Similar to Venmo, Cash App allows one to make payments and transfer money using a credit card. Any Cash App user can link their credit card to the Square payment Cash app with a few simple taps to their account.

Yes, Cash App takes credit Card payments. It allows credit, debit, and network branded (e.g. American Express, Discover, MasterCard, Visa) cards registered under your name to be added to Cash App. Cash App charges 3% of the transaction to send money that is linked to a credit card.

Users can also receive money from another Cash App account with a Credit card as their funding source.

Does Cash app take Credit Card payments?

Yes, Cash app takes credit card payments. Cash App allows you to link your credit cards to your account and use those cards to make payments or transfer money.

There are some users who are confused as to whether it is limited to just debit cards. So, we have to clear out the doubt for you guys and that the payment app allows you to link and send payments from your credit card.

However, unlike debit card which is free to transfer money to and from users, Cash App does charge a 3% fee for payments using a credit card.

Since lenders tag your Cash App credit card transactions as cash advances, it would be a good idea to stick to debit or a linked bank account when using Cash App.

To avoid the fee, you can also open a free bank account and link your debit card to Cash App as it is the most affordable way to utilize their service.

How to Link Credit Card to Cash App: Step-By-Step

Here’s how to link a credit card to Cash App:

Total Time: 5 minutes

Step 1: Open Cash App

Open the Cash App. Look for the friendly icon with a green background.

Step 2: Go to Your Account Settings

In the top corner, you’ll see your profile image. Tap on it, and it will take you to your account settings.

Step 3: Find Linked Banks

Once you’re in your account settings, scroll down a bit until you spot “Linked Banks.” Tap on it to proceed.

Step 4: Add Your Credit Card

Okay, now here comes the exciting part! In the “Linked Banks” section, you’ll see an option to “Link Credit Card.” Go ahead and select it.

Step 5: Enter Your Credit Card Details

You’ll see some spaces where you need to enter your credit card details. Don’t worry, it’s totally secure! Just fill in the required info, like your card number, expiration date, and CVV. Then, press “Next.”

Step 6: Confirm and You’re Done!

After entering your credit card details, you’ll see a quick confirmation screen. Just take a moment to double-check everything is correct. If it is, hit that confirmation button, and you’re all set!

Step 7: See Your Credit Card Listed

Once you’ve confirmed, Cash App will take you back to your linked banks. You’ll notice your shiny new credit card listed there, ready to be used!

What Credit cards does Cash app take?

Cash App accepts and supports credit cards from Visa, Mastercard, Discover, and American Express.

However, it does not currently accept business debit cards, PayPal Cards, or ATM cards.

Most of the bank accounts, debit cards, and credit cards are supported on the app.

However, to receive money, you can only fund money into your debit card, which you can pull out of your checking account and use to pay from your credit card.

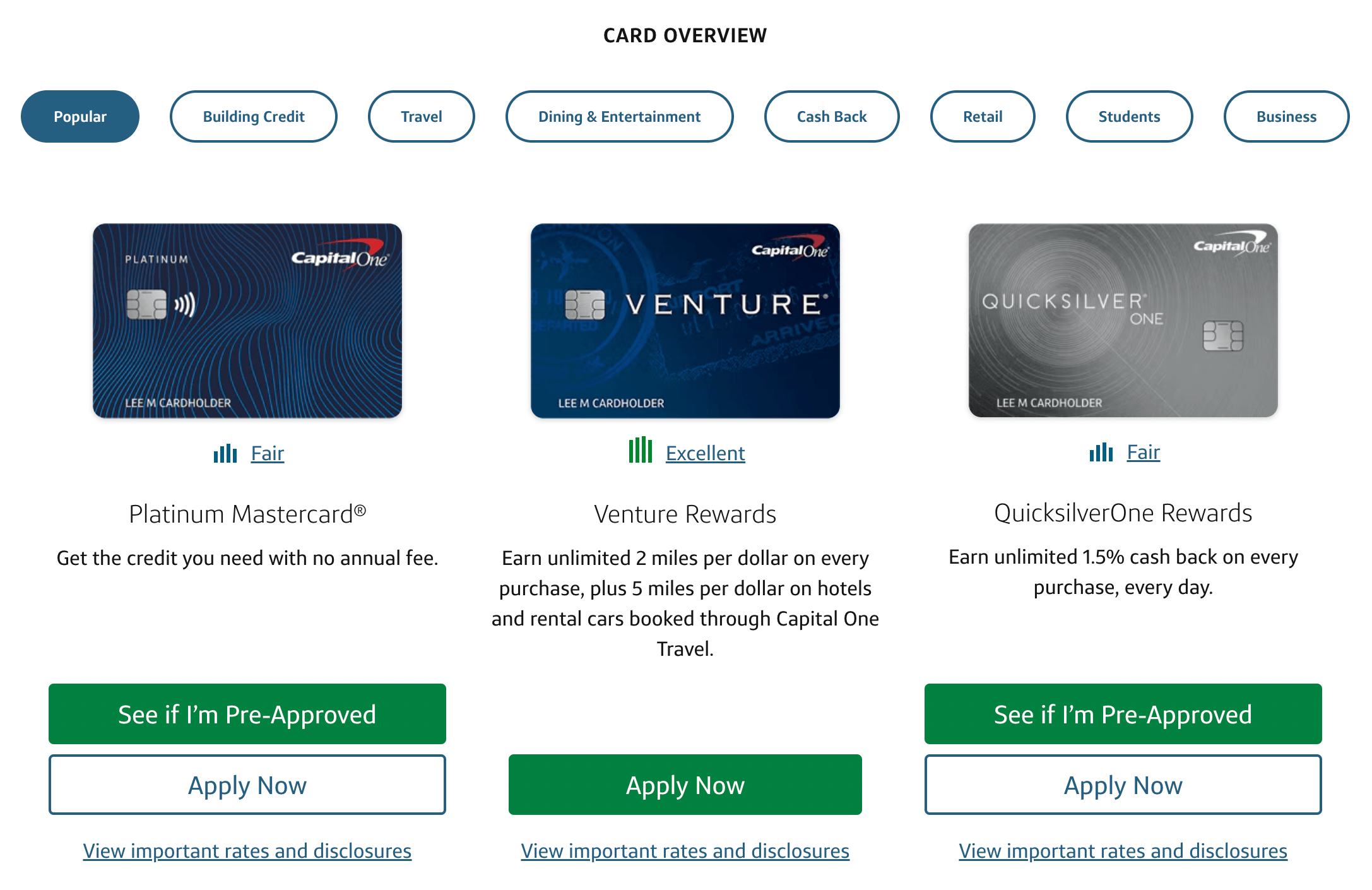

Does Cash app take capital one credit cards?

Yes, Cash app takes capital one credit card. You can use Capital One credit cards and link them to your Cash app account to fund your account and send and receive money.

Cash App with credit cards as Cash Advance

Credit cards enable you to use your bank account to obtain cash or “cash equivalent” called “cash advances”, and the interest rate on these transactions is usually higher than the interest rate on purchases.

When you use a credit card to transfer money to friends and family on Cash App, note that your lender might categorize the transaction as a cash advance.

>> Read: What is Cash App Bank Name for Direct Deposit?

Be aware that some lenders might count peer-to-peer transactions as cash advances because they do consider it similar to handing your friend cash — and cash advances do come with higher-than-usual interest rates that begin to compound the day the payment is made, and has no grace period to pay off the debt interest-free.

So, in order to minimize the cost of a cash advance, make sure to pay off your credit card balance as quickly as possible.

Credit Card Payment Fees on Cash App

There are not many fees you need to pay for most Cash App services.

However, as mentioned above, if you wanna send money through a credit card, you will be charged a 3% transaction fee.

The only other fee apart from the credit card charge is an Instant Transfer fee, which is 1.5% of your deposit with a minimum of $0.25 charged.

(An instant transfer is requesting a real-time money transfer to your debit card. To transfer money to your bank account, there is no fee, but need to wait 1-3 business days for the money to reach your account)

Whether Credit Or Debit is Best On Cash App

Cash App doesn’t accept prepaid cards in the traditional sense, however, those who’ve received government benefits — such as Economic Impact Payments and unemployment benefits — from a government-prepaid card can still use the app to transfer money.

But it is a nice convenience considering if don’t have traditional bank accounts, but the problem arises when depositing money onto the card.

That’s when you are required to use a credit card and open a free bank account to link it to your Cash App account and unlock all the services offered.

Cash App Credit cards Payment Reward

Cash App can help you to maximize your credit card rewards.

For instance, If you’re out for dinner with your colleagues, you could use a credit card that rewards restaurants to pay for the meals and your colleagues could send you their share with Cash App.

If you have a top rewards credit card in your wallet, make sure to use the card for as many purchases as possible — and if you can pay for the group bill and get your colleagues to use Cash App to pay you back their share of the dinner.

It’s a win-win situation.

Steps Required before linking a Credit Card

This is meant to be just as a reminder if you have forgotten or didn’t already know…

Cash App doesn’t give you the option to link a credit card directly. You first have to link your debit card and bank account first.

After linking those two first, the option to ‘Add Credit Card’ link will appear from your card option.

Conclusion:

When you create a new Cash App account, you’ll be asked to link your bank account via your debit card.

After entering your debit card number to complete the linking process, you can add additional banks and link your credit cards by tapping the bank icon on the app home screen.

Did you find this guide helpful? Let us know below!