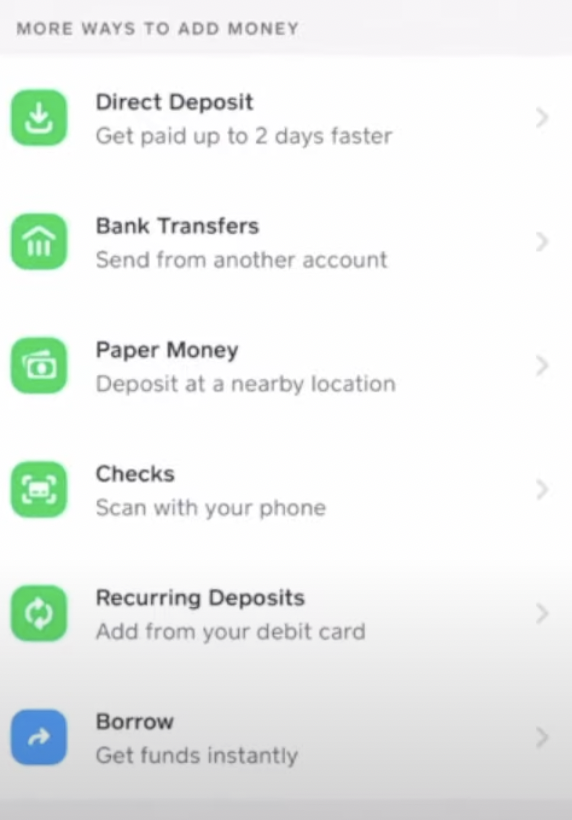

The Cash App Borrow feature is slowly being rolled out on Cash App, allowing users to take out loans. Once the borrow feature is unlocked, it will appear under the “more ways to add money” section.

Can you Borrow Money on Cash App?

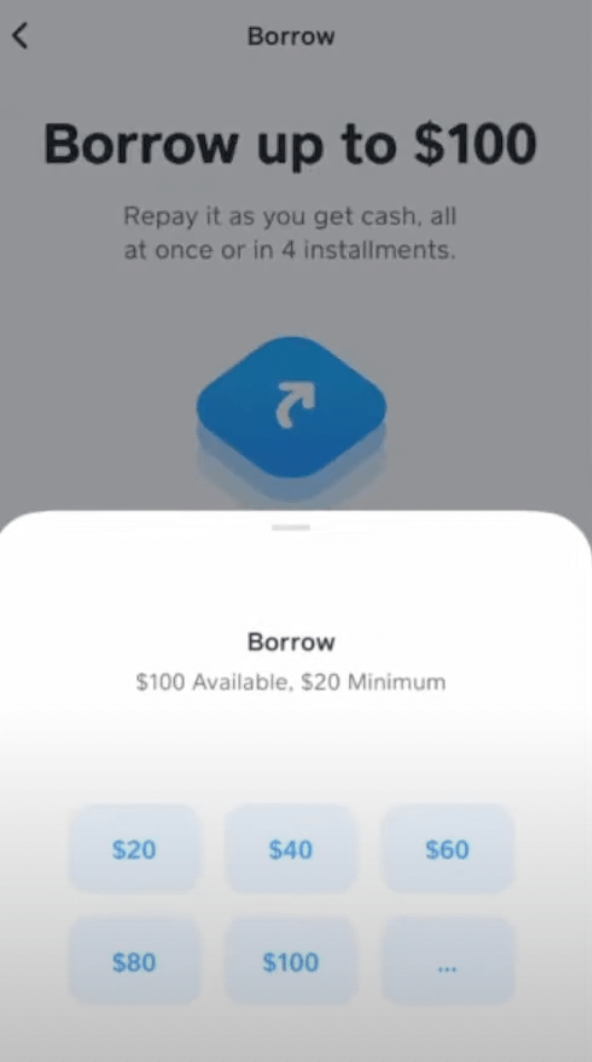

Yes, you can borrow on Cash App anywhere from $20 all the way up to $300. To borrow money on Cash App Loan: 1. Go to banking tab 2. Select “borrow,” 3. Choose the desired amount, and review the borrowing fees. If approved, the borrowed funds will be credited soon.

Cash App Borrow Summary

| Name | Cash App Loan |

|---|---|

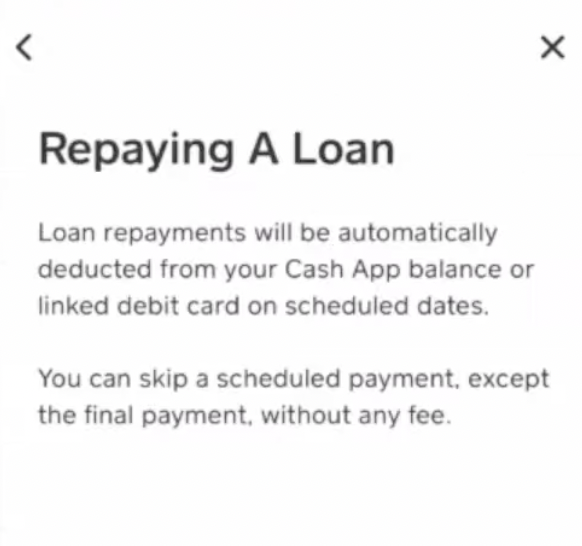

| 📅 Repay In | 4 Weeks |

| 💰 Borrow Up To | $200 |

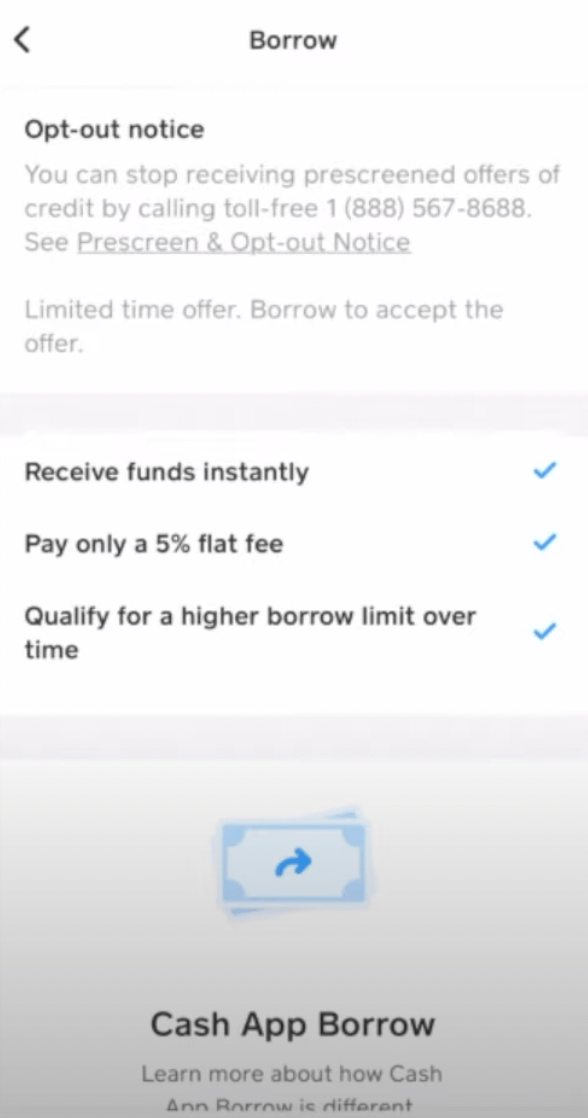

| 💸 Receive Funds | Instantly |

| 🏦 Loan Fee | 5% Flat Fee |

| ⏰ Required | 18+ US Resident |

| ⭐ How To Unlock | 6 Steps to Borrow |

Read: How to Add Money to Cash app card (Online and in-Store)

How to Borrow Money From Cash App on iPhone/ Android?

Here is a step-by-step guide on the process of borrowing money from Cash App, ensuring a smooth experience.

Total Time: 10 minutes

Step 1: Open the Cash App on your device

Open the Cash App on your device and log in to your account. Once logged in, navigate to the banking tab on your Cash App screen.

Step 2: Select the Borrow Option

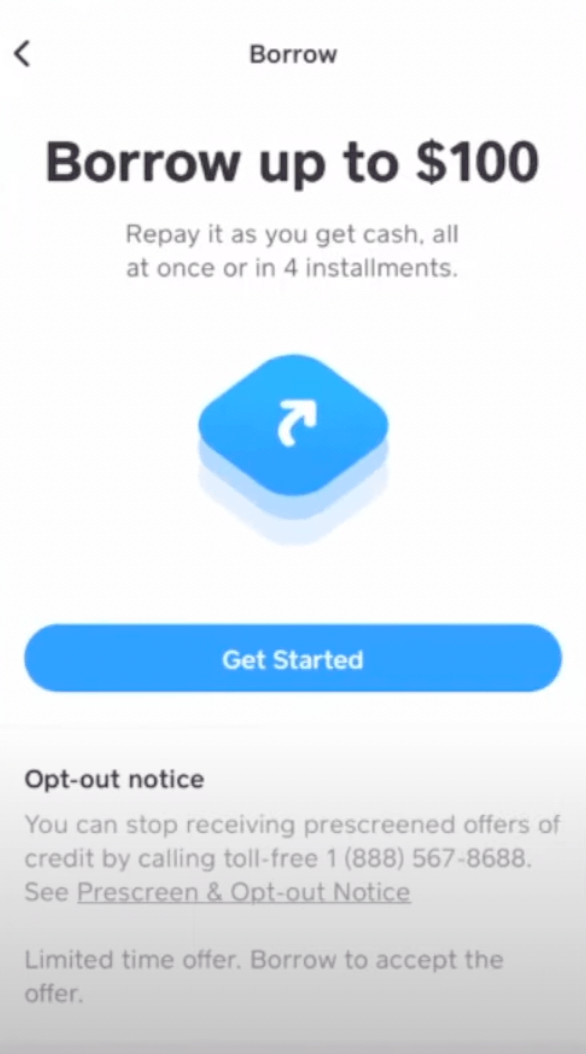

Within the banking tab, locate and select the “Borrow” option. This will initiate the borrowing process.

Step 3: Choosing the Loan Amount

Cash App sets a borrowing limit, and the maximum loan amount available varies for users from state and other variables come into factor too from $20 all the way to $300.

Step 4: Reviewing Borrowing Fees

Cash App provides a flat rate fee for borrowing money. Review the borrowing fees displayed on the screen to understand the cost associated with the loan.

Currently, Cash App charges a five percent flat rate fee, which amounts to $5 for a $100 loan

Step 5: Accept the Loan Terms

If you agree with the borrowing fees and terms, click on the “Get Started” or “Borrow” button to proceed.

Step 6: Repayment Options

Cash App allows you to repay the loan in one installment or split it into four installments. Choose the repayment option that suits your preferences and financial situation.

Step 7: Loan Approval and Availability

Once you have accepted the loan terms, Cash App will review your borrowing eligibility. If approved, the borrowed funds will be made available in your Cash App account.

Click here to find out what happens if you default on the Cash App loan and fail to pay it back along with all the FAQs you might be interested to hear regarding the Cash App loan feature.

Why Cash App’s Loan Borrow Feature is not available for some users?

Check Borrow Feature Availability

- Tap on the icon in the top right corner of the Cash App home screen.

- Scroll down and select “Support.”

- Search for “borrow” in the support search bar.

- Select the option related to borrowing to access information on the feature.

- Note that the borrow feature may not be available to all US residents yet.

Factors Affecting Borrow Feature Access

Cash App’s eligibility for the borrow feature may be influenced by:

- State of residence

- Having an active Cash App card

- Cash App usage frequency

- Credit history

How to Improve Borrowing Chances in Cash App?

To increase the likelihood of getting access to borrowing, users are advised to use the Cash App card frequently and deposit $200 or more in a month.

How to Increase the Cash App Borrow Limit?

You can increase the borrowing limit on your Cash App Loan if you pay off your earlier loan in time, then they increase your borrow limit.

Can Everyone Borrow Money from Cash App?

The cash App borrows feature is not fully rolled out yet. The loan concept is still under testing and is limited to loans of only $20 to $200. It is not available for everyone and is eligible for a select few only at least for now.

Currently, the borrow option is not available. Due to some undisclosed reasons, Cash App seems to have rolled back the plan of launching the Cash App borrow feature.

However, that doesn’t mean the Borrow feature on Cash App has permanently ceased. We will update for everything news on the loan feature of the app.

There are quite a few murmurs that the borrowed money feature might be rolled into reality in the very near future.

Reports from TechCrunch, the Cash App loans will require you to pay back in four weeks’ time or less. Cash App will charge a 5% flat fee to borrow, along with another 1.25% per week after the loan grace period.

Can Anyone Apply for the Borrow feature on Cash App?

Payday loans are usually based on how much you earn, and you also have to provide a pay stub when applying for the loan.

I have received a few emails regarding this particular topic on how the Cash App borrow money feature works and is it available for all users, sort of those questions.

So, why not let me clear the air. Read the below post for more in-depth regarding the topic.

If this feature ever becomes a reality, for the first few months or years: it seems that only a handful of potential users will be able to apply for a Cash App loan.

Similar to a traditional Credit Card application, a Cash App loan potential user eligibility check may include your balance, Creditworthiness, and account spending activity along with many others and those who maintain a good Cash App balance and get paid through the Cash App direct deposit every month, etc.

Why can’t I Borrow money from Cash App?

The reason why you cannot borrow money on Cash App may include – If you have an outstanding negative balance on Cash App wallet, You have not verified your Cash App account, Your account has violated TOS, and your Cash App mobile app is not updated to the latest version.

Even if you do pass all the above-mentioned requirements, we don’t know exactly how Cash App borrow feature is made available and what criteria are used for someone to be able to borrow money on Cash App.

How much can I Apply with Cash App Borrow Feature?

You can borrow between $20 and $200 through Cash App if you are one of the lucky 1,000 users Squares is currently testing for the feature.

Cash App provides an “affordable alternative to the high-interest payday loans” and may be best suited for borrowers with no credit history or bad credit.

You can borrow between $20 and $200 for up to 4 weeks, along with a flat fee of 5%(an APR of 60%).

If personal loans are out of your reach due to your bad credit, a reliable Cash App loan could prove a viable solution if it is managed correctly.

This should involve a solid plan as to how your payments will be met and an absolute resolution not to miss the payment deadlines that have been set by Cash App.

Best Cash App Payday Loan Alternatives

If the Cash App Borrow feature isn’t available for your account, you can have a look at some of the best payday loans online available with no credit check.

- Check Into Cash – Check Into Cash offers a smaller range of loan amounts and deals directly with customers for their cash needs.

- CashNetUSA – It allows borrowing amounts ranging from $100-$3,000 in a single installment amount with a quick approval process and delivery of funds to customer accounts.

- Oportun – The company offers affordable repayment plans and accepts loan payments in multiple forms.

- Speedy Cash – You can borrow anywhere from $100-500 at a time at a low rate of interest and also has support for customers with low credit.

- Check ’n Go – It can apply to borrow money between $300 to $3,000 for one month with industry average rates and practices.

- Rise Credit – Rise Credit can provide loans between $500 to $5,000 and make repayments affordable.

Is Cash App Borrow Loan Feature Safe?

Considering the company is owned by Square, Inc. which is an American financial service and digital payments company, in terms of safety and security, we can assume it to be particularly safe.

Before applying for any, we recommend checking their BBB rating, and Trustpilot reviews and seeing if they are an accredited member of the CFSA to prove that they are trustworthy lenders.

As for the Cash App loan, it is safe as you can expect.

You can say it is similar to a payday loan where you can quickly get a few couple hundred bucks to cover some of your expenses before your next salary of Paycheck.

Final Thoughts:

Like all loans, If you’re interested in Cash App to borrow feature or payday loan, don’t overlook the importance of their Terms and conditions, disclaimer, guidelines, safety and security, and your data and privacy among many others. It can haunt you back later.

The same applies to Cash App when compared to most Payday online lenders that claim to provide cheaper loans, but the loans are still pretty expensive and can get really bad if you don’t pay the balance off quickly along with the interest if required.

Considering that if you are not a part of the 1,000 users Square is currently testing short-term loans with, you can’t borrow money on Cash App yet.

So, if you really need to borrow money for the short term, start considering the other options mentioned above.

However, be sure to fully understand what you’re signing up for, their payment requirements, repayment deadlines, interest rates, and whether you can really afford to borrow or not.

Did you find this article helpful? Let us know in the comments below!