Can you deposit money on Cash App Card at ATM?

With the growing availability of cash deposits on deposit-enabled ATMs, users can now use ATMs to make deposits rather than visiting their bank to do so.

No, you cannot put money on Cash App Card at ATM – there’s no way to deposit cash to your Cash App account in an ATM machine like you can with a bank. You can use the Cash card everywhere VISA is accepted with no fee in stores and online.

However, If you are interested to learn how to make a cash deposit at an ATM for your other cards.

How to Put Money on Card at ATM: Step-By-Step

Here are the steps to put money on a Card at ATM:

Total Time: 5 minutes

Step 1: Insert your card

Insert your Card into the ATM machine. If the card has a chip, you may be asked to insert it again and leave it in the machine.

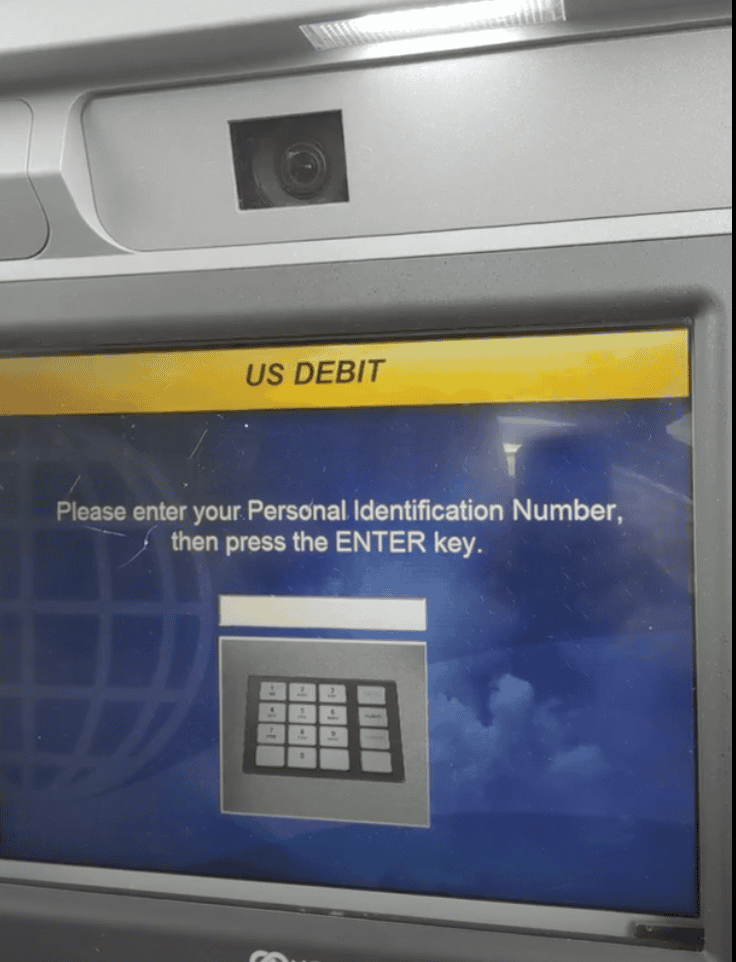

Step 2: Enter Pin Number

Enter your personal identification number (PIN) on the keypad provided by the ATM.

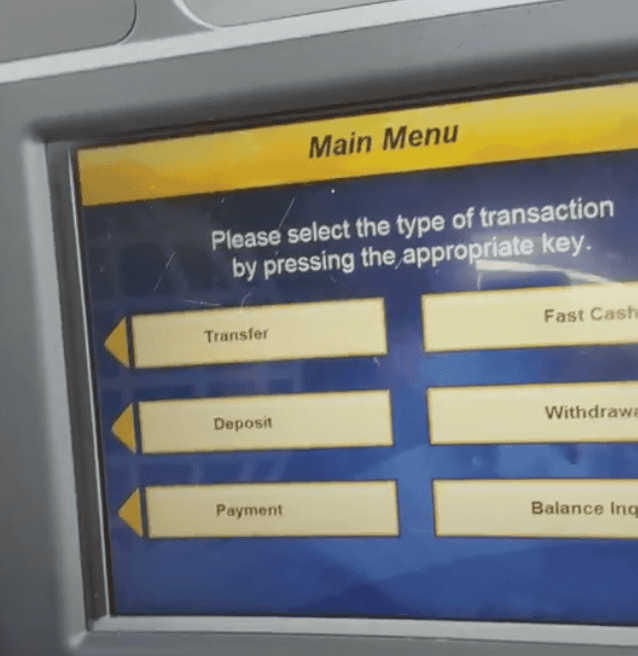

Step 3: Select Deposit

On the ATM screen, choose the “Deposit” option from the available menu options.

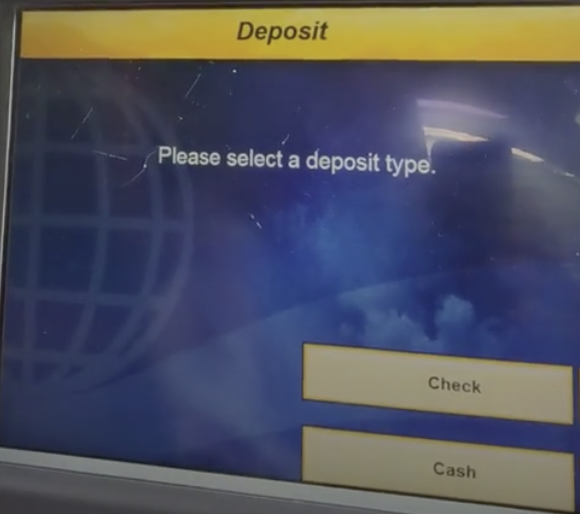

Step 4: Choose Cash

Within the deposit options, select the cash deposit option. Note that there may also be an option to deposit a check.

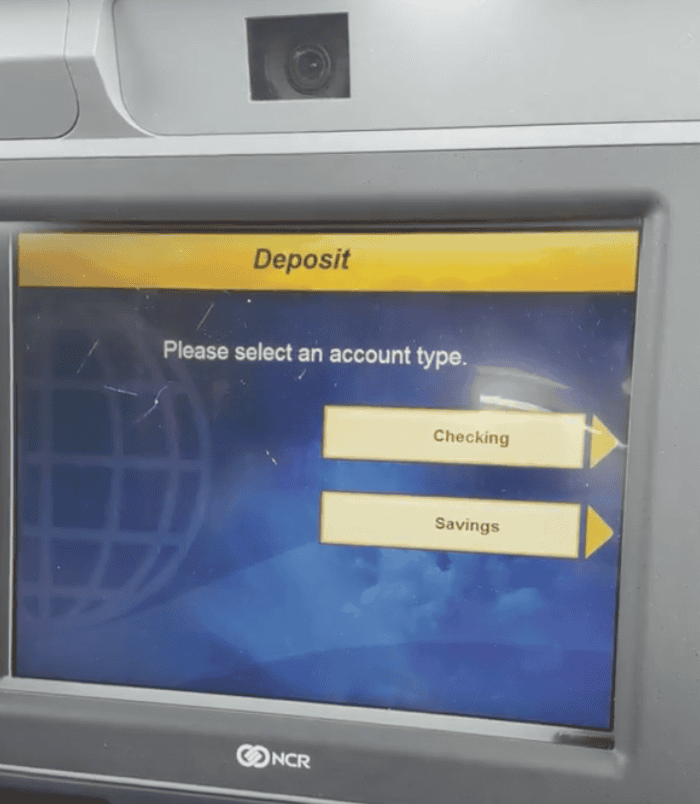

Step 5: Specify Account

Indicate whether the cash should be deposited into your checking account, savings account, or any other account you have linked to your card.

Step 6: Deposit Cash

Insert the cash into the ATM’s cash deposit slot. Follow any instructions provided by the ATM on how to insert the bills.

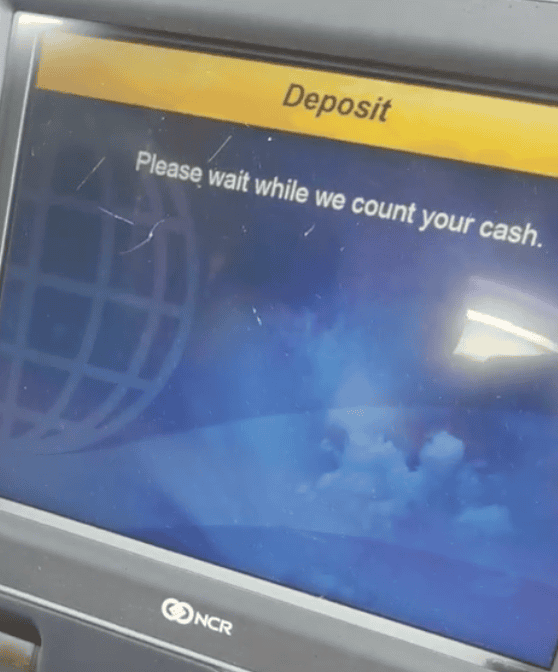

Step 7: Wait for Verification

Wait for the ATM to count and verify the deposited cash. The ATM will display a message indicating the amount that has been deposited.

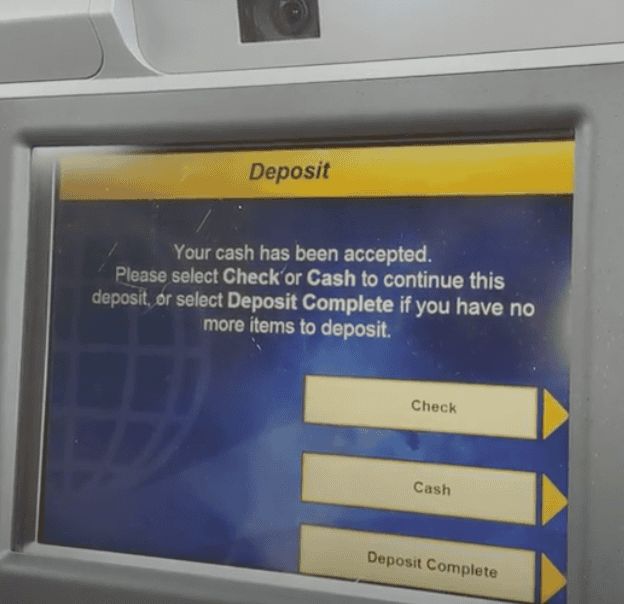

Step 8: Transaction Complete

Once the ATM has finished counting and verifying your cash, you will receive a notification on the screen confirming that the deposit is complete.

If you can deposit money into an ATM, you can skip the hassle of working around the bank business hours, queue, etc

There are plenty of deposit-enabled ATMs that do not accept deposits based on your financial institution.

However, this is not a traditional bank card, we are talking about Cash App card here.

So, are ATM cash deposits possible on your Cash Card and use Cash App card at ATM?

Can you Put Money on Cash App Card at ATM?

No, you cannot add money to Cash App Card at ATM as an ATM deposit on Cash App Card is not supported. There are two ways to put money in your Cash App Card. The first one is through your Debit card and the second one is in Store.

If a bank that operates only online, in this case, Cash App, and also applies to other financial institutions do so are not able to deposit any cash at all in ATM.

Most of the institutions that offer ATM deposits only do so at their own ATMs. Since Cash App is a P2P payment platform and it does not own any ATMs of its own, hence it is not possible to deposit money directly to your Cash App card from an ATM.

However, you can work around in a multi-step process and transfer your money from your traditional card to your Cash App Card.

You just need to add money on ATM to your Card that is linked to your Cash App and fund it to your Cash App wallet.

Or draw funds directly from the debit card linked when using your Cash App card to make purchases both online and in-stores.

>> Read: Can I Use Cash App Card at ATM? Fees and Withdrawal Limit

Can You Deposit Cash at an ATM?

Yes, you can deposit cash at ATMs for a traditional bank-issued card, but not all the ATMs. In most cases, you can do ATM cash deposits at a branch or in-network ATMs.

Not all of the ATMs accept allow you to add money, and not all deposit-enabled ATMs will work with your card or account.

The deposit process varies by bank and financial institution but it’s quite simple to deposit cash at an ATM.

As mentioned above, you cannot put money on Cash App Card at an ATM.

How much money can you Put on Card at ATM?

Deposit limits on ATMs exist, too, although they are less common.

For example, there’s no limit to the amount of money you can put in a Chase ATM, however, there might be a limit to the number of bills you can deposit in a single transaction due to the physical design of the ATM machine with up to 50 bills or 30 checks.

Another example is Capital One which has a one-time cash deposit limit of $5,000.

The Navy Federal Credit Union also accepts up to $10,000 per card per day.

Wells Fargo ATM has no limit on the amount you can deposit.

One of the benefits of depositing cash over a check is that your money will be credited and made available more quickly no matter how much amount of money you deposit.

Note: Your own bank may charge you a “non-network” ATM fee if you use ATM operated by another bank.

How To Deposit Money Without Card?

- Click “Cash deposit without card”.

- Input the account number to deposit cash.

- It will display the name of the account holder.

- Select ‘Enter’ to confirm the displayed account name

- Insert the money in the cash deposit slot and select “Continue”.

- The ATM Machine will sort the cash and display the summary.

- Double-check the cash summary and click on “Deposit”.

- The money will be deposited and a receipt will be generated.

Final Thoughts:

With the ATM deposit feature, you don’t need to stand in queues at your bank for depositing cash into your account. You just need to visit your nearest ATM to deposit put in your card or account.

Familiarize yourself with your particular bank’s policies concerning ATM money deposits.

Back to Cash App, the Cash App card cannot be loaded money on ATM. Hopefully, this feature can be launched in the near future in collaboration with Lincoln Savings Bank which is the official bank partner of the Square payment app. All the money of the cash app is stored, maintained, and regulated by the Lincoln Savings Bank.

Hopefully, the feature to deposit Cash to your Cash Card will be introduced. But for now, there is no option and You can deposit cash only using the add funds method using your debit card and bank account.

Did you find this article helpful? Let us know in the comments below!