To ensure you don’t go over your budget, create a realistic spending plan, prioritize essential expenses, build an emergency fund, regularly review and adjust your budget, track expenses diligently, set spending limits for discretionary categories, automate savings, avoid impulse purchases, negotiate bills, and involve family members in budget decisions.

Try the “ paying yourself first” method of budgeting if you truly wish to accelerate your savings. This means committing a reasonable amount of your income to savings and spending whatever is left on your expenses.

14 Practical Tips to Stay on Budget

To ensure you don’t go over your budget, consider implementing the following strategies:

- Create a Budget and stick to it

- Prioritise Needs over Wants

- Think twice before making big purchases

- Track Everything Manually

- Focus on Your Savings

- Find Additional Ways to Make Money

- Cut Bad Spending Habits

- Shop for UnBrand Names with Similar Quality

- Save and Use coupons

- Avoid Going out all the time and eat at Home More Often

- Pay Down Big Debt

- Pay in cash

- Bargain and Negotiate prices

- Track your Budget progress.

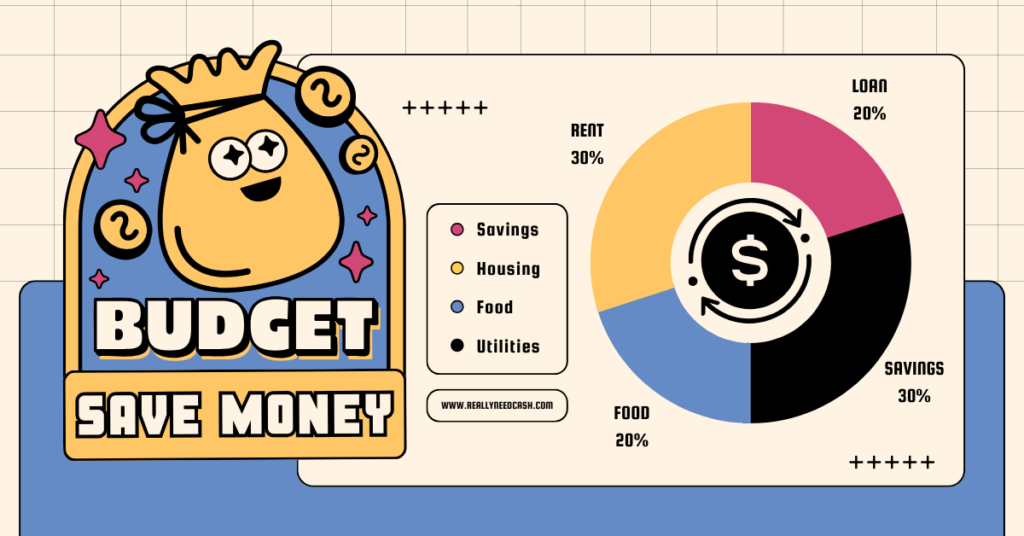

Expert Tip: The best way to stick to your personal budget is by adopting fiscal discipline. Overspending can easily come in the way of effective budgeting and money management when you focus more on paying others. Taking care of all your expenses including rent, utilities, food, entertainment, etc before setting aside a sizeable chunk for savings can heavily disrupt your budget.

– Laurens Yarpei (CFA)

How to Budget Money – 4 Ways to Do it Right!

I have personally done a few of these and it works like a charm all the time.

1. Try Zero Budgeting

Zero budgeting means when you prepare your budget, the outcome should look something like this:

Income – Expenses = 0

This is the most effective method of budgeting and it works very well for people struggling to manage their monthly expenses.

This way of budgeting ensures that every penny you earn is assigned a job whether it’s saving or necessary expenses.

You are basically cutting off any potential for overspending by equaling your income with expenses.

I want to add here that this method doesn’t mean you are stuck in your budget for a month, unable to make changes. Instead, this method’s whole purpose is to bring flexibility into your monthly finances and prepare you for the unexpected!

2. Revise Your Budget Multiple Times

If you haven’t prepared a budget before, know that this job can be confusing. You are bound to make mistakes the first time you do budgeting. That is why, it’s really important to revise everything you have written over and over again before finalizing your budget.

For instance, if you are trying the zero budgeting method and the outcome isn’t zero, don’t fret! You might have some holes in your budget that you just overlooked.

Are you spending $5 on coffee every day? Maybe you should switch to home-brewed options to save some bucks. Or maybe you could put a hold on buying those expensive clothes this month to settle your budget!

Look for these small holes in your budget that can be filled in to make everything perfect. In the end, it all comes down to how effectively you analyze your expenses!

3. Focus on Debt Payment

You can’t effectively save for the future and manage your present expenses if you have a debt to be paid. Paying debt needs to be your top priority, and there should be clear goals for it.

There are two most common methods of paying down debt that can help you achieve your goals faster:

- Debt snowball method

- Debt avalanche method

Each of these methods has its own unique characteristics. For instance, the debt snowball method is typically used when you are not in a high-interest debt. This means you can easily manage paying down your debt in the lowest to largest balance.

But obviously, this method isn’t very quick. On the contrary, if you have credit card debt or other high-interest debt that needs to be handled quickly, consider the avalanche method.

This method allows you to pay off your debt in order of interest rate. So, naturally, the debt with a high interest rate is tackled first and quickly!

Expert tip: if you are in credit card debt, pay more than the modest minimum. This will allow you to cut your debt faster while ensuring you don’t pay hundreds of dollars in added interest.

4. Draw a Miscellaneous Section in Your Budget

Aside from the food, shelter, transportation, and utility section, there should be a miscellaneous section in your budget. This section will specify the unexpected expenses you incur throughout the month.

It’s a smart move to keep aside some money for unexpected, miscellaneous expenses every month. This will help you avoid experiencing a money crisis whenever something unexpected comes up.

When you don’t have a miscellaneous line in your budget, you will likely end up spending your savings or debt money on these unexpected expenses.

So, think smart and prepare in advance.

Why Doesn’t My Budget Work?

There are countless reasons why personal budgets fail–some of them are:

- Overspending especially when it comes to entertainment or shopping.

- Not having a major savings goal.

- Unexpected or non-monthly expenses such as car repair or pet appointments.

- Not leaving enough room for errors and spontaneity.

Taking the “paying others first” approach is another major reason why your budget might not be working. This is typically what people do with their monthly finances:

- They get their salary.

- They spend it on utilities, food, shelter, and other expenses.

- They stash whatever’s left for savings.

But there is a flaw in this approach. When you don’t have a proper savings plan and there is no compulsion, you are likely to overspend. You might be tempted to buy those branded shoes or invest in a new phone when you have the money.

The budget you carefully prepared at the start of the month often goes down the drain after unnecessary purchases, leaving you with nothing but regret!

So, what’s the solution? As I discussed above, thinking about saving money before you pay for your expenses is the key to successful budget planning. So, this is what you should be doing with your income:

- Receive your monthly income.

- Set aside money for necessary expenses such as debt payment, rent, and utilities.

- Chuck a reasonable amount from your income (ideally, 10-20 percent) into a savings account.

- Use whatever is left for other expenses such as food and entertainment.

Budgeting is like a long race, not a quick one.

It might be hard sometimes, but if you think about what you really want and focus on those things, it helps you stick to your plan.

10 Proven Strategies to Combat Overspending

- Pause and Reflect: Take a deep breath and Ask yourself if it’s a need or a want.

- Budget Check: Review your budget. See if overspending in this category will impact other financial goals.

- Prioritize Purchases: Rank your purchases by importance. Focus on essentials before indulging in non-essentials.

- Set Spending Limits: Establish daily or weekly spending limits and stick to them.

- Sleep on It: Delay the purchase. If you still want it after a day or two, consider its importance.

- Compare Prices: Look for better deals or alternatives. Online tools can help you find the best prices.

- Leave the Credit Card at Home: Use cash for discretionary spending. It makes you more aware of your expenses.

- Track Expenses: Keep a record of your daily spending. It helps identify patterns and areas for improvement.

- Visualize Goals: Remind yourself of your financial goals. Assess how the impulse purchase aligns with these goals.

- Accountability Partner: Share your financial goals with a friend or family member who can help keep you accountable.

How Can You Effectively Manage Monthly Bills with a Weekly Budget?

You have to pay for things like your house, electricity bill, and phone every month, but you get your money weekly. To make sure you have enough for everything, you add up all those monthly bills, round up a bit, and then divide by four.

That’s how much money you put aside each week to pay your bills. You can also ask if the companies will let you pick when to pay, so it’s easier.

And just like you plan your week, you plan your money, so you have enough for everything and even save some!