Wondering if getting a Cash App Card is worth it? Continue reading to discover the most important Cash App Card benefits.

Cash App Card Benefits: 1. Allow ATM Withdrawals 2. Have the Cash Boost Feature 3. Can Be Linked to Apple or Google Pay. 4. No Fees.

In 2017, Cash App launched its Cash Card, and out of the 30 million users Cash App has, about one-third of them have a Cash Card.

That’s all due to the benefits that a Cash Card offers, such as having the ability to withdraw money from your Cash App balance, using it to pay for purchases, and even getting discounts on these purchases.

So, if you’re interested in knowing how useful a Cash Card is, keep reading, and you’ll find out all you need to know.

What Are Cash App Cards?

To put it simply, a Cash App Card, also known as Cash Card, is a debit card that’s linked to your Cash App balance.

Accordingly, you can use it to pay for products or services both online and in-store, provided that these places accept Visa.

Benefits of Cash App Cards

A Cash Card offers a myriad of benefits that make having one so worth it. Let’s have a look at them.

1. Allow ATM Withdrawals

The first advantage of having a Cash Card is the fact that you can withdraw money from your Cash App balance.

Unlike other debit cards, Cash Cards don’t need to be connected to a personal bank account or a debit card. As long as you have money in your Cash App balance, you can withdraw that money at any ATM or point-of-sale-terminal (POS) device.

2. Have the Cash Boost Feature

The best thing about owning a Cash Card is having access to the Boost Feature. Essentially, this Boost feature allows you to save money when you use your Cash Card to pay for stuff.

How?

Well, Cash App allows Cash Card owners to select a certain “boost” on their account. This means that whenever you make a purchase with a certain vendor, you’re eligible to get a discount when you use your Cash Card.

But you can’t have more than one boost active at a time. However, you can switch from boost to boost whenever you want.

For example, if you’ve set up your boost for a certain coffee shop and you decide to go to a different place, you can swap your boost to that new place. And thankfully, swapping boosts is easy to do.

- Just go to the Cash Card tab,

- Click “Add Boost,”

- Find the boost you want, then

- Click “Add.”

3. Can Be Linked to Apple or Google Pay

Since Cash Cards basically function like any other debit card, they can be added to Apple or Google Pay and utilized to pay for your necessities at any store that accepts these modes of payment.

To add your Cash Card to these services, simply:

- Choose the Cash Card tab on your home screen

- Select the image of your Cash Card

- Pick Add to Apple Pay or Google Pay

- Follow the instructions that pop up

You can also add your Cash Card to Apple Pay by using your Apple Wallet.

- First, open the Apple Wallet,

- Tap “+,” follow the specified steps, then

- Verify that the card has been added by Opening Cash App.

4. No Fees for Basic Use

Cash App doesn’t charge fees for its basic services. There are no monthly subscription fees, charges to send or receive money, inactivity fees, or foreign transaction fees.

You can order a free optional debit card.

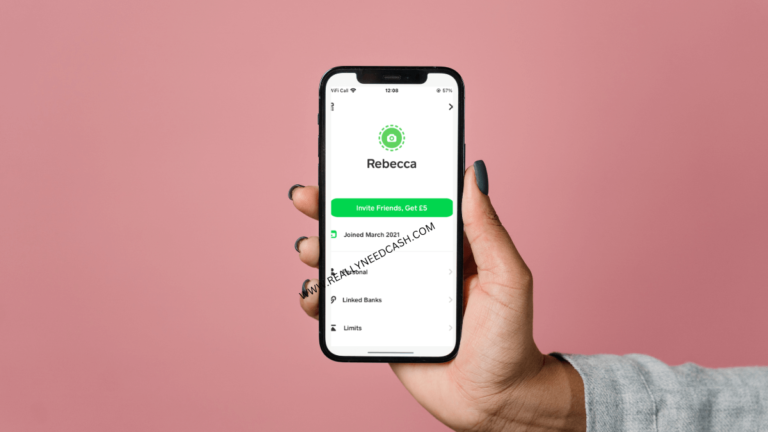

How Do You Get a Cash App Card?

Fortunately, getting a Cash Card is quite straightforward. Here’s how:

- Select the Cash Card tab on the home screen

- Tap “Get Cash Card”

- Choose the style, color, emojis, and signature you want to be on your card

- Provide your mailing address and confirm your details

Once you’re done, you’ll get your card in 10 business days. When it arrives, your card will be ready to use once you activate it.

To do so, open up your Cash App and scan the QR code on the card’s envelope.

Cash App Card Limits

It’s important to know that there are ATM withdrawal limits for all Cash Cards. You can only withdraw $1,000 per transaction. Moreover, you can’t exceed $1,000 per day and $1,000 per week.

Also, ATM withdrawals with Cash Cards have a $2 fee. However, if you get at least $300 in paychecks directly deposited into your Cash App account every month, you can withdraw money free of charge.

There are also limits on your Cash Card transaction. Basically, you can only pay $7,000 per transaction, $7,000 per day, $10,000 per week, and $25,000 per month. While this may seem restricting, it’s all done so that Cash App can protect your Card Account.

Conclusion

Having a Cash Card can offer you lots of benefits, be it allowing you to withdraw your Cash App balance money or save some bucks on your purchases.

While there are some restrictions and limitations, they aren’t anything too difficult to deal with, and you’ll still be able to put your card to good use.