Do you want to know the difference between business and personal Cash App accounts?

Cash App Business Account VS Personal accounts: 1) Business accounts incur a 2.75% transaction fee, while personal accounts do not. 2) Business accounts can make instant transfers to their bank accounts without fees. 4) Business accounts receive a 1099-K form, potentially impacting tax obligations.

While both types seem self-explanatory, it can be hard to spot the actual differences when it comes to fees, transfer limits, and restrictions.

Which is Safer Personal or Business Cash App?

Both Personal and Business Cash App accounts are safe and secure. It Uses encryption to protect user information, making the app safe for both types of transactions. The platform offers a safe environment for financial transactions, utilizing advanced fraud detection.

Users can confidently use either account type for secure money transfers and payments.

Cash App Business Account vs Personal Account: Comparision Table

| Feature | Cash App Personal Account | Cash App Business Account |

|---|---|---|

| Instant Deposit Fee | The instant deposit fee is 1.5% or $0.25 (minimum). | The instant deposit fee is 1.5% or $0.25 (minimum). |

| Usage | Designed for personal use, sending/receiving money to/from friends and family. | Designed for business use, receiving payments from customers. |

| 1099-K Form | Gross payments that exceed $600 (Starting Jan. 1, 2022) | Gross payments that exceed $600 (Starting Jan. 1, 2022) |

| Standard customer support is available. | No fees for sending/receiving money to/from family and friends. | 3% fee on each transaction received from customers. |

| Money Transfer Speed | Money transfers are almost immediate. | Money transfers are almost immediate. |

| Limits | Lower monthly limits for sending and receiving money. | Higher monthly limits for sending and receiving money. |

| Account Verification | Requires basic personal information for verification. | Requires additional business information for verification. |

| Customer Support | Standard customer support is available. | Not easy to switch from a personal to business account. |

| Switching Account Types | Not easy to switch from a personal to a business account. | Contact customer service to switch from business to personal. |

| Business Logo | No business logo is displayed. | Displays a green building logo next to the profile icon. |

Cash App Business Account vs Personal Account: Who it’s For

- Cash App Business account is intended for businesses looking to receive money from a large number of customers.

- Cash App personal accounts are more suitable for individuals looking to send and receive money to/from friends and family members.

What is the difference between Cash App Personal and Business accounts?

All Cash App accounts allow you to send and receive payments.

- Cash App Personal: Recommended for users who wish to send or receive personal payments for shared expenses such as splitting of dinner bills or rental charges, shop and pay online.

- Cash App Business: Recommended for individuals and merchants who operate under a company/group name. It offers additional features such as the ability to create their own payment link allowing non-Cash App users to make payments through the link without needing to create a Cash app account, a higher transaction limit to handle more payments, etc

Why Would You Need a Business Cash App Account?

You might be wondering about the benefits of having a business Cash App account or asking yourself what’s in it for you as a business in the first place.

Let’s find out!

1. Unlimited Transfers

With a Cash App personal account, there’s a transfer limit of $250 for unverified accounts and a $2,500 limit for verified ones. Business accounts, on the other hand, allow merchants to receive unlimited money from their customers.

The limit for sending money is also much higher for business accounts than it is for personal accounts. You can send up to $7,500 a week with a business account, while personal accounts have a transfer limit of $2,500 per month.

2. Non-Cash-App Users

If you have a personal Cash App account, you’ll only be able to receive money from Cash App users. Whereas creating a business account will enable you to receive money from customers who don’t have a Cash App account. After all, you wouldn’t want to limit your customer base to Cash App users only.

But how is that even possible? It’s actually quite simple. All you have to do is generate a payment link for your business and share it with your customers.

Pros of Cash App Business Accounts

Here are some extra perks for switching from a personal Cash App account to a business one:

1. Secure Payments

Even with the widespread use of online payment solutions, many customers are still skeptical about providing their card information to online retailers. That’s where a Cash App business account comes to the rescue; it offers your customers the safety of not needing to share their credit card info with you.

2. Ease of Use

Cash App is super easy to use, both for you and your customers. Creating a payment link takes little to no time with the Cashtag functionality. Additionally, you can check your payment history and even monitor your balance through the user-friendly app interface.

3. Reasonable Fees

Very few online payment apps offer business accounts without charging tons of fees for them. Luckily, with Cash App, you don’t need to worry about hidden fees that’ll set your business back. There are some fees, of course, but nothing that’ll break the bank.

4. Simple Setup

Setting up a new Cash App business account is pretty straightforward and shouldn’t take you more than a few minutes, provided that you’re already done with your tax filing, something which Cash App can also help you with, by the way.

Cons of Cash App Business Accounts

While Cash App business accounts are more flexible and have fewer restrictions than personal accounts, there are still some disadvantages that you need to keep in mind. These include:

1. Charges

With a Cash App business account, you have to pay a 2.75% fee for every payment you receive from your customers. Personal accounts, on the other hand, are charged no fees when it comes to receiving payments.

Additionally, Cash App charges business account users a 1.5% fee, or a minimum of $0.25, for instant deposits. But, the good news is that standard deposits are free of charge.

2. Limited Business Features

You’d expect an app offering business accounts to include some features that’ll make business management a bit easier, like payment tracking or appointment scheduling. However, Cash App doesn’t have any of these features; it can literally only be used for sending and receiving payments, no more, no less.

3. Very Few Customer Support Options

Receiving payments can be tricky; there’s always a chance for something to go wrong. If that happens, you’ll only be able to get in touch with Cash App’s customer support through app messages. There’s no option to contact customer support through phone calls or live chat, which can really slow things down.

4. Requires a Bank Account

Unlike Cash App personal accounts, you need to link your Cash App business account to your bank account to be able to transfer money to your wallet. Personal account users can quickly load up their wallets through ATMs without having to open an account, but unfortunately, you can’t do this if your account is for business use.

Switching Between Personal and Business Accounts

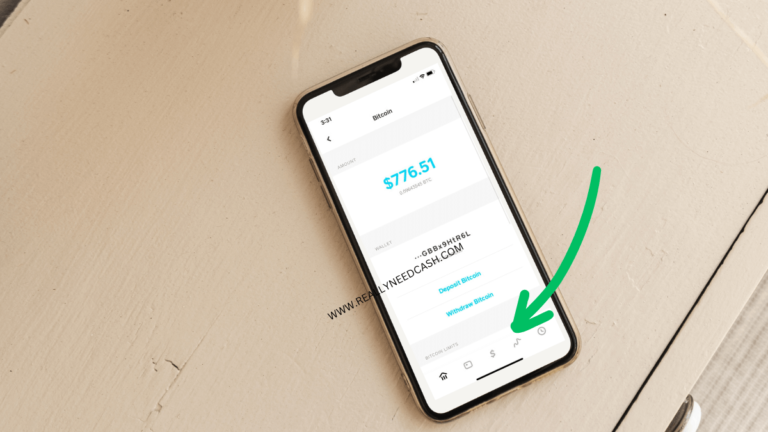

If you already have a personal Cash App account and want to switch to business without creating a new account, follow these steps:

- Launch Cash App on your phone

- Press the profile button and navigate to the “Personal” tab

- Choose ‘Change Account Type’ and confirm the changes with your biometric data or pin code

It’s worth noting that you can do it the other way around and switch from a business account to a personal one by following the same steps.

Can You Have Both Personal and Business Cash App Accounts?

Cash App allows users to have multiple accounts, whether they’re for personal or business use. However, keep in mind that you need a new phone number for every new account you create.

Final Words

To recap, Cash App business accounts are definitely worthwhile for those looking to efficiently sell their goods and services to customers.

Nevertheless, you might still be able to do business with a Cash App personal account, but only if you’re still starting and your customer base is mostly Cash App users. Once your business starts growing, consider switching to a business account for smoother payments and fewer restrictions.