Are you wondering why your Cash App account shows a negative balance? Continue reading to learn more about overdrafts and Cash App and how you can pay it off.

Can You Overdraft Cash App?

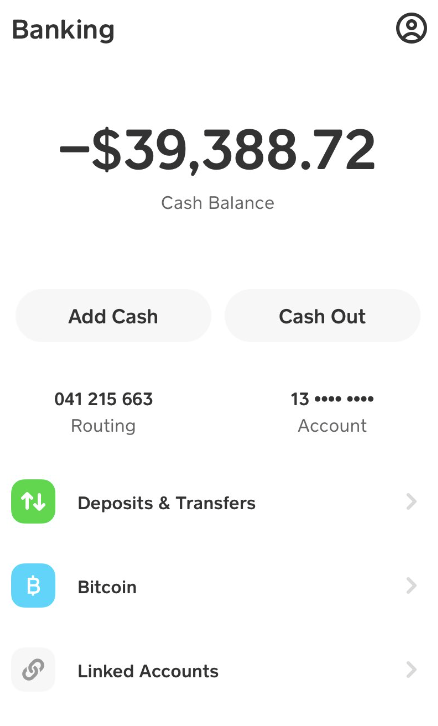

No, You cannot overdraft Cash App and Cash card. Payment over your balance limit will not be covered by Cash App as it has no line of credit attached. Pending and secondary charges can impact a negative balance on your account which must be paid off to return to normal balance.

What crosses your mind when you wake up to find a negative balance on your Cash App? Do you think it’s because of the urgent payment you had to make at the grocery store? Do you remember if you had enough balance at the time? Did you just overdraft your Cash App?

Read: Can You Overdraft a Cash App Card for Gas?

How to Repay Back the Overdraft to Clear Negative Balance on Cash App: Tutorials

You can add money to your Cash App account and clear your overdraft-negative balance. Here’s how to do it:

Total Time: 4 minutes

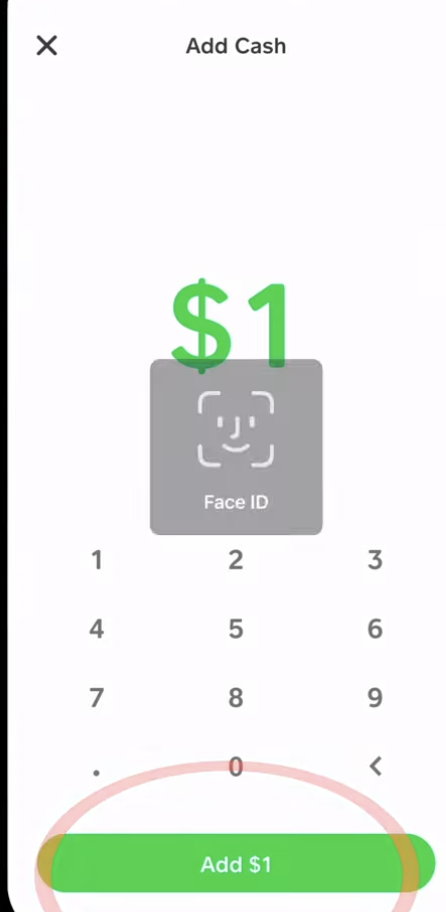

Step 1: Open the Cash App on your mobile device

First of all, open the app on your phone.

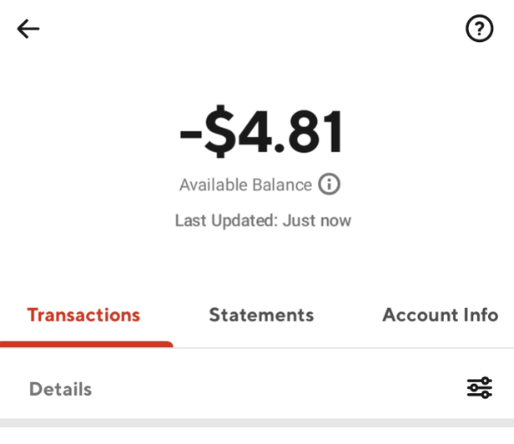

Step 2: Tap the Balance tab on the home screen

Go to your balance tab.

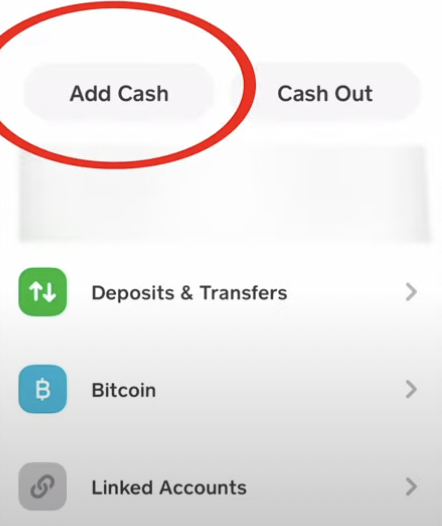

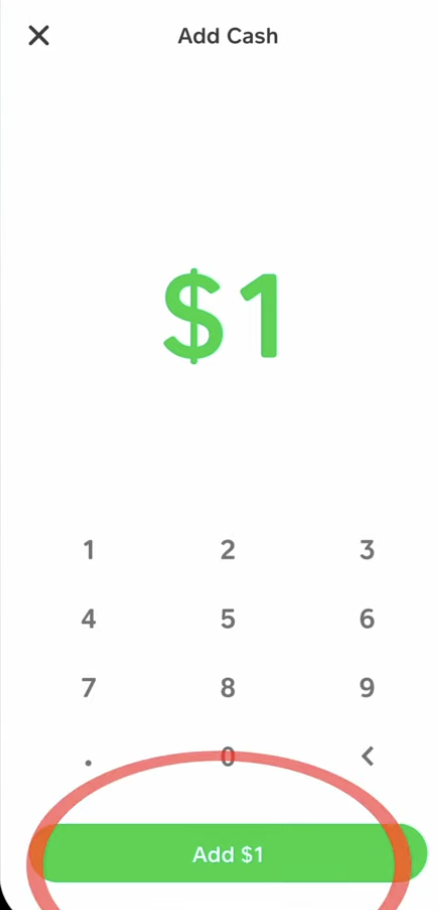

Step 3: Click on the Add Cash button.

Select Add Cash Icon.

Step 4: Enter the amount of money you want to add to your account.

Input the amount to add and Next, Tap the Add button.

Step 5: Confirm your Cash App PIN/ Face ID

Step 6: Cash App Negative Balance Overdraft Will be Cleared

Can You Overdraft Your Cash App Account?

No, you cannot overdraft your Cash App account. You’re not at full liberty to overdraft it by yourself. Instead, when you don’t have enough funds in your Cash App account while carrying out a transaction, it automatically runs into negatives.

Luckily, there are ways to fix it. But first, let’s know what exactly an overdraft means.

Does Cash app let you Overdraft?

No, You cannot overdraft on Cash App and if you use your Cash App account to make a purchase that exceeds the balance in your linked bank account, you could incur overdraft fees, even if you chose not to allow overdrafts.

The best option to fix an Overdraft is to pay off the negative balance to your Cash App account.

Read: How to Add Funds to your Cash App Card?

What Does It Mean When You Overdraft Your Account?

An overdraft means that you’ve spent more money than you have in your account. So when your account hits a negative balance, it means you didn’t have enough money to make that payment. In that case, Cash App will overdraft your account. Technically, you owe this money to your bank.

Let’s look at some examples of how an overdraft can happen on Cash App.

1. At a Grocery store

Although it’s always advised that you have some extra money to pay the retailer at the grocery store, some customers still run into the negatives when they don’t.

2. During Shipping

Your account may also read negative when an online retailer places a temporary charge on your account when you place an order. Then, after the shipping of your goods, the transaction is completed.

3. A Mistaken Money Transfer

If someone mistakenly sends you some money and requests that you send it back, and you refuse to, they can report it to the Cash App customer service. Cash App would examine the situation, and if you’re guilty, the money would be deducted from your account and sent to the person.

If you didn’t have enough money to cover the charges, your account would also run into the negatives.

How to Fix an Overdraft on Cash App?

A negative balance shouldn’t be much trouble. You can simply fix it on your own by following some simple steps.

Generally, an overdraft will be fixed when you deposit money into your Cash App account.

Let’s have a look at how you can do that.

1. By Using Your Credit Card

You’ll only need to enter your card details and your ZIP code to identify your address and, more importantly, the amount to cover your balance.

2. By Directly Depositing Your Paycheck

If you have no other source of funding, this method is best for you. Provide your employer with your Cash App details and have the funds wired straight into your account. This will clear your negative balance.

3. By Depositing From a Bank Account

Here’s another option. A simple transfer from your bank account to your Cash App fixes your negative balance.

Keep in mind that it’s advisable to load your account with enough money to cover the overdraft and leave a surplus for potential secondary charges. This way, you’ll ensure that you don’t run into the negatives again.

It’s also important to note that technical errors may occur, which may give you a negative read in your balance. So if you try all these options and the negative doesn’t clear, you can reach Cash App support to register your complaint.

Frequently Asked Questions

Will Cash App Charge Interest During Overdrafts?

Cash App charges no interest over your overdraft. Some users say it’s the good part. However, although Cash App doesn’t have an overdraft fee, you’ll still be penalized by your bank. That’s why we recommend that you pay up your overdrafts as soon as you can.

Also, if you want to continue using the bank services, you’d have to pay the overdraft balance back.

Can You Overdraft Your Cash Card?

No, you can’t overdraft your Cash App Card. The only case Cash App may allow overdrafts are automatic ones. During these, Cash App can push your pending payments forward to be drafted.

Can You Overdraft a Cash Card at an ATM?

No, you can’t overdraft your Cash App Card at an ATM. This is because the Cash App has a debit card feature. This means that it allows you to hold money from your bank to your Cash App account.

Summary

In this article, we’ve discussed how you can overdraft your Cash App account. We also walked through ways to fix it, such as using your credit card, a paycheck deposit, or a bank deposit.

Keep in mind that even if Cash App doesn’t charge interest on overdrafts, banks do.

So take care of that and enjoy cashless transactions on your Cash App.

Did you find this article helpful? Let us know in the comments below!