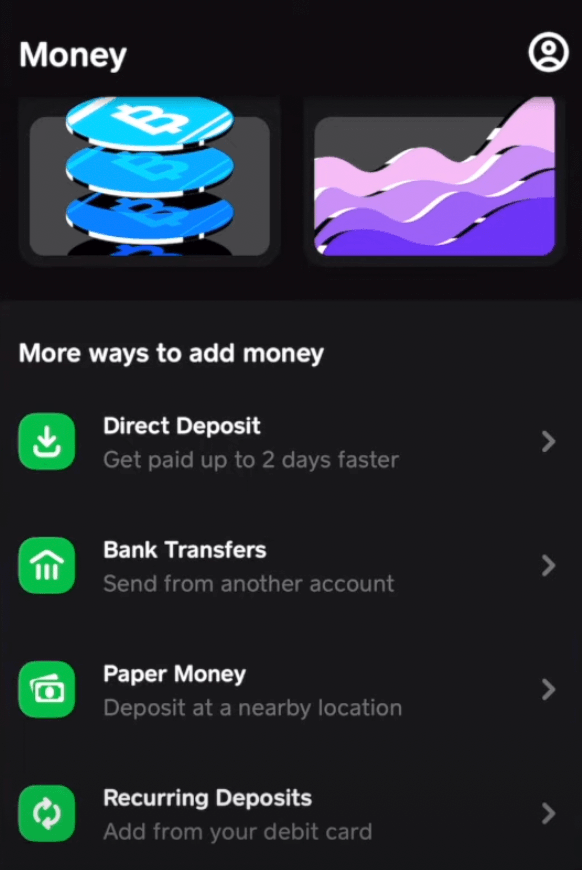

Cash App has a paper money option! That’s right.

It has made adding money to your account even more accessible by letting you deposit paper money at select locations such as Walmart, Dollar General, CVS, and more.

To Get Paper Money Option on Cash App: 1. Link a Bank Account. 2. Tap the “Banking” tab 3. Select “Paper Money” and follow the prompts to enable the feature.

What is Paper Money on Cash App?

Paper Money on Cash App allows you to reload your Cash App account by scanning the barcode within your Cash App.

Visit a nearby merchant store and hand them the money you want to deposit. The funds will automatically be added after scanning the barcode.

In Case, if the feature is not available in your account, Click Here to read a full-on detailed guide and the possible reasons.

How to Get Paper Money Option on Cash App: Step-By-Step

By following these steps, you will be able to access the Paper Money option on Cash App and deposit cash at a nearby location.

Total Time: 10 minutes

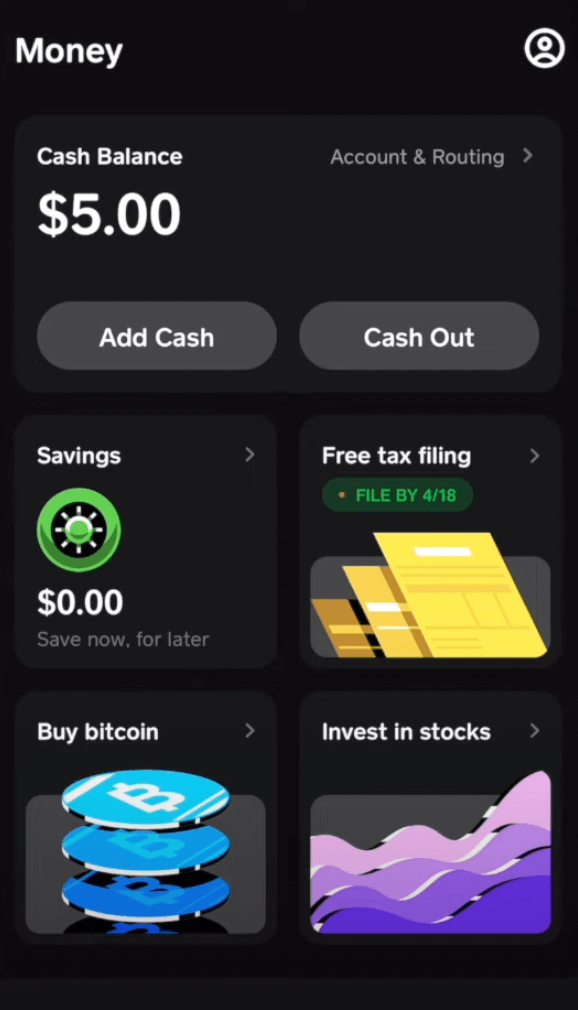

Step 1: Open Cash App

Open the app on your device after downloading it from App Store.

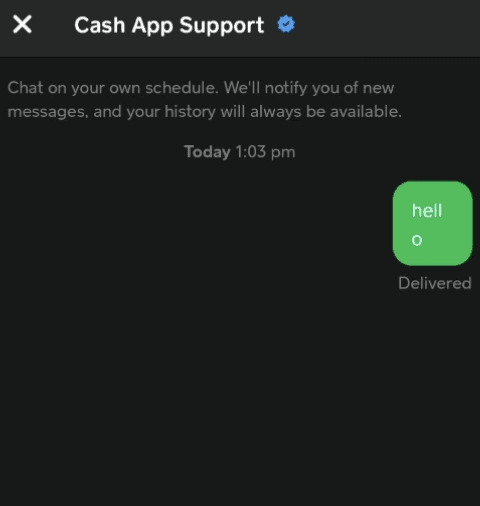

Step 3: Enable the Paper Money Option

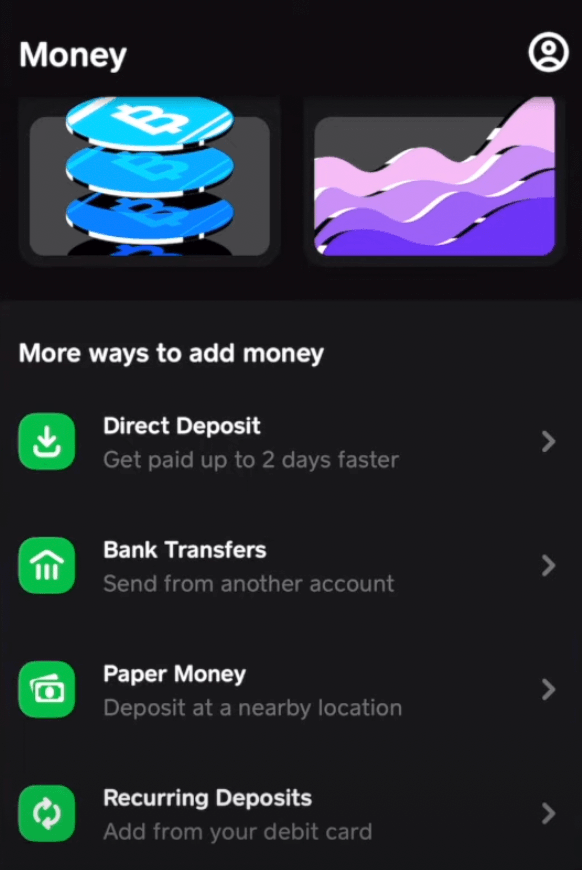

After linking your bank account to your Cash App account, you must enable the paper money option. To do this, Tap the “Banking” tab again and select your connected bank account. Then, tap “Paper Money” and follow the prompts to enable the feature. Or Contact Cash App Support to enable the feature.

Step 4: Got to the Banking tab

After enabling the paper option, Open the Cash App and navigate to the Banking tab on the home screen.

Step 5: Click on Paper Money

Select the Paper Money option from the available options.

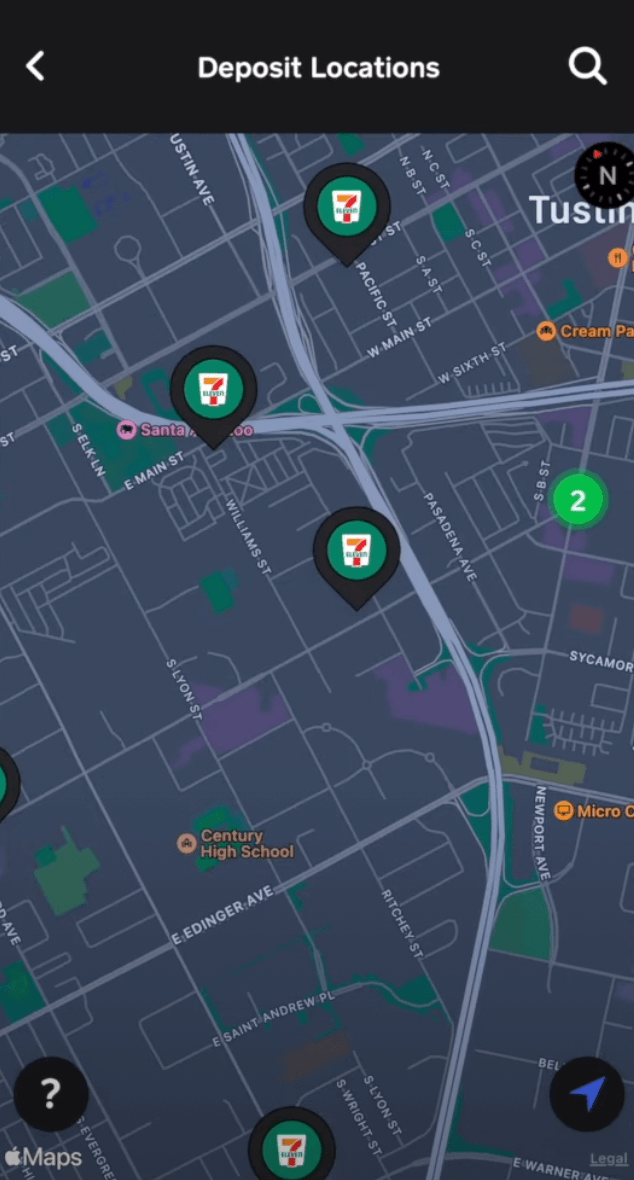

Step 6: Search for Location

Use the search bar to enter an address or find a location near you.

Step 7: Select the Address

Once you’ve selected a location, you can proceed with the paper money deposit process.

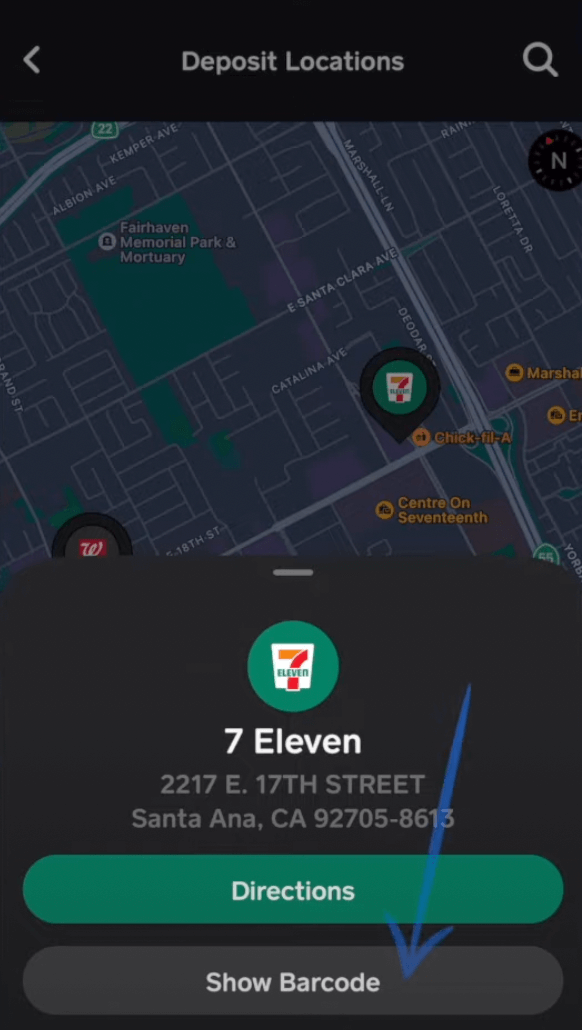

Step 8: Click on Show Barcode

Visit the location and approach the cashier.

Step 8: Scan Barcode

Show the cashier the barcode to scan and load money into your account. Follow the prompts and instructions provided by the app to complete the transaction.

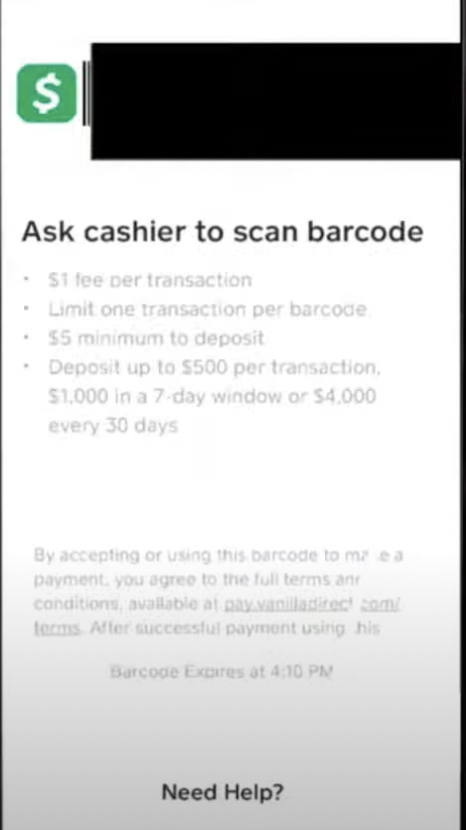

Step 9: Wait for Payment Confirmation

Your funds will be credited within a few seconds and accompanied by a notification confirming that the money has been successfully credited.

Paper Money Features

| Feature | Limit | Rolling Days | Fees | Locations |

|---|---|---|---|---|

| Paper Money Deposit | $5 – $500 | 7 days | None | Walmart (Customer Service Desk/Money Centers), Walgreens, Duane Reade, 7-Eleven, Family Dollar, GoMart, Sheetz, Kum & Go, KwikTrip, Speedway, H-E-B, Rite Aid, Thorntons, TravelCenters of America, Dollar General, Pilot Travel Centers |

| Paper Money Deposit | Up to $1,000 per rolling 7 days, $4,000 per rolling 30 days | 7 days, 30 days | None | Walmart (Customer Service Desk/Money Centers), Walgreens, Duane Reade, 7-Eleven, Family Dollar, GoMart, Sheetz, Kum & Go, KwikTrip, Speedway, H-E-B, Rite Aid, Thorntons, TravelCenters of America, Dollar General, Pilot Travel Centers |

How to Check Paper Money Option on Cash App

- Tap the “Banking” tab again and

- Select “Paper Money” and follow the prompts to enable the feature.

What must I do to access the paper money feature on Cash App?

To access the paper money feature on Cash App, you will need to follow a few simple steps:

Step 1: Update your Cash App

Before you can access the paper money feature, you must ensure that your Cash App is up-to-date. You can check for updates in your app store and download the latest version of Cash App.

Step 2: Link your Cash Card

You must have a Cash Card linked to your account to enable the paper money feature.

You can order one through the app if you don’t have a Cash Card. Once you receive your Cash Card, link it to your account by following the prompts in the app.

Step 3: Verify your identity

This simple process involves providing your name, date of birth, and social security number.

This information is securely stored and used only for identity verification purposes.

Step 4: Try Enabling the paper money feature

Once you have completed the above steps, you can check if the paper money feature is available.

Cash App Paper Money Deposit Locations

Cash App’s Paper Money deposit feature allows users to add money to their Cash App account at specific retail locations:

| Cash App Paper Money Deposit Locations | Availability |

|---|---|

| Walgreens | Available |

| Duane Reade | Available |

| 7-Eleven | Available |

| Family Dollar | Available |

| GoMart | Available |

| Sheetz | Available |

| Kum & Go | Available |

| KwikTrip | Available |

| Speedway | Available |

| H-E-B | Available |

| Rite Aid | Available |

| Thorntons | Available |

| TravelCenters of America | Available |

| Dollar General | Available |

| Pilot Travel Centers | Available |

What is the Cash App Paper Money Deposit Limit?

The deposit limits for the paper money feature are $1,000 per rolling 7-day period and $4,000 per rolling 30-day period. Please note that the minimum deposit amount is $5, and the maximum deposit per transaction is $500.

We understand that everyone has different financial needs, so Cash App offers multiple options for adding money to your account.

In addition to paper money, you can also add funds using your linked bank account or debit card.

How Long Does Paper Money Take for Cash App?

The timing for adding paper money to your Cash App account can vary depending on several factors.

In general, adding paper money to your account should be instant, but there can be some delays or processing times depending on the source of the funds.

Summary

In conclusion, the Cash App Paper Money deposit feature is a convenient and reliable way for users to add funds to their Cash App account without needing a bank account or credit card.

With a wide range of participating stores across the US, users can easily find a location to make a deposit.

The deposit limits of $1,000 per rolling seven days and $4,000 per rolling 30 days provide flexibility for users with varying needs.

The low fees and quick processing time make this an attractive option for those looking to manage their finances more efficiently. Overall, the Paper Money deposit feature on Cash App is an excellent option for users who want a simple and convenient way to add funds to their account.