Like any service-providing apps, the Cash app has both advantages and disadvantages.

Pros

1) Easy Transactions

This is one of the reasons for their popularity. The transactions aren’t only simple to perform as highlighted above but also fast. Your transactions can be finished in seconds once confirmed.

2) Bartering Bitcoin

Cash App allows you to exchange Bitcoins with a reasonable fee of 1.76 percent, compared to other trading platforms like Coinbase.

3) Free Transactions

The transfer fee is 1.5 percent. However, if you want to avoid this, you can choose to complete transactions in 1-3 days. This saves you money, a win-win situation.

4) Reimbursements Made Easy

Confused about how to split bills between friends after lunch? Let one of your friends pay the restaurant bill and reimburse them with Cash App. You can also find out when and who has reimbursed you.

5) No Commission Fees for Stocks and Investments

Exchange Cash App stocks with no commission. Save time so you don’t have to use another app for stock transactions.

Cons:

1) Limit for the first 30 days is low

You are limited to transactions of only $1000 for the first 30 days on the app. This means that you need to rely on other apps during this period to make larger transactions.

2) No Federal Deposit Insurance Company (FDIC) coverage

FDIC coverage allows up to $250,000 worth of cash to be insured. Unfortunately, Cash App is not FDIC insured, so large transactions are done at your own risk.

3) Cannot Be Used Everywhere

Despite allowing international transactions, Cash App is limited to transactions in the UK and USA. If you want to send or receive money to other countries, you will need to use other apps.

Things to Avoid

Staying alert when making any monetary decisions is always a good decision. Here are some common pitfalls to avoid when using Cash App.

- Storing large amounts of money. Remember the FDIC coverage issue, so it’s better to transfer small amounts of money.

- Make transactions with unknown people. Always make transactions with people you know and trust. And always verify account information before transactions.

- Transaction scams are common. Cash App warns its users against transaction scams such as scammers promising money or services in exchange for Cash App payments.

- Customer support scams against vulnerable users. Cash App has no direct line to customer care, allowing scammers to impersonate them so they can access mobile devices and even steal sensitive user information. You can contact Cash App support through the app, on the website, or via phone.

Conclusion

Adding money to your Cash App card is pretty simple, as we have discussed above. You can also fund your card by linking it to your bank account or asking family or friends to send you cash via their Cash App account.

Cash App helps keep track of your spending in addition to the cash card benefits.

So before making your next buy, download the app, load money to the card at any authorized store, and enjoy your shopping sprees without worry.