Understanding Cash App and PayPal Integration

Cash App and PayPal are popular online payment platforms that allow users to send and receive money easily. Integrating the two can enhance financial flexibility. Here are key details about each app and how they connect.

Fundamentals of Cash App

Cash App is a peer-to-peer payment service that lets me send money quickly to friends or businesses. I can link my bank account or use a Cash Card for transactions. Cash App allows me to send money instantly, but transfers to my bank may take a few days.

When I sign up, I provide my email or phone number, and a unique username called $Cashtag. The app requires verification to ensure security. It uses encryption to protect my financial information during every transaction. The process is user-friendly, making it a go-to option for many.

Overview of PayPal Services

PayPal is another widely used service for online payments. I can use it to make purchases, send money, or receive funds securely. PayPal connects to my bank account, debit card, or credit card, offering multiple ways to fund my transactions.

With PayPal, I enjoy buyer protection for eligible purchases. This service also provides an easy way to shop online without exposing my bank details. Signing up involves linking my bank account or card, which is simple and straightforward. After linking, I can use PayPal for various transactions.

Compatibilities Between Cash App and PayPal

Currently, Cash App does not support direct transfers to PayPal. To transfer money, I can first send funds from Cash App to my bank account, then from the bank account to PayPal. This process requires some time, as it typically takes 1-3 business days.

Linking my bank account to both apps is crucial. I need the correct routing number and account details to ensure smooth transfers. Security is a priority for both services, which use measures to protect my details. Although it may seem complicated initially, once I set things up, transferring money becomes straightforward.

Transferring Money from Cash App to PayPal

Transferring money from Cash App to PayPal can be a straightforward process if you understand the steps involved. It’s important to know how to initiate the transfer, what security measures are in place, and the different transfer options available.

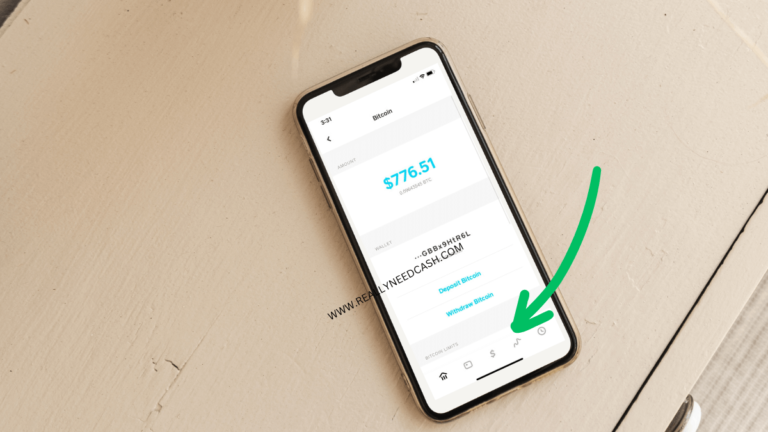

Initiate the Transfer Process

To start, I open my Cash App and select the amount I want to send. Then, I choose the option to transfer funds. If I prefer a standard transfer, it might take a few days, but an instant transfer usually appears in my PayPal account right away. After I tap the transfer button, I’ll need to confirm my identity, which may include entering my PIN or using Touch ID. If I haven’t linked my Cash Card to PayPal yet, I must do that first using my card details.

Security Measures and Verification

When transferring money, security is a top priority for me. Cash App uses various measures to protect my transaction, including encryption and two-factor authentication. Before completing the transfer, I often check that my Cash App settings allow for secure transactions. If my transfer involves a large sum, I may get prompted for extra verification steps. It’s always good practice to keep my mobile device secured and to review my transaction history afterward to ensure everything is in order.

Transfer Options and Processing Time

I have different options for transferring funds. A standard transfer can take 3-5 business days to reach my PayPal account, which is more cost-effective. In contrast, an instant transfer usually takes less than an hour but may incur a small fee. If I frequently send and receive money, I prefer using my debit card linked to my Cash App for quicker access. Using my Cash Card details can streamline this process. Awareness of these options helps me choose the best method based on urgency and cost.

Managing Financial Transactions and Fees

When managing transactions between Cash App and PayPal, it’s important to be aware of various factors like fees, linked bank accounts, and customer support options. Below, I’ll cover these key areas to help you navigate your financial transactions with ease.

Understanding Transaction Fees

Cash App has different transaction fees depending on the transfer option you choose. For standard bank transfers, there is usually no fee, but this can take 1-3 business days. If you want an instant transfer, Cash App will charge a fee, typically around 1.5% of the amount being sent. PayPal is similar, often charging a fee for instant withdrawals or sending money from your PayPal balance to another service.

Linking Bank Accounts and Cards

To send money between Cash App and PayPal, I need to link my bank account or debit card in both apps. For Cash App, I can do this through the Banking section, adding my routing and account numbers. Once linked, I can transfer money to and from my bank account easily. It’s crucial to ensure that my bank accounts are correctly linked to avoid delays in transactions.

Customer Support and Resolution

If I face issues, both Cash App and PayPal provide customer support teams to assist. I can reach them through the apps, where I’ll find options for live chat or email. It’s wise to have my transaction details handy to resolve issues quickly. Each platform also has FAQs that can help troubleshoot common problems, saving me time. If I find a workaround isn’t working, customer support can guide me effectively.

Frequently Asked Questions

In this section, I will address common questions about sending money from Cash App to PayPal. These questions cover transfer methods, fees, and account issues.

How can I transfer funds from my Cash App account to PayPal?

To transfer funds, first, withdraw money from Cash App to your linked bank account. Then, you can add that money to your PayPal account. This method moves your cash to PayPal indirectly.

Is there a fee associated with moving money from Cash App to PayPal?

Cash App does not charge a fee for withdrawing money to a bank account. However, PayPal may charge a fee to add funds from your bank account. It’s good to check their fees before transferring.

What methods are available for transferring money from Cash App to a PayPal account?

The main method involves transferring money from Cash App to a linked bank account and then moving it to PayPal. Some may consider using third-party services, but it’s important to ensure their legitimacy.

Can I send money directly from Cash App to someone’s PayPal without a bank account?

No, you cannot send money directly from Cash App to someone’s PayPal account. You need to use a bank account as a middleman to accomplish this.

Why was my attempt to transfer money from PayPal to Cash App denied?

Transfers can be denied for several reasons, such as mismatched account information or insufficient funds. Sometimes, PayPal’s security measures can block transactions if they suspect fraud.

Are Cash App and PayPal owned by the same company?

No, Cash App and PayPal are not owned by the same company. Cash App is owned by Square, while PayPal operates as an independent company. Each has its unique features and services.