Cash App card cardholders can withdraw cash at ATMs and participating locations nationwide.

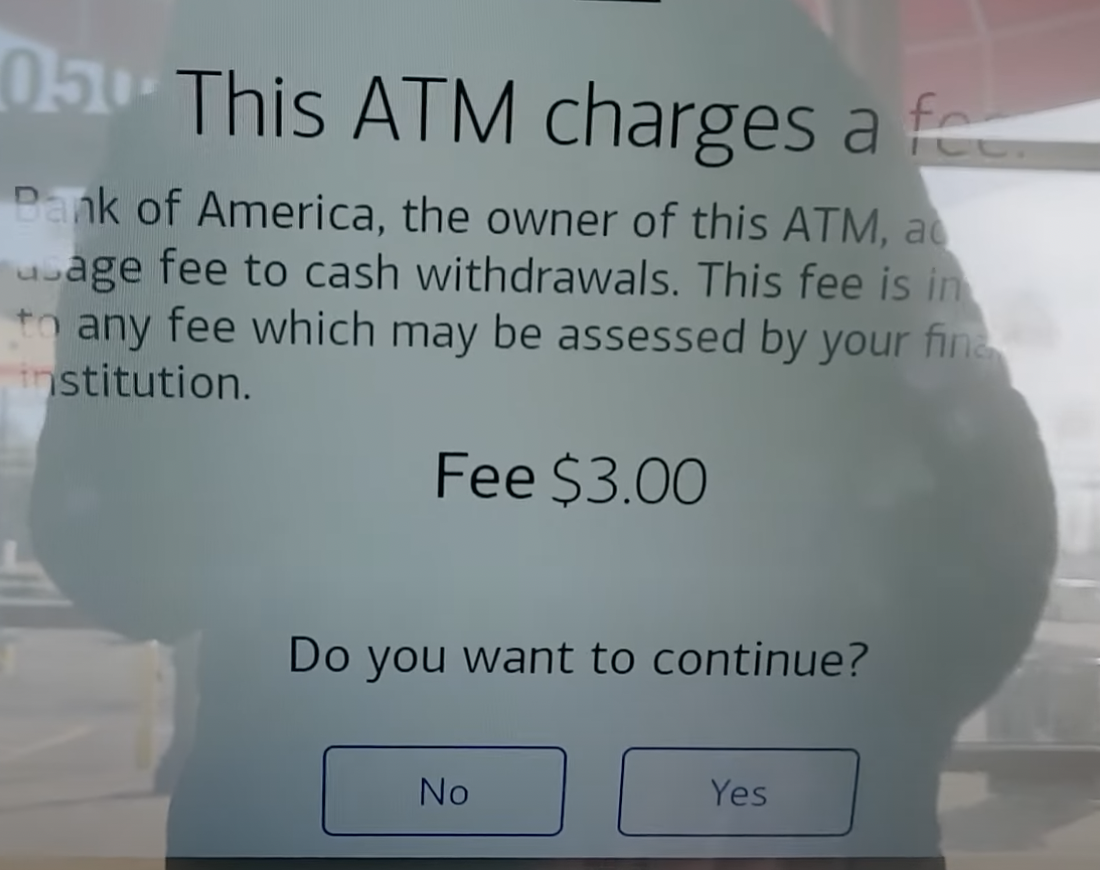

There are service fees associated with a cash withdrawal with a $2 fee charged by Cash App and an additional fee in most ATMs ($3) that belongs to a different bank.

To Use Cash App Card at ATM: 1. Insert Card and Enter PIN 2. Select “Get Cash” Option 3. Choose Account Type 4. Enter Withdrawal Amount 5. Confirm Withdrawal taking note that the ATM may charge a $3 fee for transaction 6. Collect the Cash.

You can use your cash App card at ATM.

How to Use Cash App Card at ATM: Step-By-Step

Step-by-Step Guide to Withdraw Cash from Cash App Card at ATM:

Total Time: 2 minutes

Step 1: Insert Cash App Card

Insert your Cash App Card into the ATM

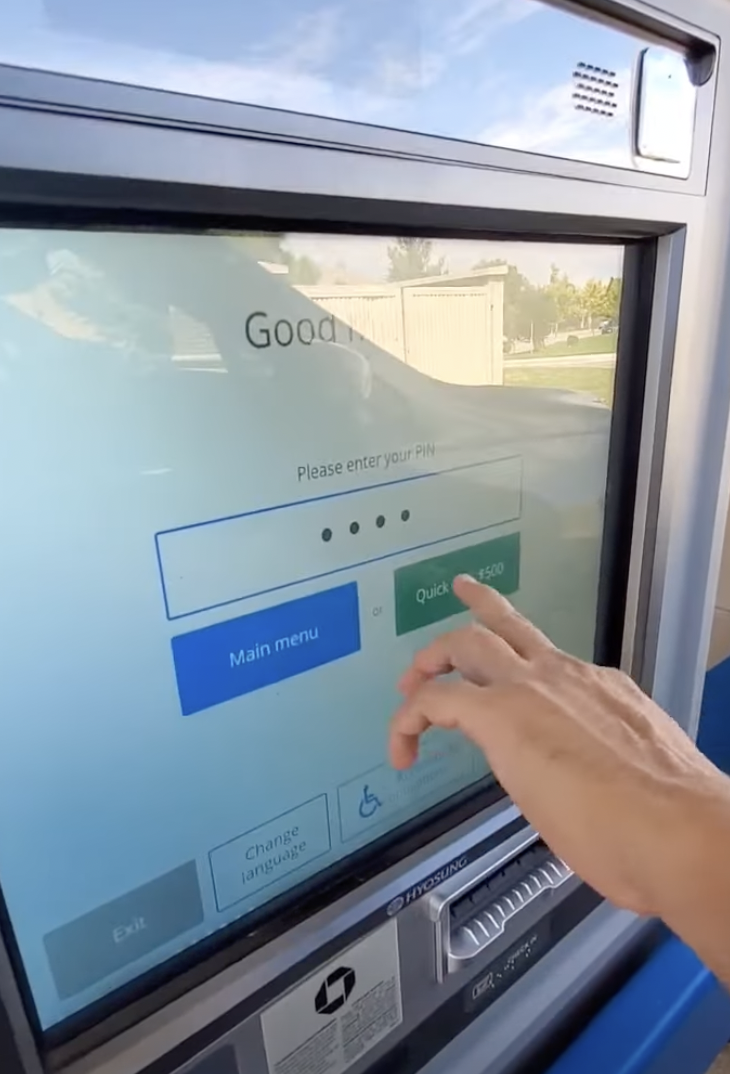

Step 2: Enter the Pin

Enter the PIN number associated with your card.

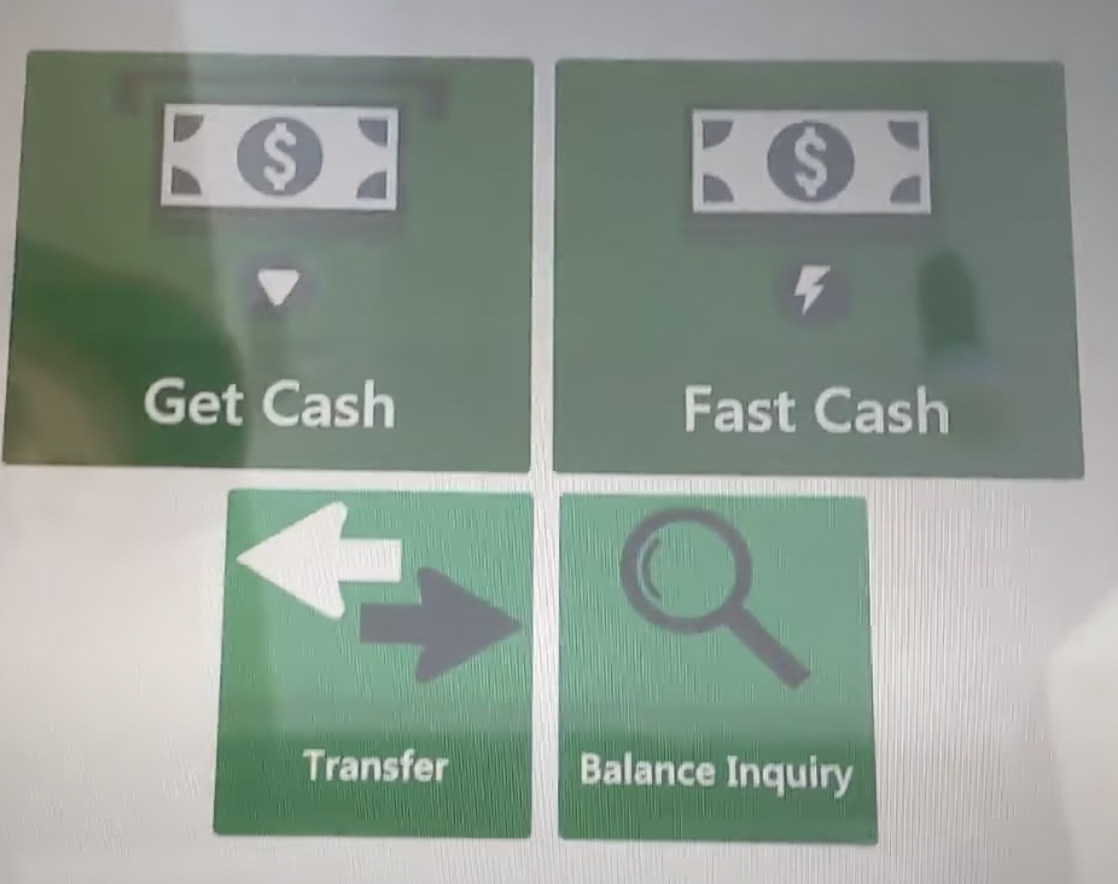

Step 3: Select the “Get Cash” Option

On the ATM screen, choose the “Get Cash” option to proceed with the withdrawal.

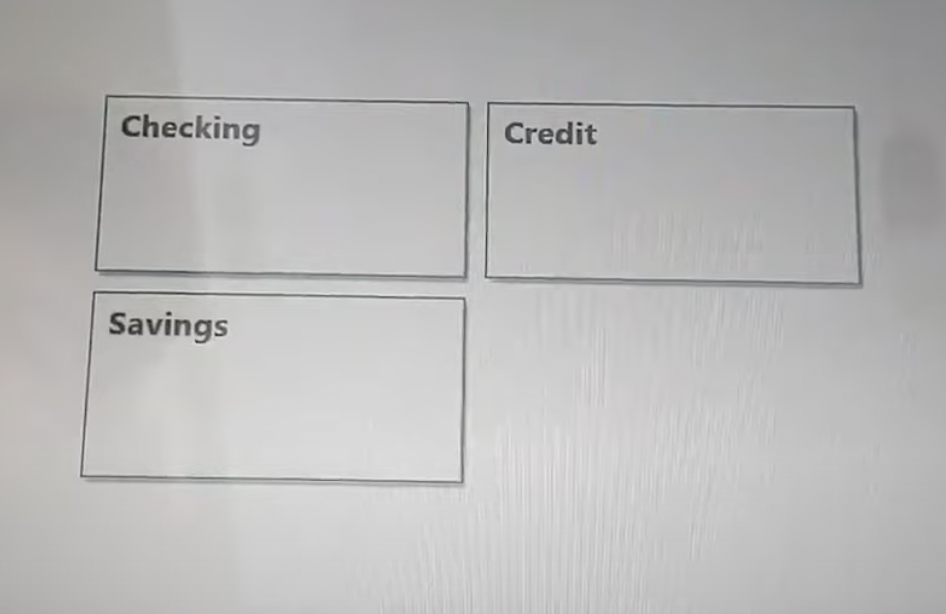

Step 4: Choose Account Type

Select the type of account from which you want to withdraw cash, such as checking, savings, or credit (for cash advances).

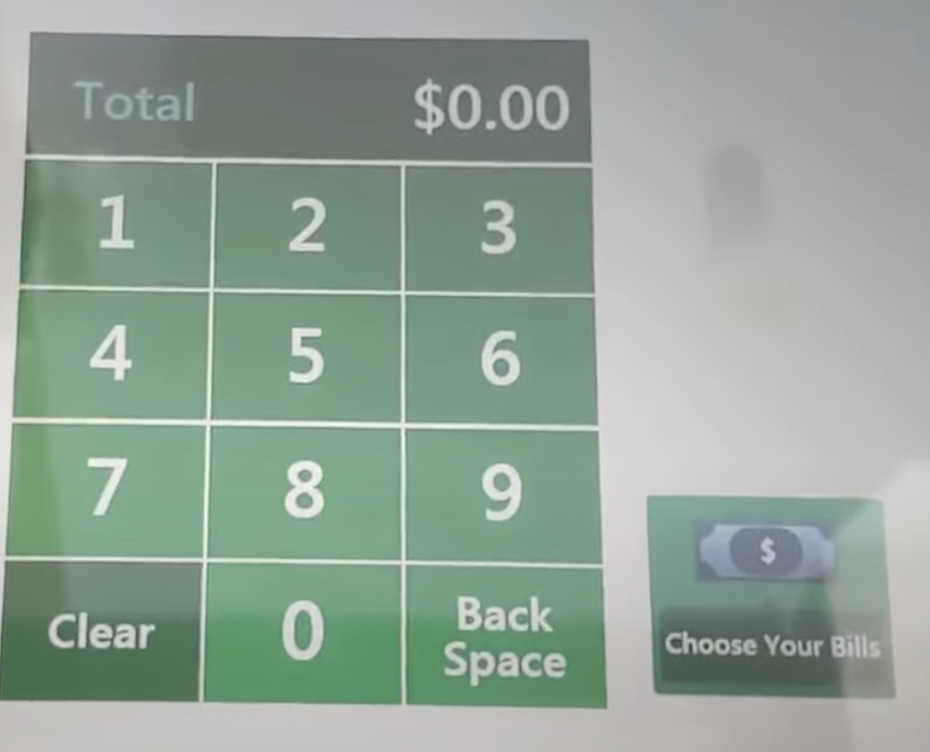

Step 5: Enter the Withdrawal Amount

Enter the specific amount of cash you wish to withdraw, for example, $10.

Step 6: Confirm Withdrawal

Confirm the withdrawal amount, taking note that the ATM may charge a $3 fee for the transaction.

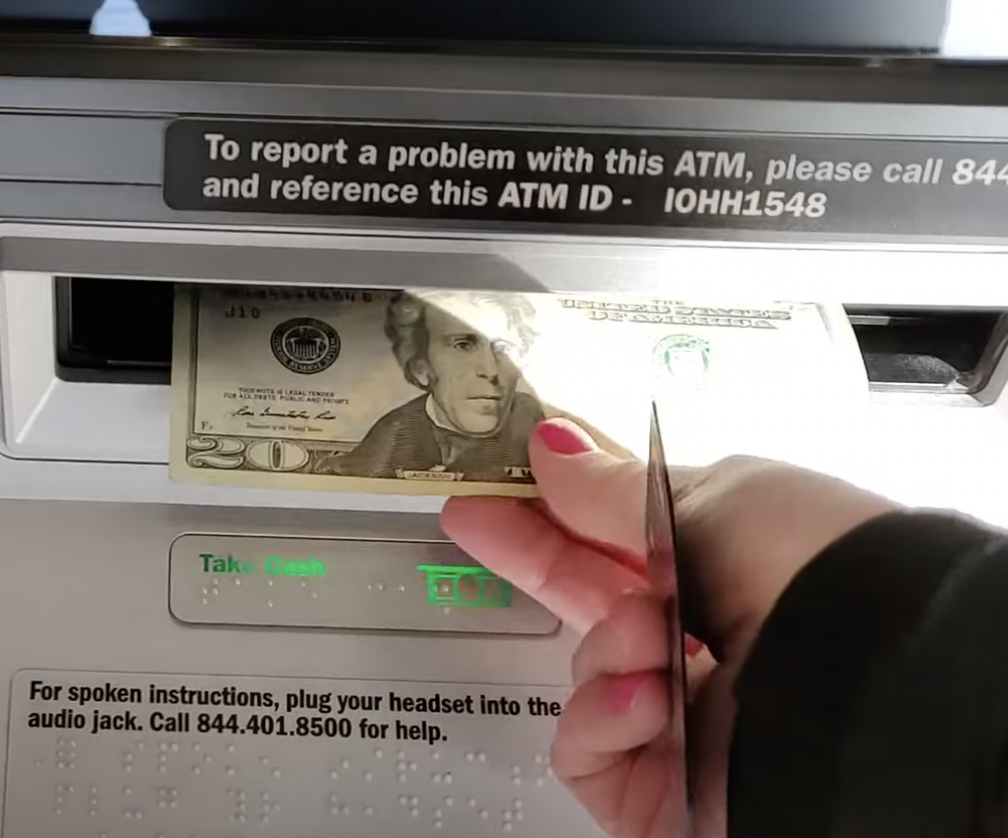

Step 7: Collect Cash

Wait for the ATM to dispense the Cash and collect it. Do not forget to take your Cash Card with you after the transaction.

Cash App Free ATM

| 🏧 Cash App ATMs | Bank of America, Chase, Wells Fargo, PNC |

| 💵 ATM fees | $2.50+ (reimbursement available for $300+ ) |

| ⏲️ Withdrawal limits | $1,000.00 per day, and $1,000.00 per week. |

Is it Free to Use Cash App Card at ATM?

No, there are no Cash App Free ATMs. Cash App charges a $2 fee for transactions. Cash App will refund your ATM fees for $300+ in paychecks directly deposited into their Cash App each month getting free ATM withdrawals for 31 days.

Cash App is a P2P payment platform for making payments to your friend and family.

If you want instant access to your cash, you can apply for the Cash App VISA debit card that you can use to withdraw money from most of the ATMs.

How to use Cash App Card at ATM?

- Insert your Cash App VISA debit card. Some ATMs require that you swipe and remove your card right away, but with others, you keep it inserted until you’re done with your transactions.

- Input your Cash Card PIN (don’t let anyone else see it).

- Request a transaction: You’ll get a list of choices, such as a balance inquiry, cash withdrawal, or deposit.

- Follow the on-screen instructions to withdraw and enter the amount.

- For cash withdrawal, Select the Withdrawal Option.

- Take the Cash: Now collect the cash from the lower slot of the machine.

- Collect a printed receipt, if needed by clicking yes and closing the transaction.

- Take your card and make sure the screen shows you’re clear.

Is Walgreens ATM Free for Cash App?

No, Walgreens ATMs are not free for Cash App. Walgreens ATM – $2.50 fee charged by Cash App.

Can you take Money Off a Cash App Card?

Yes! You can use your Cash App Debit Card to make cash at ATMs, purchase items, and discounts when completing a purchase with Cash App boost.

Cash withdrawal made at ATM with Cash Card located in the U.S is subject to a $2 fee charged by Cash App.

You can use the money you receive in your Cash App balance to make other online purchases or you can transfer the balance to the bank account you have linked to your Cash App account, although the latter may take several days to process for standard transfer.

Can I use my Cash App VISA Debit Card to make ATM withdrawals?

Yes, You can use your Cash App Card to make cash withdrawals at ATMs. You’ll need your Cash Debit Card PIN to make cash withdrawals on ATM.

What ATM can you use for Cash App?

You can use your Cash App card to make cash withdrawals at ATMs nationwide. It allows cash withdrawals at ATMs that have the VISA Card acceptance marks. To use your Cash Card at an ATM, simply use your Cash Card and the PIN when you activate your card.

Don’t forget, it allows you to withdraw cash from ATMs across the country.

You’ll need to set up a Cash PIN when you activate your card. This is the same pin that you need to use for ATM withdrawals.

What ATM is free for Cash App?

Currently, there is no ATM to withdraw the Cash App balance for free. You’ll pay a $2 fee to Cash App as a withdrawal fee unless you receive qualifying direct deposits over $300+ to get reimbursed for 3 ATM withdrawals every 31 days, and up to $7 fees for every withdrawal.

Can I use my Cash App Debit Card in ATM outside the US?

Please note Cash App Debit Card cannot be used with international merchants and other countries outside the US.

Cash Debit Cards can only be used in the U.S at U.S. merchants for transactions in USD. Please note Cash App Card cannot be used with international merchants, even if you are placing an online order physically from the United States.

How to withdraw Cash App Cards for Free on ATM?

If you are looking for ways to withdraw your Cash App balance for free using your Cash Card at no cost there are options!

You can withdraw the money from your balance by transferring it to your Bank account and then withdraw it using your bank card in-network ATM to avoid the fees.

Depending on where you bank and what ATMs are around you or nearby your hotels, you could save money on fees if you plan ahead rather than paying much more than you needed.

You can simply transfer your Cash App funds to your traditional Card and use it on ATMs rather than directly using your Cash Card if you wanna save a few dollars.

However, if you use an ATM that isn’t operated by your own bank to make Cash withdrawals, deposits, or even simple balance inquiries, you can get charged a bundle of extra fees.

Note that you won’t be notified about such transaction fees at any time during your ATM transaction. So, make sure to do some research about your bank and ATM charges before transacting to avoid any unnecessary charges and fees.

>> Read: Can You Put Money On Cash App Card at ATM?

You may also withdraw the money at no cost using a MoneyPass ATM within the U.S. and in some U.S. territories too.

How to Avoid Paying High ATM Fees

You can avoid paying high ATM fees by doing some research ahead and thinking about your ATM withdrawing/ spending habits.

- Always try to use your bank’s operated ATMs near you

- When you are paying at stores and merchants, use the cash-back option

- Withdraw money in Cashless frequently but in larger amounts

Where do I find my Cash App Card withdrawal History?

In the Cash app, you can check your card purchases by tapping the Activity tab on your Cash App home screen. Tap the payment to review to see its status.

You can view all of your Cash App transaction history including your Cash App reloads, Card purchases, ATM withdrawals, and fees, online payments, payments to contacts, etc.

Protect your Cash Card against Unauthorized Purchases

If your card is stolen or lost and use it to make a purchase, there are a couple of things you can do.

First, you can disable and deactivate your card in the app. We recommend doing so if you suspect your Cash card’s been compromised.

In this case, if you misplace and find it again, you can activate it again, all through the Cash app.

Final Thoughts:

Cash App withdrawals — made at the ATM, over the shop counter, or at the checkout — aren’t covered with the reload feature. Those ATM withdrawal fees are straight outdrawn of your Cash App balance.

The Cash App Card is a convenient way to pay, split payments and withdraw cash. So, if you still haven’t got the card, it’s a no-brainer for applying for a debit card.

Also, make sure to pay attention to where you’re using your Cash card for withdrawing cash as you don’t wanna shrink your Cash balance by paying excessive ATM withdrawal fees.

Did you find this article useful? For any queries, Let us know in the comments below!