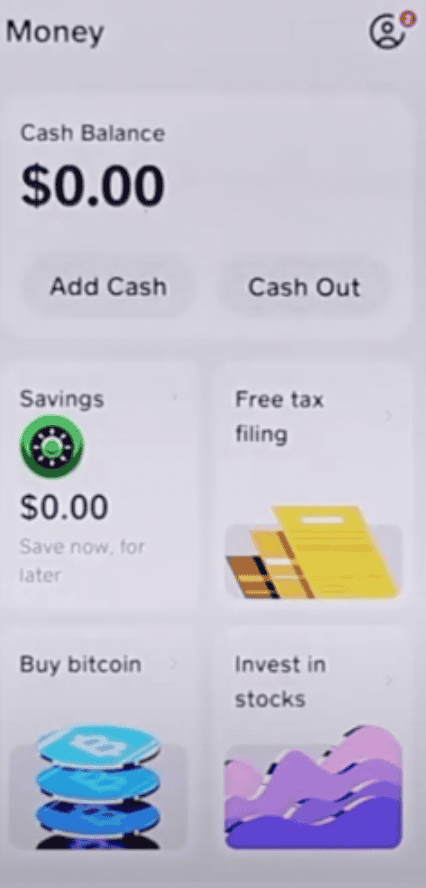

Cash App is one of the most reliable mobile banking apps. Using the app, you can send and receive money as well as several other features, such as trading stocks and bitcoin.

To stop Cash app from canceling payments: 1. Link Your Cash App with Your Own Bank Accounts 2. Enter the Right Transaction Details 3. Send or Receive Money from Accounts That You Know 4. Avoid Leaving Your Cash App Unused for a Long Time 5. Sufficient Funds to Complete the Transaction.

Although the transaction process is usually smooth, sometimes, Cash App may cancel your payments.

Why does Cash app Cancel Payments?

When Cash App payment gets canceled, it’s usually due to security reasons as Cash App monitors your account for anything that looks out of the ordinary and blocks potentially fraudulent payments. It can also happen because of problems with your bank or issues with the details of your transfer.

How to Stop Cash App from Canceling Payments: Step-By-Step

Step-by-Step Guide to Stop Cash App from Canceling Payments:

Total Time: 15 minutes

Step 1: Save the Recipient’s Number in the Contacts

When sending money to a person for the first time, save their number in your contacts to avoid payment errors.

Step 2: Check Airplane Mode

Try Enabling airplane mode for 60 seconds and then disabling it to refresh the network connection and resolve any temporary connectivity issues.

Step 3: Verify Date & Time Settings

Ensure that the date and time settings on your iPhone are accurate. If the toggle is off, turn it on and select your time zone.

Step 4: Offload and Reinstall Cash App

If the problem persists, offload the Cash App from your iPhone’s storage settings, then reinstall the app to fix any potential software issues.

Step 5: Reset All Settings

If previous steps didn’t resolve the issue, reset all settings on your Phone to default. This can help eliminate any misconfigured settings causing the payment failure.

Step 6: Restart Your Phone

After resetting the settings, restart your iPhone to ensure the changes take effect. This final step can help refresh the device’s overall functionality.

Step 7: Contact Cash App

If nothing else works, contact Cash App support to solve the issue.

RELATED READ:

- Cash App Transfer Failed: Why is my Bank Declining my Cash App Payment?

- Why is My Cash App Payment Pending?

- 7 Reasons Why Cash App Won’t Let me Send Money?

- 2 Reasons for Cash App Payment Declined Due to Unusual Activity

Why does a Cash App Payment Fail or Get Declined?

The “Transfer Canceled” messages can also happen sometimes when you’re using Cash App to make a payment. This happens for a wide range of reasons, so let’s have a quick look at each one of them:

1. You’re Sending or Receiving Money from a Suspicious Account

One of the most common reasons why payments are canceled when you’re sending money to someone you don’t know personally is flagging as a fraudulent act.

When the Cash App security system suspects a transaction that involves a scammer, it’ll immediately decline the transaction or cancel it.

This also happens when you receive the message “Cash App Transfer Failed for my Protection”. But more about this one later.

2. There Are Insufficient Funds to Complete the Transaction Process

If your account doesn’t have enough money to complete the transaction, including any included taxes and transaction fees, the payment may get canceled.

This mostly happens when the taxes and fees are spent separately from the initial costs within the system.

3. You’re Using an Outdated Version of the App

Cash App constantly releases new updates with improved performance, blocked exploits, and enhanced security as well as bug fixes.

If you’re using an outdated version of the Cash App, transactions might trigger the security system as an insecure connection. To solve this problem, make sure that you update to the latest version.

4. Connection Problems

Another trigger to the security systems of Cash App is having a bad internet connection. This happens mainly with open and unprotected public wifi connections which can’t establish a secure connection.

Alternatively, the app may cancel a transaction when the servers are down. You can check the app’s status by clicking here.

5. Your Bank Is Blocking the Transfer

If you’re making a transaction from your linked bank account, the bank may block the transaction. In that case, Cash App will also cancel your payment.

6. Incorrect Transaction Details

Even the tiniest typo can affect the transaction process, so make sure that you’ve typed the right $cashtag, card name, expiration date, CVV, etc.

Cash App Payments Canceled Troubleshooting Steps

Now that you know more about the reasons why some transactions are canceled or declined, here are some of the things that you can do to stop or reduce the risk of your payment getting canceled:

1. Link Your Cash App with Your Own Bank Accounts

When you link your Cash App with a bank account or bank card that carries a different name, you’re much more likely to get your payments canceled, so make sure that they both have the same name.

2. Make Sure That You’re Typing the Right Transaction Details

As previously mentioned, make sure that all the details are entered correctly before confirming the transaction, including the amount paid and the recipient’s $cashtag.

3. Only Send or Receive Money from Accounts That You Know and Trust

Payments that are sent to accounts that are known for scamming users are usually flagged and canceled, so this might be the case.

4. Avoid Leaving Your Cash App Unused for a Long Time

Continue using your Cash App to build up a healthy record that increases your trust factor, which is something similar to the credit score system in banks.

5. Contact Customer Support

When all else fails, you can contact customer support to find out more about the problem. You can contact them on your app, through the phone, or through their website. Click here for more information on how to contact Cash App.

What Does the “Cash App Transfer Failed for my Protection” Message Mean?

One of the most common errors that people might receive when there’s no apparent reason for canceling a transaction is “Cash App Transfer Failed for my Protection”.

This message is mainly generated when Cash App flags a specific transaction due to actions that are marked as fraudulent, suspicious, or out of the ordinary.

The reason why Cash App does that is that a lot of scammers try to take advantage of unsuspecting users, which causes a lot of problems.

These scammers and hackers try to either trick the Cash App system or the users out of their money through various tactics and schemes.

While this security system helps in blocking many suspicious transactions and scams, sometimes, innocent transactions may accidentally trigger these security systems, hence the error message.

How Long Does it Take a Canceled Payment to be Refunded Back to My Account?

The answer here depends on the stage at which the payment got canceled. If the payment is canceled while initiating the transaction, the payment process fails. Therefore, your money should stay in your account.

If the payment is canceled at the stage where the transaction is awaiting authentication or authorization by Cash App, your money should also return almost instantly to your account.

This also applies to transactions that are initiated from your linked account. In that case, the money should return back to your account immediately. Since the refund process here involves your bank, it may take up to 3 business days.

The Bottom Line

There you have it! A brief guide that walks you through all the details that you need to know when you’re dealing with recurring Cash App payment cancellations.

As you can see, there are several reasons why your transaction or payment is canceled. Since Cash App moves billions of dollars in a single day, they have to stay vigilant to anything that might seem “out of the ordinary”.

If you follow the previously mentioned tips, you should greatly decrease the risk of getting your payment canceled by Cash App.

If the problem persists despite all trials to solve the problem, you can always contact the Cash App support team to find out more about the issue.