Overview of Cash App

Cash App is a popular mobile payment service that enables users to easily send and receive money. It was launched by Square, Inc. in 2013 and is now part of Block, Inc.

Key Features

- Peer-to-Peer Money Transfer: I can quickly transfer funds to friends and family without needing cash.

- $Cashtag: Each user gets a unique $cashtag to simplify payments.

- Banking Services: While Cash App is not a bank, it partners with banks to offer certain financial services like direct deposits and prepaid debit cards.

How It Works

- Account Setup: I create an account using my email or phone number.

- Link a Bank Account: I can link my bank account or debit card to move money in and out of Cash App.

- Sending Money: I enter the amount and recipient’s $cashtag or phone number, and the funds are sent instantly.

Security Measures

Cash App prioritizes user security. It employs encryption and fraud detection to protect my money and information while using the app.

Cash App has transformed how we handle money with its user-friendly design and quick transactions. For more details, I can check out NerdWallet.

Financial Features and Services

Cash App offers a variety of financial features and services that make it a flexible tool for managing money. I’ll cover how it allows users to send and receive money, along with banking options, debit cards, and investment opportunities.

Sending and Receiving Money

Using Cash App to send and receive money is straightforward. I just need to connect my bank account or debit card to the app. To send money, I enter the amount and the recipient’s phone number or email. If my friends also use Cash App, the process is instant and usually free. For receiving money, the funds can be added directly to my Cash App balance, which can later be transferred to my bank account.

Fees can occur if I use a credit card or opt for an instant transfer to my bank. Typically, the fee is around 3% for credit card transfers. I can also split bills with friends, making it easy to handle shared expenses.

Banking and Savings

Cash App offers banking services through partnerships with Lincoln Savings Bank and Sutton Bank. This means I can keep my money safe and access features like direct deposit, which is helpful for receiving my paycheck.

Moreover, Cash App provides a high-yield savings account that is FDIC-insured. This means my savings are protected up to $250,000. I can set aside money and earn interest without needing a separate bank account. The savings feature lets me easily manage my finances without hassle.

Cash Card and Debit Cards

The Cash Card is a customizable debit card linked to my Cash App balance. It allows me to spend directly from my balance at retailers that accept Visa. Using the Cash Card is convenient because I can also withdraw cash at ATMs.

There are usually ATM fees, but Cash App sometimes reimburses these fees, depending on my account balance. Plus, I can use the card to receive discounts at certain retailers. This gives me flexibility and access to my funds wherever needed.

Investing and Bitcoin

Investing through Cash App is user-friendly. I can buy and sell stocks, including fractional shares which means I don’t need to purchase a whole share. This is perfect for beginners like me.

Cash App also has a cryptocurrency feature that allows me to buy and sell Bitcoin. It’s a simple way to get involved in investing without needing a separate platform. I can even set up automatic purchases of Bitcoin if I want to invest consistently over time. This flexibility can help me grow my investment portfolio easily.

Security, Taxes, and Compliance

Security and compliance are important aspects of using Cash App and similar platforms. They help ensure safe transactions and proper reporting for tax purposes. Here, I will cover the key points around security measures and tax obligations.

Security and Fraud Prevention

Cash App employs several features to protect users from fraud and ensure secure transactions. They use encryption techniques to secure personal and financial data. This makes it difficult for hackers to access sensitive information.

Users can also enable two-factor authentication. This adds an extra layer of security when sending money or using a Cash App card. Cash App continually monitors for suspicious activity to prevent scams.

It’s important for users to be aware of common scams. Always verify the identity of the person you are sending money to. If something feels off, trust your instincts. Many platforms, like Venmo and PayPal, adopt similar security measures, but it’s always good to stay informed.

Tax and Compliance Services

When using Cash App for business transactions, it’s wise to understand the tax rules. The IRS requires apps like Cash App to report any payments over $600 in a calendar year through Form 1099-K. This ensures that income is properly reported for tax purposes.

Cash App offers services for tax filing through Cash App Taxes, allowing users to file federal and state taxes for free. This can simplify the tax process as I can manage my finances in one place.

It’s also important to keep track of all transactions. This includes noting payments received or sent, as correct reporting will help avoid any tax issues later. Many similar platforms, such as Zelle, do not provide tax reports, making Cash App a noteworthy option for managing these responsibilities.

Frequently Asked Questions

There are several common questions about Cash App that many users have. I’ll address important topics, including its banking partnerships, security measures, and its origin.

What bank is Cash App affiliated with?

Cash App partners with Lincoln Savings Bank and Sutton Bank. These banks handle various functions, including supporting Cash Card services and providing banking features.

How can I safely sign up for Cash App?

To sign up safely, I recommend downloading Cash App directly from the official app store on my device. After installation, I should enter my phone number or email, verify my identity, and create a secure password.

What is the origin of Cash App as a service?

Cash App was launched in 2013 by Block, Inc., which was formerly known as Square, Inc. It began as a way to send money quickly between friends and has evolved to include many financial services.

How does Cash App ensure the security of its users?

Cash App employs encryption and security features like two-factor authentication. These measures help protect my information and prevent unauthorized access to my account.

Can I download Cash App on an Android device?

Yes, Cash App is available for download on both Android and iOS devices. I can find it on the Google Play Store for Android users.

Where is the headquarters of Cash App located?

Cash App is headquartered in San Francisco, California. This location serves as the central hub for its operations and customer support.

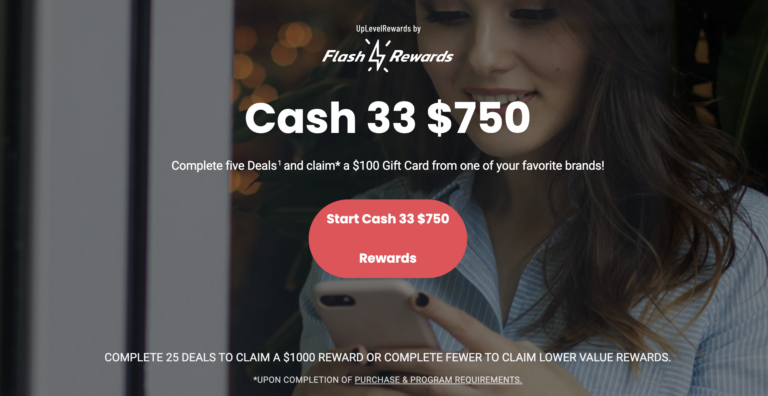

FlashRewards Programme 2024 (Real or Fake?)

FlashRewards Programme 2024 (Real or Fake?)