How To Cash a Money Order Online?

To Cash a Money Order Online, use Western Union®, MoneyGram, WorldRemit, Wise, and XE Money Transfer. Fill out the money order page and send the receipt online. Head to an Agent location with a valid ID, confirmation number, and the original money order to pick up the cash.

Is this your first time trying to buy a Money Order or has someone sent you a Money order and has no clue to Cash Out?

Well, whatever the reason may be, I will help you out in a few simple steps, and you’ll be able to cash your money order online in no time.

Just a side note, I will urge you to remember and keep your confirmation number and ID handy when you go to pick up your cash. Also please don’t lose it, it will be such a problematic experience if you lose it or don’t remember it.

How to Cash a Money Order Online: Tutorials

Here’s a step-by-step guide to Cash a Money Western Union money order online:

Step 1: Open a Western Union Account

I would say the first thing is to create an account with Western Union if you don’t already have an account.

It’s a regular and simple process with provides basic information like your name and email address.

Step 2: Click the “Send Money” tab.

Just a sidenote Western Union treats money orders as a form of cash, so you’ll need to send the money to yourself in order to cash it.

To start a money transfer, simply login to your account and click on the “Send Money” tab.

Step 3: Enter the details

Now I want you to enter the details of your money order such as:

- Name of the issuer

- Serial number.

- YSelect the country where the money order was issued.

Step 4: Choose “Cash at Agent Location”

On the next page, you will be asked how you want to send the money, choose “Cash at Agent Location”.

This basically allows you to pick up the cash at a Western Union agent location near your location.

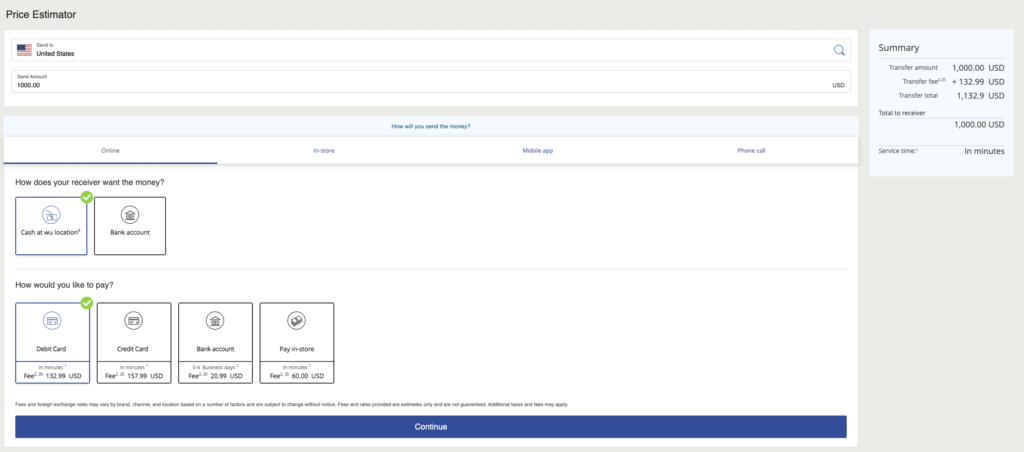

Step 5: Pay for the Transfer

All Businesses need fees to survive and Western Union will charge a small fee for sending your money order.

You can pay for it by using a credit or debit card, or by linking your bank account. Once you’ve paid for the transfer, you’ll receive a confirmation number.

Step 6: Pick up your cash

The person who has to receive the money needs to have the confirmation number in hand. Once that is done, head to a Western Union agent location near you to pick up your cash.

I would recommend bringing a valid ID with you, as well as the confirmation number and the original money order.

What’s a Money Order?

A money order is a payment order for a pre-specified amount of money. It’s basically like a check that you can use to pay for goods and services or to send money to someone.

They’re a bit like checks, but I would say they’re more secure and easier to use in certain situations.

And I know personally for a fact that they’re also a good option to send money through the mail or when you don’t have a bank account and need to make sure that the payment is secure and can’t be altered or stolen.

Money Order Fees

- To send $1000 to the United States using a debit card with the option of Cash at a Western Union location, the estimated transfer fee is $132.99 USD.

- The total cost for this transfer, including the fee, is $1,132.99 USD.

How to Cash Paper Checks on Cash App?

Here’s a simple, quick, and easy guide:

- Step 1: Open Cash app

- Step 2: Go to the Banking tab

- Step 3: Scroll down and Select the deposit option

- Step 4: Choose the “Check” option

- Step 5: Take photos of the front and back of your check (Make sure that the check is clear and legible.)

- Step 6: Enter the date and the amount of the check

- Step 7: Hit “Deposit”

RELATED READ: 29 Ways to Earn $2000 Online

Where Can I Cash My Money Order?

- Banks and Credit Unions – I will say your bank or credit union is one of the safest and easiest places to cash a money order.

- Post Office – A cheaper alternative and also safe regardless.

- Check-Cashing Stores – I will choose this if I don’t have a bank account. They are also faster and usually charge a fee, but in my opinion, it’s worth it, especially if you need cash quickly)

- Convenience and Grocery Stores – Not all of them offer these services. So, check with the store first to see if they have it or not.

How to Pay for a Money Order?

- Decide on the amount: Mind you there are limits on how much you can get a money order for.

- Get the cash: Use cash, a debit card, or a traveler’s check to pay for the money order.

- Find a place to buy the money order: You can get a money order at a bank, post office, or convenience store.

- Fill out the money order: It includes the name of the recipient, your name and address, and any other necessary information.

- Keep the receipt: Very important in case anything goes wrong or the money order gets lost.

I just told you to fill up the money order above, but if this is your first time and don’t have much understanding about it, here’s how it works.

UPDATE: Wegmans has stopped doing money orders.

How to Fill Out a Money Order

- “Pay to the Order Of”: Name of the person or business you’re sending the money order to.

- “From” or “Sender”: Own name and address

- “Amount”: Write the amount of the money order in both numbers and words.

- “Purchaser, Signer for Drawer”: Sign the money order

As you can see, it’s super simple and not so hard after all.

How Long Does Money Orders Take?

It depends on where you go to cash it and different places have different policies and procedures.

For example, if you decide to go to a bank or credit union (eg. Western Union) to cash your money order, the process can take anywhere from a few minutes to a few hours.

This is simply because these Big institutions have to verify the authenticity of the money order and make sure that it has not been altered or forged in any way.

On the other hand, let’s say you go to a check-cashing store or a grocery store to cash your money order, the process can be much quicker.

The reason is that they handle transactions like this quickly and efficiently, so you can usually get your money within a matter of minutes.

How to Send Money Orders Domestically?

These can be completed at any Post Office location.

- Step 1: Choose the amount to send ($1,000 in a single order anywhere in the United States).

- Step 2: Go to any Post Office location.

- Step 3: Bring cash, a debit card, or a traveler’s check (credit card is not allowed).

- Step 4: Fill out the money order at the counter with a retail associate.

- Step 5: Pay the dollar value of the money order plus the issuing fee.

- Step 6: Collect your receipt to track the money order.

How to Cash Domestic Money Orders Within the Country?

- Find a place that cashes money orders: e.g. Post Office

- Sign the money order at the counter: Take a primary photo ID with the money order to any Post Office location and Sign the money order at the counter in front of a retail associate.

- Additional requirements: If the money order is made out to organizations, more than one person, or minors, there are additional requirements.

How Much Money Orders Can I Buy?

You can buy a single money order of $1,000 at once.

So, if you need to send $5,000, just purchase five money orders worth a grand apiece.

Regular money orders can be purchased at your local bank, post office, or some grocery stores.

Again as I mentioned, international money orders come with their own set of limitations.

- Other Countries: $700

- Guyana or El Salvador: $500.

The United States Postal Service charges up to $2.90 per order if going to a customer in the U.S.; those being sent internationally cost $49.65 per $700.

WellFargo Money Order

- Visit a Wells Fargo branch

- Provide a valid ID, such as a driver’s license or passport, and the money order itself.

- The fee for cashing a Wells Fargo money order is $5 per money order.

Again remember that if you cash a money order at a different bank, they may charge additional fees.

Where You Can Cash a Money Order Online?

So, you’ve got a money order in your hands, but let’s suppose that you don’t have a bank account or can’t make it to a physical location to cash it.

There are a few options available for you to cash your money order:

Step 1: Check with the Issuer

The first step is to check with the issuer of the money order. Some issuers, for instance, let’s say Western Union allow you to cash your money order online through their website or mobile app.

Others may only have partnerships with online cashing services and don’t provide physical locations.

I would recommend you do your prior research before committing to one.

Step 2: Use an Online Cashing Service

In case the issuer doesn’t offer online cashing, you can use an online cashing service like Check Into Cash, MoneyGram, or ACE Cash Express.

Basically what these services do is allow you to upload a photo of your money order and then deposit the funds into your bank account or onto a prepaid card.

Step 3: Check with Your Bank

The best option is to check with your bank.

Many banks allow you to deposit money orders and I know that may even allow you to cash the money order online if you have a bank account with them.

I sometimes use my Bank Money order as it is very convenient but that is up to you to make your own decision as I would always prefer Western Union for many reasons (but use my bank sometimes).

Step 4: Consider a Prepaid Debit Card

Companies like Netspend, Green Dot, and Walmart offer prepaid debit cards that allow you to deposit checks and money orders through their mobile app or websites.

How Long Is a Money Order Accepted/ Good For?

Money orders don’t expire, but depending on the state and issuer, they may incur additional service charges if you cash them more than a year after they were issued.

The terms for how long a money order is accepted and good for will be described on the back of your money order.

So, when you receive a money order, make sure to check the back for any information about expiration dates or fees.

I will explain this with an example: Let’s say you have a domestic money order from the U.S. Postal Service. Well, these money orders will never expire or lose their value, so you can hold onto them for as long as you need to.

What If My Money Order Is Lost or Stolen?

- Contact the issuer of the money order.

- Fill out a form to report the lost or stolen money order.

- The issuer will then investigate the matter and determine whether or not the money order has been cashed.

In case the money order has not been cashed, the issuer will likely issue you a new one. But if the money order has been cashed, the issuer will provide you with a copy of the cashed money order.

Frequently Asked Questions

Where Can I Cash a Money Order Online?

You can cash money orders online at Western Union, MoneyGram.

What Information Do I Need to Cash a Money Order Online?

To cash a money order online, you’ll need to provide your name, address, and bank account information. You may also need to provide a photo ID to verify your identity.

Are There Any Fees Associated with Cashing a Money Order Online?

Yes, there are usually fees associated with cashing a money order online and it differs from states and services.