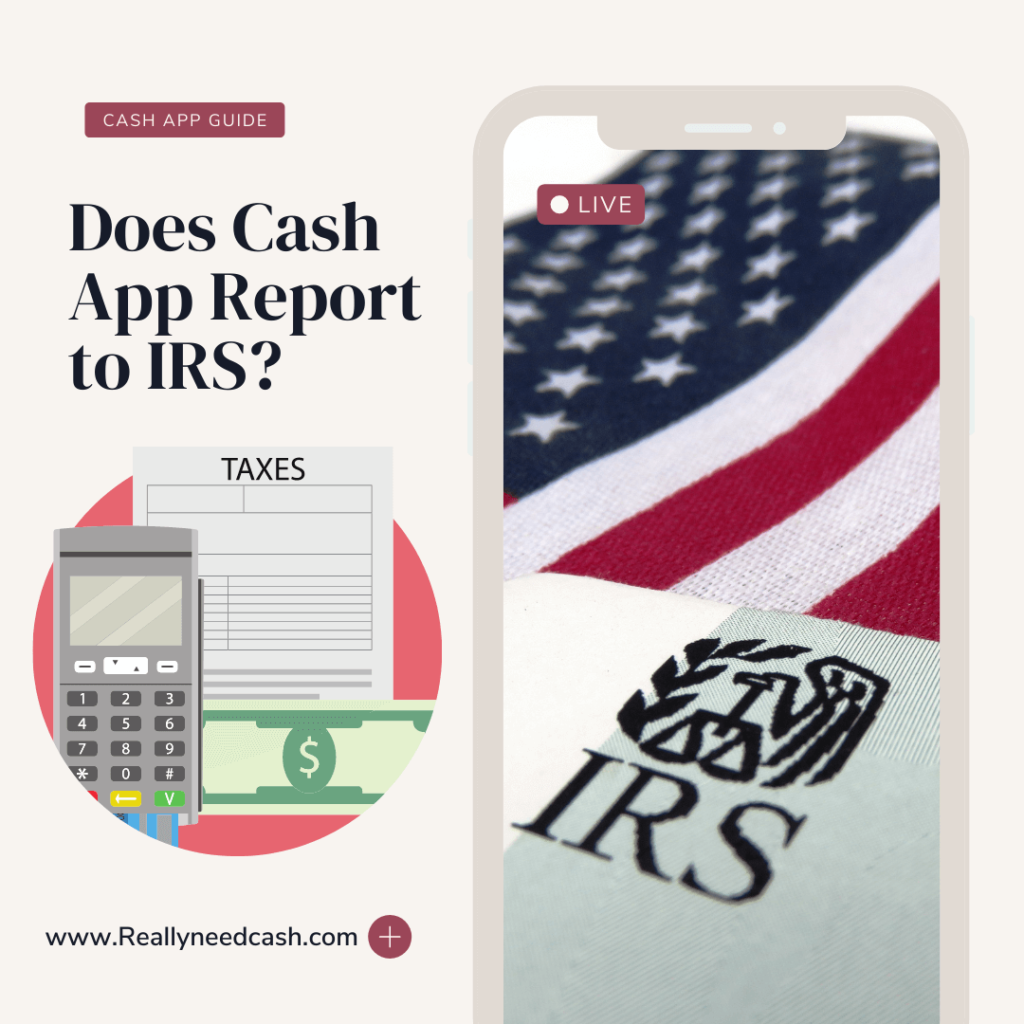

Apparently, The IRS wanted to crack down on businesses that use mobile payment platforms such as Cash App to circumvent banks and the old traditional forms of reporting income.

Does Cash App Report Personal Accounts To IRS?

No, Personal Cash App accounts are not required to be reported to the IRS. For Business, it will report transactions to the IRS if you pay US taxes and your Cash app business account exceed more than $600. You will receive a 1099-B form for the applicable tax year.

According to the new law requires, Cash App report payments of $600 or more to the IRS will start from January 1, 2022.

The reporting requirement starts in 2023 when filing taxes, and is triggered when an individual spends more than $600 on a specific platform.

Most of us use Cash App for Personal use to send and receive money with our friends and family.

Do you have to pay taxes on Cash App?

Yes, you will pay Cash App tax depending on the sales of goods or services in a single year and if you exceed the amount required by the IRS. You will get a 1099-B Form if you do need to pay tax.

However, Cash App only applies the reporting requirement to business accounts, not personal accounts.

The gig economy workers will be heavily impacted, as the reporting requirement now applies to any earnings above $600.

If you are using Cash App personal account and have received over x amount of money, how would you go about your taxes?

Read: Understanding Your New Cash App 1099-K Form|

Cash App 2022 Tax Change

- Cash App will report business transactions over $600 from the previous $2000.

- The new Cash App Tax Rule only applies to business transactions and not personal transactions.

- The IRS will send out 1099-K forms for businesses receiving over $600 on any cash app account.

- It is recommended for all Business owners using cash apps be vigilant and abide by the new law.

Read on below as sometimes it can be confusing as to how tax reporting works on Cash App.

Do you have to Pay Taxes on Cash App?

Yes, you will be required to pay taxes on Cash App. From the IRS’s perspective, business income collected on Cash App is no different from any other transaction on a traditional bank account.

Businesses are required to report any payments received through Cash App as taxable income when filing taxes.

You need to report them in your income tax return and pay tax on them.

What is Taxable Income to IRS?

Before Cash App needs to report to IRS if the business transacted more than $20,000 dollars. However, with the new law coming in effect from January 1, 2022, that amount has come down to $600.

Let’s say that your friend transferred you $10 on Cash App after winning a bet on a game.

It’s only $10 right?

Yes, but technically, it is still income.

You’re required by law to confess the income to the IRS, no matter how minimal they are.

However, when we are talking about Cash App 1099 Tax reporting to the IRS, it can get complicated.

>> Read: Can Someone Hack Your Cash App with Just Your Username?

Note: We are discussing Cash App Personal accounts and not Business accounts. They might have different regulations for both business and personal which the Cash app has not specified.

Do you have to pay taxes because of this Tax change?

While this proposal is going to be a new way of reporting, the way of taxable, deductible, and nontaxable amounts are immune to this change.

For example, the regular payments send to your friend or paying someone back for a night out are still nontaxable.

However, on the alternative, if you are receiving money for sale, it will be considered as a business transaction and you are mandatory to claim the money on your tax return and have to pay taxes on the said income.

Do I have to pay Tax for money received in my personal cash app account?

Unless Cash app files 1099-B then the incomes are not reported to the IRS.

Regardless of the type of account – Personal or Business, if you received less than the trigger amount 1099 will not be filed on your account.

If you exceed the trigger amount 1099 will be filed on your Cash App account.

Cash app never specified the trigger amount of 1099 for the personal accounts. You just have to wait until Feb 15 if they send you a form or not.

Does Cash App Report Personal Accounts to IRS?

Cash App is mandatory to file a copy of Form 1099-B to the IRS for the applicable tax year depending on if you exceed the trigger amount for the 1099 form.

If you receive donations or “gifts” for personal use (medical expenses, Birthday Gifts, etc) is taxable income to you. It can also be treated as a self-employment income and they are subject to FICA taxes and income taxes.

All donations made or received need to be reported federally and to the state.

However, personal gifts from family and relatives with no expectation of anything in return do not affect the income of small amounts are exempted from it.

This specific may fall under the Gift Tax which is to be paid by the donor and is never taxable income to the recipient.

What is the amount as a gift without having to report it to the IRS?

Gifts up to a certain amount are tax-exempt.

In the US, you can give up to $15,000 per person per year in gifts without having to report to the IRS.

You need to add together all the gifts during that tax year, so two $10,000 gifts would be combined.

So, If you pay a third party for the gift recipient (for instance, paying off your friend’s loan as a gift), it will count as a gift unless you are paying off a school or medical care which are not tax-exempt.

That person has to file a report saying they gave you the money.

For Personal Cash app accounts, what amount do they report to the IRS?

Apparently, It’s confidential.

The same as how banks work. They have a number of factors that would flag a certain deposit.

For instance, the flag threshold amount back in the 90s was $2000, however, not all $2000 deposits are flagged.

So to put it simply, you don’t know and cannot be told.

For Cash App Business, you need to report to the IRS if you reach $20,000 &200 payments for your business accounts.

What cash App transactions are reported to the IRS?

Pretty much any income is taxable and needs to be reported.

Doesn’t matter how small the sum is.

For instance, if you regularly bet with your friends on game night and won some of those.

>> Read: How to Get Cash App Tax Refund Deposit Directly?

Continuing from the example above, that $10 every other week is going to add up quickly over a course of a year, so Cash app is going to catch on and if you reach the trigger amount for the 1099 form, they’ll have to send you the 1099-B form at the end of the year, which means the IRS will know about the simple betting income with your friend.

Cash App Tax Reporting IRS – 1099

Cash App will start sending Tax forms at the end of the year (by Feb. 15th) and if Cash App does not file a 1099 on your account, it means they did not report your activity to the IRS.

So, If Cash App doesn’t report your activity to the IRS, the IRS would know your amount of money unless you got a huge “donation” exceeding $10k+ and get it deposited into your bank account,

In that case, your Bank will notify the IRS and they could open an audit on you to check on the transaction.

Since you don’t exceed the $20k, you will probably gonna get a 1099 eventually, but if you don’t do any of those and receives no huge amount of donations, then you should be good and you didn’t reach the threshold for Cash App to report to the IRS.

If you receive your 1099-B, To view your tax documents:

- Open Cash App on your Phone

- Tap the profile icon on your Cash App home screen

- Select Personal

- Scroll down to the Documents section

- Click on Tax Documents

- Choose a year

If you use Cash App to buy and sell Bitcoin, Cash App will provide an annual 1099-B to Cash App customers that have made sales of Bitcoin during the calendar year.

NOTE: Cash App will not report your Bitcoin cost-basis, gains, or losses to the IRS at the moment or on the 1099-B form. Cash App only reports the total proceeds from the Bitcoin sales made on the Cash App platform.

Final Thoughts:

One thing to note is that the IRS isn’t stupid. They know that people didn’t keep a tab of every receipt of every single coffee or dinner they had.

It is not made known to the public for personal accounts, but for Business accounts, if it exceeds more than 20,000 and at least 200 transactions this triggers 1099. Cash app will then probably send the IRS one of these sayings Michael Doe received 21,000 this year.

That’s all you need to know for now. We will update you with any new information and changes on Cash App 1099-B to the IRS.

Did you find this article helpful? Let us know in the comments below!