With the continuous rise of online donations, charity, and mobile payments, it comes as no surprise that many nonprofit organizations are expanding their payment options to make donations effortless and maximize their donations.

Yes, Cash App for NonProfit as a payment gateway to lets your donors donate via the Cash App for Business Programme. It does not yet support nonprofits in the same way that PayPal does and cannot create an account specific to nonprofit organization.

How To Set Up Cash App For NonProfit Organizations: Step-By-Step

Here’s a step-by-step guide to Set Up Cash App For NonProfit Organizations:

Total Time: 10 minutes

Step 1: Download and Open Cash App

If you haven’t downloaded it, you can do that from the app store and launch the app.

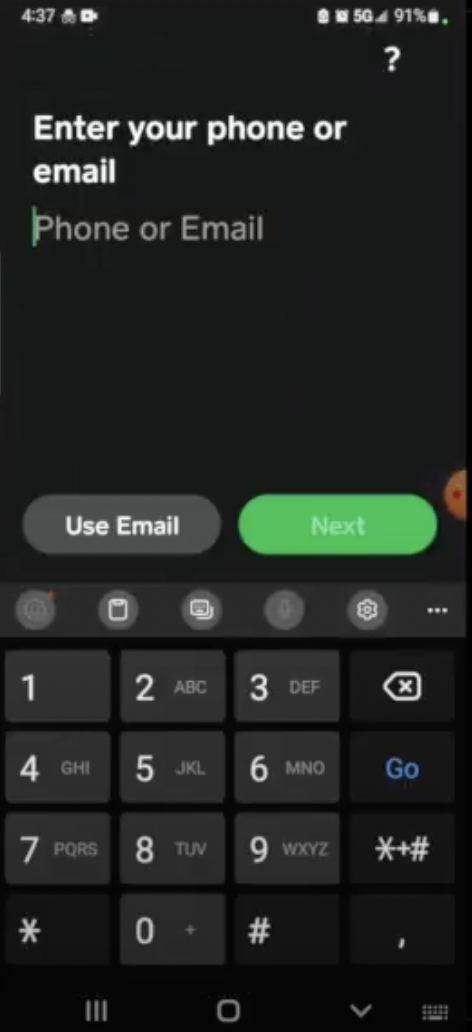

Step 2: Enter your Phone Number/ Email

1. Open the app and start by entering your phone number or email address. Most people prefer using their phone number for a smoother experience.

2. Input the required information and click “Next.”

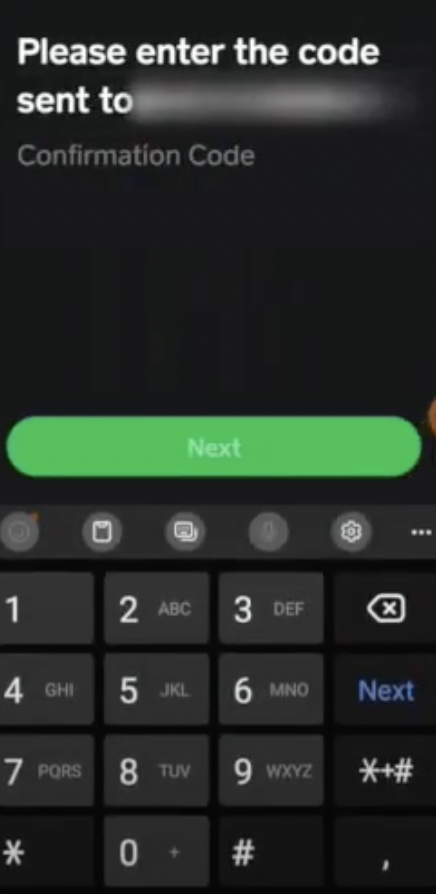

Step 3: Verify Your Account

1. Cash App will send a verification code to the phone number or email address you provided.

2. Retrieve the code and enter it on the screen to proceed.

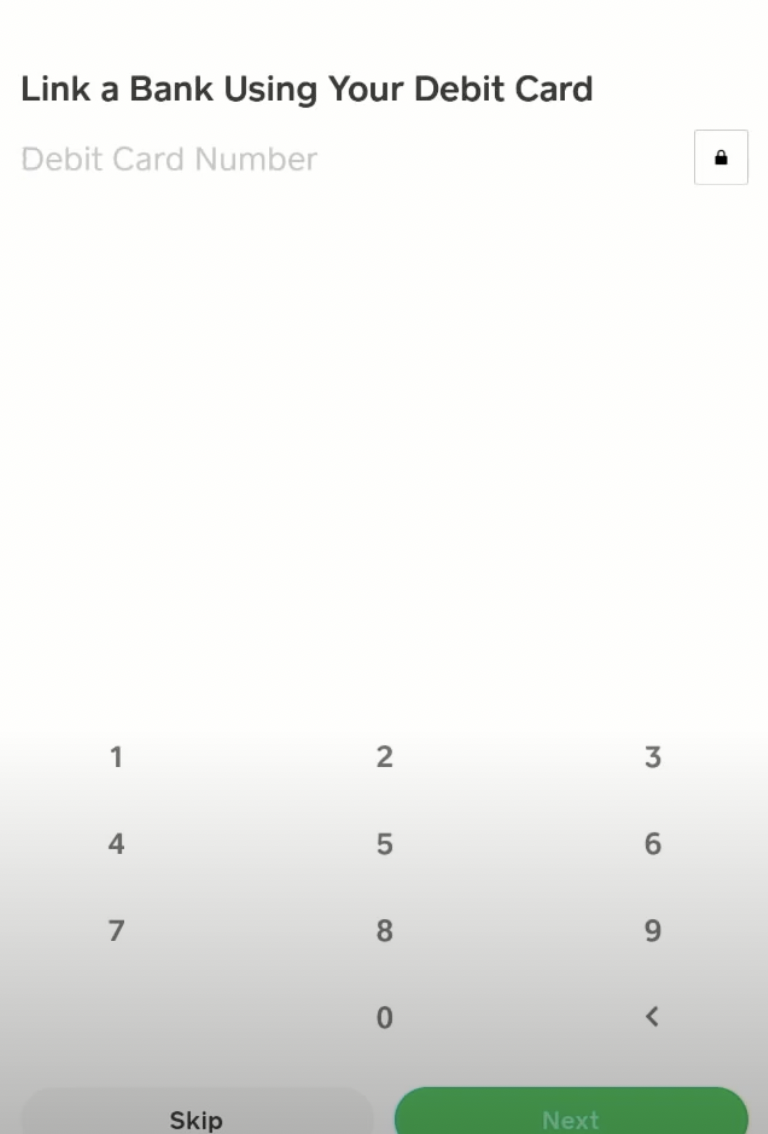

Step 4: Link Your Bank Account (Optional)

1. You will be prompted to link a bank account using your debit card. You can either enter your debit card number at this stage or choose to skip and complete this step later.

2. Linking your debit card enables cashing out and adding funds to your Cash App account.

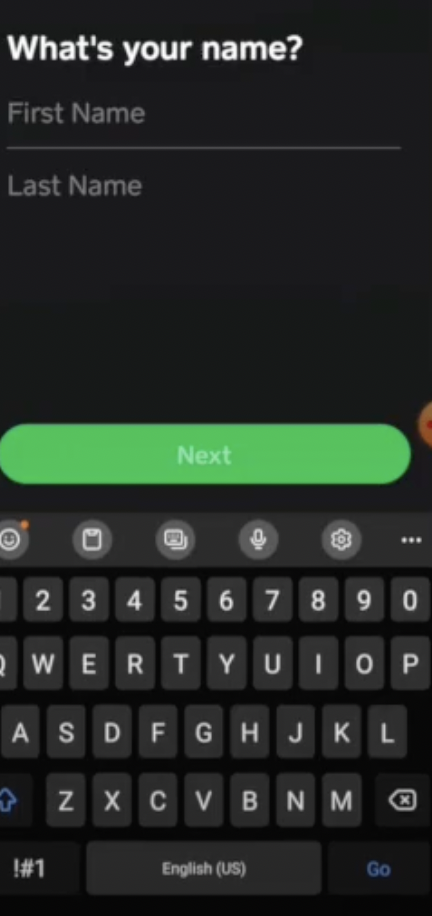

Step 5. Provide Personal Information

Fill out your first name, and last name, and choose a unique Cash Tag. The Cash Tag is what others will use to send and receive money from you.

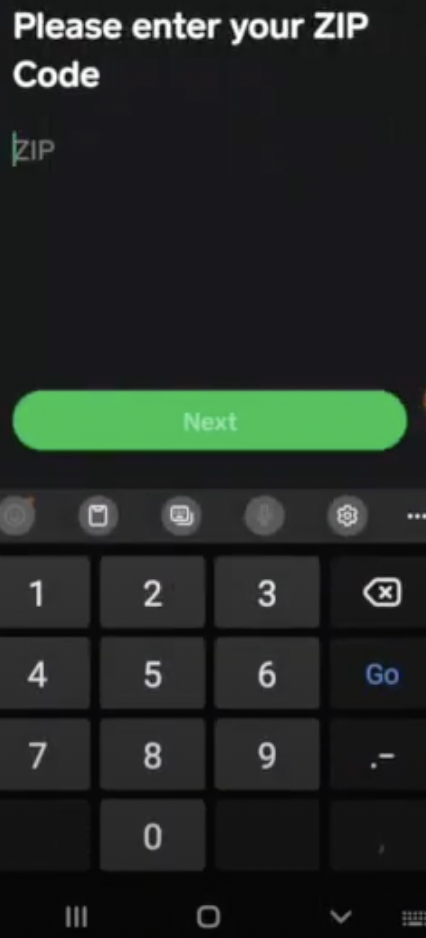

Step 6: Enter Your ZIP Code

Input your ZIP code as part of the sign-up process.

Disclaimer: Since there are no special categories for Non-Profit on Cash App, the above set-up guide is a regular installation and set-up tutorial. You can use the account for your Non-Profit organizational works.

We’ll also look at the fees and the features for Square to process payments and collect donor information.

Cash App for Nonprofit Organizations

Let’s cut straight to the chase: Currently, Cash App doesn’t have a direct formal nonprofit program to receive donations.

Cash App was meant to be a peer-to-peer money transfer service to allow users to send and receive money easily.

A major challenge to Cash App officially expanding to Non-Profit is that Nonprofits and regulators need to work through the challenges associated with new donation and solicitation channels.

However, you can still use it to receive donations for your Personal fundraising.

Can You Use Cash App for Non-Profits?

Even if there is no formal nonprofit program from Cash App at the moment, Fundraisers can still set up a Cash App account add it to one of their many payment options, and can receive donations from people who use Cash App.

Another way to get Cash App users to donate is by using the Cash App Debit Card. It works like any traditional debit card and even has boost features to earn discounts and rewards.

The Cash App Card is a Visa debit card linked to your Cash App balance which can be used to pay for products and services online and in-store.

Also, note that the Cash Card can be linked to your Apple Pay and Google Pay. So, donors can add their Cash card to Apple or Google Pay and donate with it.

RELATED: Does GoFundMe Accept Cash App Donations?

Square Cash Nonprofit Donations & Fundraising

Cash App payment service is owned by Square Inc. (SQ) and is just one part of many of Square’s business offerings. It operates as a subsidiary of Square and handles payments for many merchants and Square sellers in the US.

You can use Square to accept donations for your nonprofit. Square is already a viable option for charities to take payments and provides all the features and tools to integrate or add features as you need them.

Square POS allows donors to pay, tip, and process payments made with credit cards, gift cards, and cash.

Is Square Free for Nonprofits?

No, Square is not free for nonprofits. In fact, Square fees for nonprofits are pay-as-you-go for the most part.

There will be no additional monthly fees unless you opt into a monthly subscription; no authorization fees, statement and refund fees, or PCI compliance fees.

Below are Square’s rates for nonprofit organizations:

- 2.6% + $0.10 for any in-person donations

- 2.9% + $0.30 for donations made through a Square donation button, invoice, or the Square online store

- 3.5% + $0.15 for manually entering the credit card number from the Square POS app

Which donors can we reach with Square Cash App?

According to Vertoanalytics, Square Cash’s user base is more concentrated: with half of their user base between the ages of 25 and 34 skewing heavily towards male and outnumbering female users by a ratio of 2:1.

With the data, we can say that the majority of Cash App users are people under the age of 34 and based in the United States. So, in particular, millennials and Gen Zers are the major bulk users of the Cash App and Square payment app as the go-to for their payment processing requirements and needs.

With such a large number of users opting for Cash App for their mobile payments, it’s clear that it is a perfect way to connect with a new generation of donors.

How to get donors to use Cash App?

Now, how actually would you get people to make donations on Cash App or Square Cash?

Give a tutorial

It’s recommended to provide a tutorial on how to use the Cash App payment to make a donation. Outline how to use the app and how they can use it to donate. You can create a video tutorial to make it easier to follow.

@ your Cashtag

On your fundraising message, either in a blog post, sent via email, or social channels, make sure to include your Cash App tag to make it even easier for donations.

Say “Thank you”

After someone donates, thank them for their donations. Thank the donors for their contributions by commenting on the payments!

What are the benefits of using Cash App for nonprofits?

First of all, asking donors to pay with Cash App may be an easier ask for your nonprofit organizations. Cash App users often leave a few bucks in their account and sometimes even forget about the money.

So, it is easier to pay and makes it not seem like initiating a new transaction which can turn people off. Cash app balance uses money that’s in your account already ready to be spent.

>> Read: 28581 Cash App Text – Find Out How to Stop Text Message From 28581

Since the funds are in your balance and psychologically, It could make the donator feel less like a new expense and more like sending money for a good cause.

Conclusion:

Without manually filling in your card details, Cash App allows sending payments effortlessly without all the hassle of traditional online banking.

In fact, 1/3 of the donations and a quarter of nonprofit revenue in 2019 comes from mobile and digital payments looking to increase tenfold by 2023.

For anyone who sends or receives payment online— Cash App has become a bit of a household name.

It’s a straightforward and convenient app to move funds around.

Cash App and Square is a great options for non-profits in the US. At the moment, it is only available in the US, but there is a huge possibility that it could be launched in many other parts of the world in the near future.

Since Cash App is a trusted payment brand and a popular choice for P2P payments in the states, Accepting Cash App donations is an easy way to increase donations.

Did you find this article helpful? Let us know in the comments below!