Can I Transfer Zelle to Chime?

Yes, you can transfer from Zelle to Chime by linking your Chime debit card to your Zelle account. Open your Zelle app. Choose the person from your contacts, email, or phone number. Enter the amount you want to send. Confirm the recipient and amount. Hit “Send.”

To transfer money from Zelle to Chime, follow these steps:

- Log in to your Chime bank account via the website or app.

- Click “Move Money.”

- Select “Transfers.”

- Enter your Chime login information when prompted.

- Complete the transaction.

Chime’s Money Transfer Service:

Chime App has its own way of sending and receiving money, but you can’t use Zelle within the Chime app.

If you want to use Zelle with Chime, follow these steps:

- Get the Zelle App: Make sure you have both the Chime and Zelle apps on your phone.

- Open Zelle: Open the Zelle app and add your Chime debit card.

- Link Your Card: Enter your Chime debit card details in Zelle.

- Send and Receive: Now you can send and receive money using your Chime debit card through Zelle.

Transfer Speed and Limits:

Keep in mind, that transfers with Chime and Zelle might take up to three days and have a weekly limit of $500.

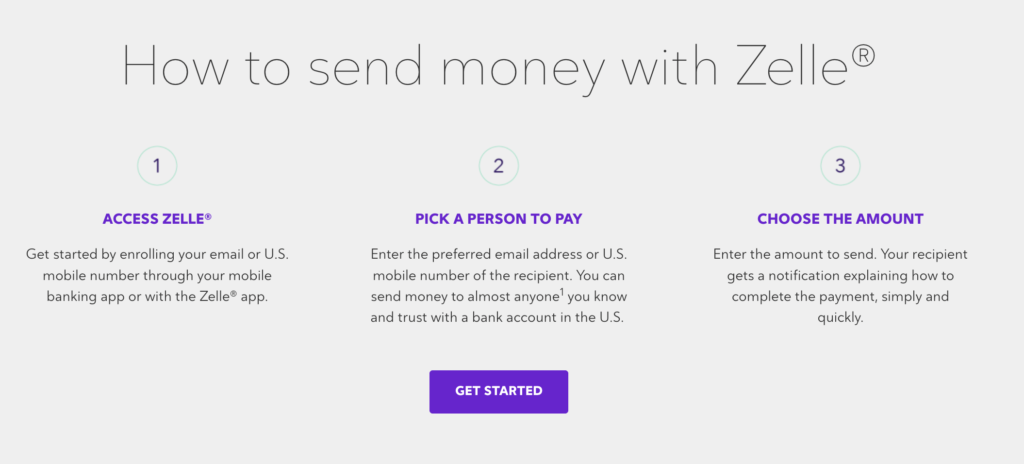

How to Send Money from Zelle to Chime?

- Open the Zelle app.

- Tap “Get Started” and follow the setup prompts.

- Enter “Chime.”

- Enter your Chime debit card details in the provided form.

- Open your Zelle app.

- Choose the person you want to send money to from your contacts or enter their email or phone number.

- Enter the amount you want to send.

- Confirm the recipient and amount.

- Hit “Send.”

To transfer money from Zelle to Chime is not a straightforward process as there is no dedicated option to seamlessly move funds between the two platforms.

It’s a multi-step process.

How to Transfer Zelle to Chime?

You need to follow a few simple steps for the workaround and you’ll be good to go.

Step 1: Open Zelle App

Launch the Zelle App on your phone. You can download it from iOS and Playstore if you haven’t already.

Step 2: Link Zelle to Your Bank Account

The first thing you need to do is link Zelle to your bank account.

If your bank doesn’t work with Zelle, you’ll need to choose a different account to proceed with the process.

- Register with Zelle: Open the Zelle app and begin the registration process. You’ll be asked to provide some basic information, such as your email address and phone number.

- Verify Your Identity: Zelle will ask you to verify your identity to ensure the security of your transactions. This might involve receiving a verification code via email or SMS.

- Link Your Bank Account: Once your identity is verified, you can link your bank account to Zelle. You’ll need to provide your bank account number and routing number.

- Set Up Your Profile: Finally, you can personalize your Zelle profile by adding your name and a profile picture. This information will be visible to others when they send you money.

Document requirements include your social security number, name and address associated with the bank account, routing number, and account number.

Step 3: Link Your Bank Account to Chime

- Open Chime App

- Go to the ‘Settings’ tab

- Select the ‘Link a Bank Account’ option.

- Scroll down to find the bank account

- Tap on it.

- Provide the same details here as you did with Zelle for adding the bank account.

Step 4: Send Money from Zelle to Chime

Once you’ve linked both Chime and Zelle to the same bank account, you can start sending money between the two platforms.

Personally, I recommend using Zelle as the recipient service and Chime as the sender.

To send money from your Chime account to a bank account via Zelle, follow these steps:

- Open the Chime App: Log in to your Chime account.

- Access the Move Money Feature: Look for the “Move Money” icon within the app, you will find them usually on the main menu.

- Initiate a Transfer: Under the “Move Money” section, select “Transfers.”

- Add an External Account: Choose the option to “Add an external account.” You’ll need to provide your bank account number and routing number for the destination bank account.

- Complete the Transfer: Follow the prompts and enter the amount of money you want to transfer. Confirm the transaction.

Your money will be sent from your Chime account to the linked external bank account via Zelle.

Are Zelle and Chime Compatible with Each Other?

You can’t directly use Zelle within Chime, but you can still make it work.

Here’s the lowdown:

- Chime and Zelle: Chime and Zelle are like two friends who don’t talk to each other at the same party. Chime doesn’t natively support Zelle, but you can still link them.

- Linking Chime and Zelle: To link your Chime account with Zelle, you need both apps. If you’ve got a Chime account and debit card, you’re ready to roll.

- Connecting Chime Debit Card: Download the Zelle app, get it started, and choose “Chime” as your bank. If you don’t see Chime listed, that’s okay. You can register your email and enter your Chime debit card info.

- Verification: You gotta understand, that both Zelle and Chime need to verify your identity, which can take a bit of time. So, don’t expect instant money magic.

- Zelle Limits: If you’re using Zelle with your Chime debit card, there’s a $500 weekly transfer limit. If you need to send more, you might need to explore other options.

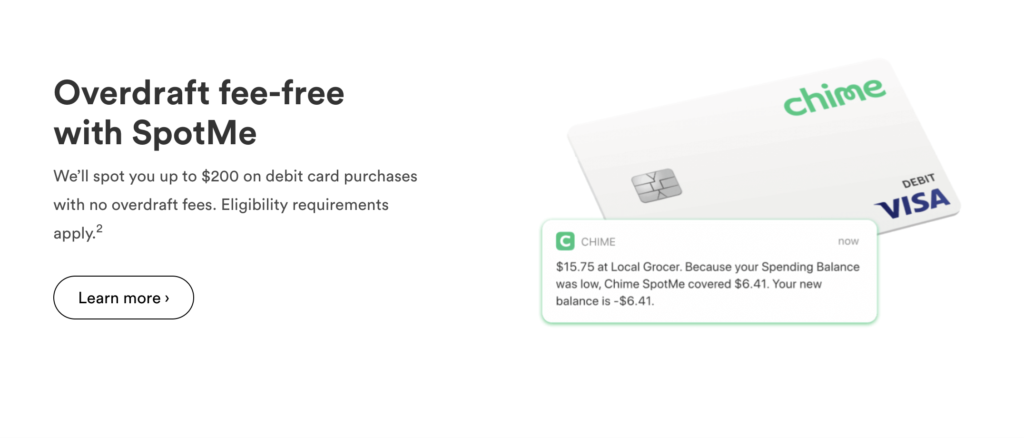

- Chime’s Pay Anyone: For sending money through Chime, there’s an easier way called “Chime’s Pay Anyone.” It’s like an express lane for sending cash, even to folks without Chime accounts. Just use the Chime app and follow the steps.

- Alternatives to Zelle: Don’t forget, there are other cool kids in town. Venmo, PayPal, and Cash App to Chime, are solid alternatives if you need more options.

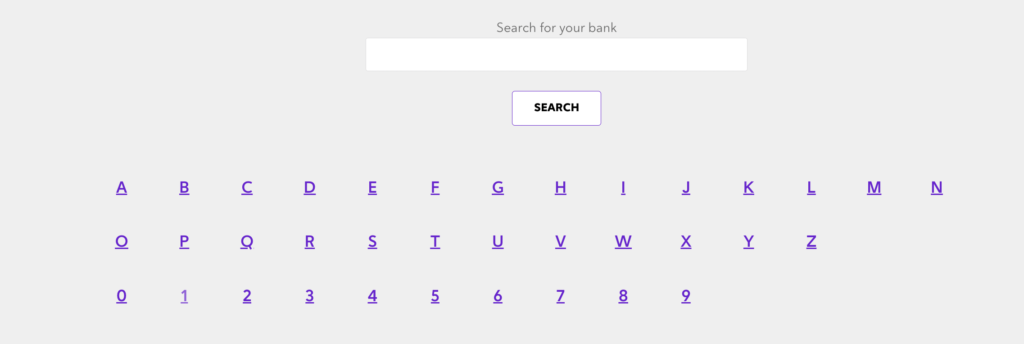

What Banks and Cards are Compatible with Zelle?

When it comes to sending and receiving money through Zelle, you should be aware if your bank and cards are compatible. Fortunately, Zelle is already integrated into over 2,100 banking apps, so chances are, your bank is already a partner.

I personally use Zelle through my bank, and it’s been a game-changer for sending money to family and friends. It’s quick, easy, and secure.

But before you can start using Zelle, you’ll need to make sure your bank or credit union is a partner.

Here’s a list of some of the major banks and credit unions that partner with Zelle:

- Bank of America

- Chase

- Wells Fargo

- Citibank

- Capital One

- PNC Bank

- US Bank

- Navy Federal Credit Union

- SunTrust Bank

- TD Bank

Keep in mind that this is not a comprehensive list, and there are many other banks and credit unions that partner with Zelle. To see if your bank is a partner, simply search the list provided on the Zelle website.

Other debit cards that are compatible with Zelle include:

- Bank of America Visa® Debit Card

- Chase Visa® Debit Card

- Wells Fargo Visa® Debit Card

- Capital One 360 Visa® Debit Card

- PNC Bank Visa® Debit Card

Again, this is not a comprehensive list, and there may be other debit cards that are compatible with Zelle.

So, it’s always a good idea to check with your bank or card issuer to confirm compatibility.

How to Link a Chime Debit Card with Zelle?

Once you have your Chime debit card details, follow these simple steps:

- Tap the “Get Started” button and follow the prompts to set up your Zelle account.

- When asked what bank you are trying to connect to, enter “Chime.”

- Select the “Don’t See Your Bank?” button.

- Register your email.

- Enter your Chime debit card details into the form provided.

By the way, you should verify your identity with both Zelle and Chime before you can start using the service.

What is Chime’s Pay Anyone Instant Transfers?

Chime’s Pay Anyone Instant Transfers is a speedy way to send money. If the person you’re sending money to has Chime, they get it instantly. If not, they have up to 14 days to claim it. It’s a quick and convenient way to send money, especially to Chime users.

For example. I use Chime, and if I need to send some money to my friend, Sarah who also has a Chime account.

So, if I use Chime’s Pay Anyone Instant Transfers to send her money, it shows up in her Chime account almost immediately.

However, another time, I needed to send money to my cousin, Tom, who doesn’t have a Chime account.

I can still use Chime’s Pay Anyone, and the cool thing was that Tom had 14 days to claim the money. So, he had some time to sign up for Chime or decide what to do with the money.

It’s the best way to send money quickly to both Chime users and those who don’t have Chime yet.

How to Set Up Chime’s Pay Anyone Instant Transfers?

Basically, Chime’s Pay Anyone feature is a game-changer when it comes to sending money to friends and family.

Step 1: Find the person you want to send money to

- Tap “Pay Anyone”

- Search for the person or enter their $ChimeSign.

If the person doesn’t have a Chime account yet, don’t worry, they won’t have to open a Chime account.

This is different from Zelle because both the sender and the recipient have to have Zelle accounts.

Step 2: Enter Payment Details

- Enter the payment details

- Add a GIF or emoji if you want to, Venmo-style.

- Double-check all the payment details

- Tap “Pay” to complete the transfer.

What is the limit for transferring money between Zelle and Chime?

The limit for transferring money between Zelle and Chime depends on whether your bank or credit union offers Zelle or not.

| Bank | Daily Zelle Transfer Limit | Monthly Zelle Transfer Limit |

|---|---|---|

| Ally | Instant transfers: $2,000 | $10,000 |

| Bank of America | $3,500 | $20,000 |

| Capital One | $2,500 | Not disclosed |

| Chase | $5,000 per transaction | Not disclosed |

| Citibank (Various Accounts) | $2,500 | $15,000 |

| Discover Bank | $600 | Not disclosed |

| Quontic Bank | Per transaction: $500 Per day: $1,000 | Not disclosed |

| TD Bank | Instant transfers: $1,000 Scheduled transfers: $2,500 | Instant transfers: $5,000 Scheduled transfers: $10,000 |

| Truist Bank | $2,000 | $10,000 |

| USAA Federal Savings Bank | $1,000 | $10,000 |

| Wells Fargo | $3,500 | $20,000 |

The limits are set by Zelle and cannot be changed by Chime or any other financial institution.

Alternative Methods of Transferring Money to Zelle

As I have mentioned above there is no direct way to transfer the funds between the two platforms.

However, there are a few alternative methods that you can use to work around.

Method 1: Utilizing Chime’s “Pay Anyone” Feature

- Open the Chime app

- Tap “Pay Anyone.”

- Enter the recipient’s $ChimeSign, email address, or phone number

- Specify the amount you want to send

- Complete the transaction.

Method 2: Linking Your Chime Card to Venmo

- Open the Venmo app

- Navigate to your profile.

- Tap the cog icon in the top-right corner

- Select “Payment Methods.”

- Add your Chime card details for sending money via Venmo.

Method 3: Add Your Chime Card to Cash App

Lastly, you can link your Chime card to Cash App to transfer money from Chime to Cash App and send it to another recipient.

- Open the Cash App

- Tap the profile icon in the top-right corner.

- Scroll down to find “Linked Banks” under the Account & Settings header

- Add your Chime card details.

Why isn’t Zelle working with my Chime account?

Let’s see why Zelle might not be playing nice with your Chime account. It’s like when two puzzle pieces just won’t fit, and we’re here to figure out why.

1. App Compatibility: First things first, make sure your Chime app and the Zelle app are both buddies on your phone. Sometimes, these apps can be a bit picky and need to hang out together.

2. Account Linking: You gotta understand, that for Zelle to work with Chime, you need to link your Chime account with Zelle. It’s like introducing two friends who’ve never met.

3. Verification: Now, double-check if your Chime account is fully verified. You know, like making sure your ID picture is clear – no blurry faces allowed.

4. Contact Support: If all else fails, don’t hesitate to reach out to Chime’s support team.

Frequently Asked Questions

Can I receive money through Zelle on my Chime account?

You can receive money on your Chime account using Zelle.

1. Link Your Chime Account with Zelle.

2. Once linked, you can receive money from anyone using Zelle.

3. The money will be deposited directly into your Chime account.

4. You’ll get a notification when the transfer is done.

Can I send money from Zelle to Cash App?

No, you cannot send money from Zelle to Cash App. Zelle is only compatible with certain banks and credit unions, and Cash App is not one of them. However, you can link your Cash App account with a different bank account and then use Zelle to transfer money to that account. Once the money is in your bank account, you can transfer it to your Cash App account.