Can you add money to your Cash App at 711? Are there any fees involved?

To load money on Cash app card at 711: 1. Open Cash App 2. Go to Paper Money Option 3. Select the Nearest 7-11 Store 4. Tap Show Barcode 5. Ask the Cashier to scan the Barcode 6. Confirm the transaction.

You can use your Cash App card as your main bank since it is reloadable. For those who can’t acquire a standard bank account due to poor credit history, this is an excellent choice.

How to Add Money to Cash App Card at 7-Eleven: Step-By-Step

Step-by-Step Guide to Add Money to Cash App Card at 7-Eleven:

Total Time: 10 minutes

Step 1: Open Cash App

Open the Cash App on your device

Step 2: Click on Dollar Icon

Select the $ icon located on the left side of the app.

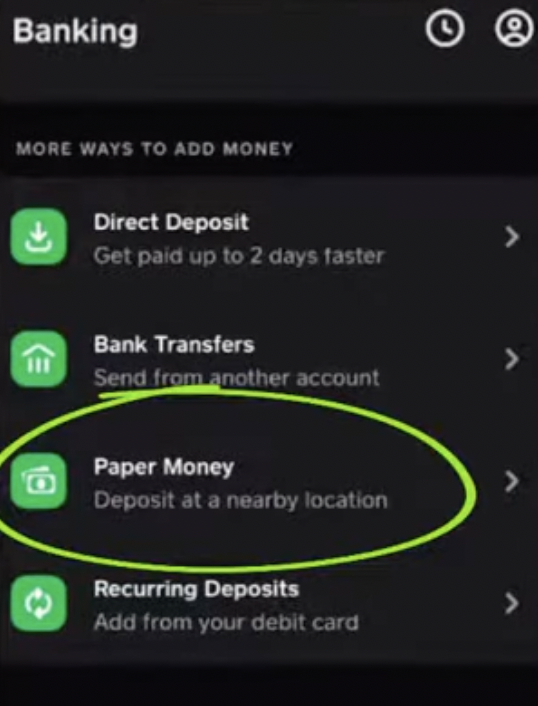

Step 3: Click on Paper Money Option

Scroll down and tap on the “paper money” option.

Step 4: Select the Nearest 7-11 Store

Choose the nearest 7-11 to you.

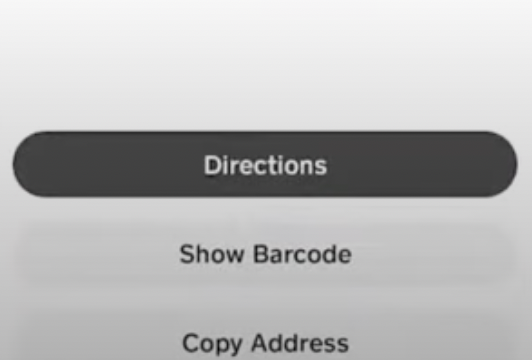

Step 5: Tap “Show barcode” on the menu.

From the pop-up menu, select the “show barcode” on the menu.

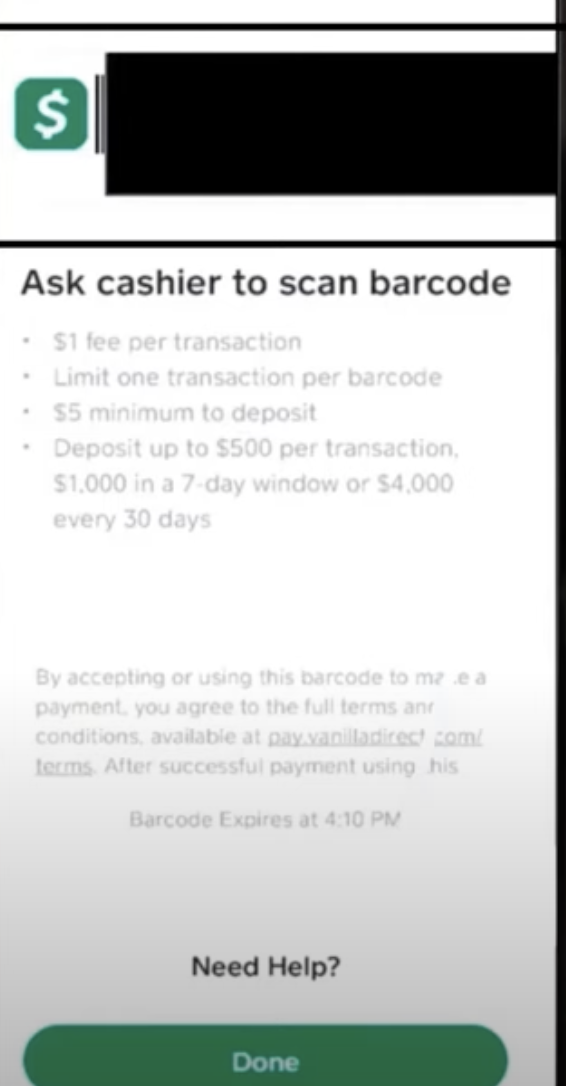

Step 6: 7-11 Barcode Scanning

Present your Cash App 7-11 barcode to the cashier and the cashier will scan the barcode using their scanning device.

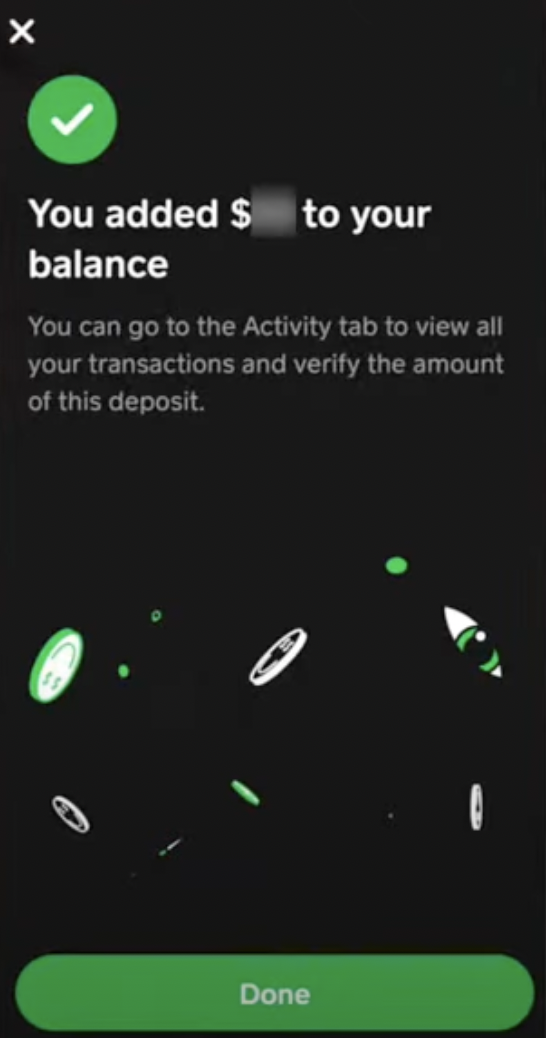

Step 7: Confirmation Notification

Within a few seconds, you’ll receive a notification confirming the addition of money to your Cash App Card.

Step 8: Make Payment

Pay the required amount in paper cash to the 7-11 Cashiers to complete the transaction.

3 Different Ways to Load your Cash App Card at 7-11

Cash App customers may refill their Cash App cards in various methods, including in-store, online, or by asking their friends.

Where can I get my Cash App Card loaded? The 7-Eleven outlets are all places where you can load your Cash App card.

1. Online

Yes, you can add money to your cash app card or load money at 7-Eleven outlets. Just go to a Dollar General shop and inform the cashier that you want to deposit money into the cash app.

The amount of money that can be loaded onto your cash card is limited. The amount varies based on the deposit method you select to load money to your cash app.

2. 711 In-Store

Money may be deposited in your Cash App Card at 711 Stores and cash deposit partners at retail locations. Inquire with the clerk at a 7-Eleven store about making a deposit to your Cash App account. If you add money to your Card, you may be charged a fee.

3. Ask Your Friends

Request that your friend Cash App you and pay you in cash.

You can fund your card using any way that is most convenient for you. You may top up your card with funds from a connected bank account or debit card, as well as simply visit a retailer.

What is Cash App?

It is a money transfer business that focuses on mobile apps. Similar to PayPal or Venmo, you may send and receive money directly and rapidly. Cash App, on the other hand, has a few extra features.

Apart from fund transfer, Cash App will set up your bank account and provide a debit card for you to withdraw cash from any ATM. The program also allows you to invest in stocks and Bitcoin. Some of these services are free, while others have a price associated with them.

Read: How to Add Money to Cash App Card at Walmart?

Brief Introduction of 7-Eleven

The 7-Eleven outlet’s date back to 1927 when five icehouse firms in Dallas joined to become the Southland Ice Company, which primarily offered block ice for food preservation to houses without electric refrigerators.

What other Stores support Cash App?

There are several other stores that support the Cash app. And you can also load your Cash app from the following stores:

N.B: eBay is not accepting Cash App currently.

Cash App Loading Fees at 711

Cash App Card reloading fee is a fee imposed by 711 the retail location for adding money to your card. Not all 7-eleven stores have the same charge or offer the same services. Some locations may have other fees in addition to the ones listed below or may differ.

You can expect up to $4.95 for each transaction. However, for instance, in the case of the Serve American Express Free Reloads prepaid card, you pay zero for cash reloads.

How to Use Cash App?

Go to a Walmart, CVS, or Walgreen store’s cash register and ask the cashier to load money on your Cash App card to make purchases. If you use your Cash App to deposit actual money, you could be charged processing fees.

Adding money to your card may involve fees. However, there are currently no set charges for all merchants with whom you can do business.

Sending Money

- Open the Cash App on your phone.

- Fill in the amount.

- Pay with a tap.

- Enter an email address, phone number, or $Cashtag in the fields provided.

- Tap Pay once you’ve entered what you’re paying for.

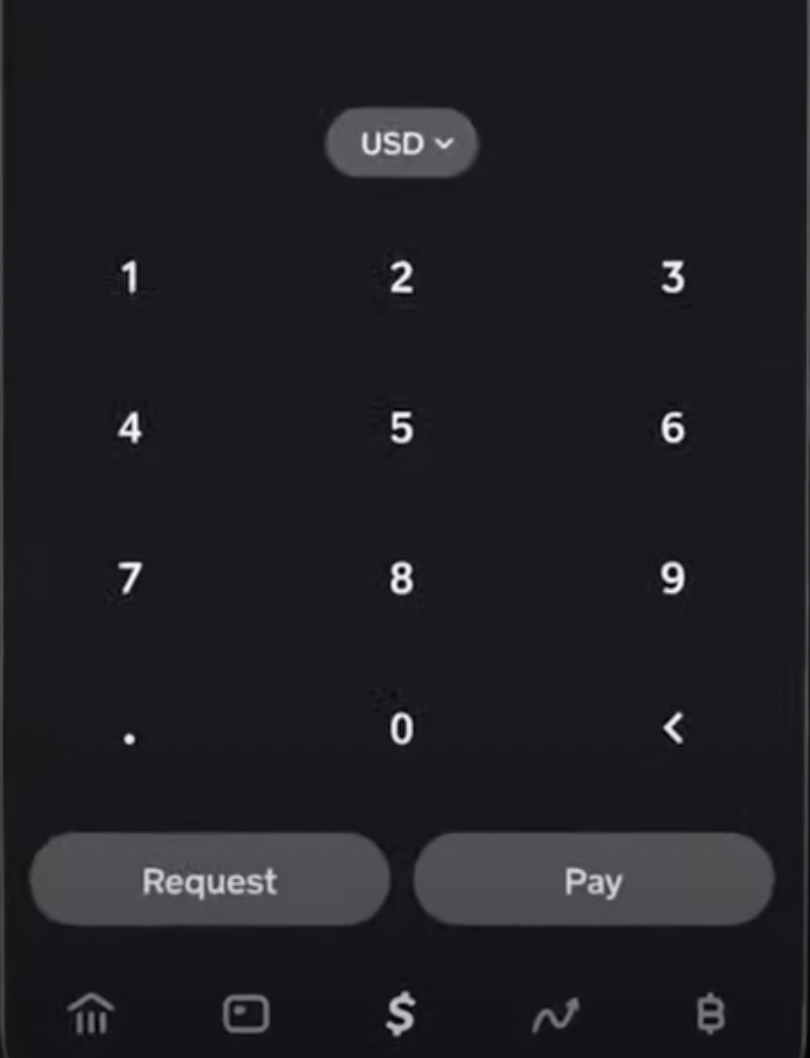

Receive Money

- Open the Cash App on your phone or tablet.

- Go to the dollar sign “$” tab in the bottom center of the screen to make a money request.

- Enter a dollar amount, then click the “Request” button in the bottom-left corner.

- Choose a person (or many persons) from the list of suggested people or manually input their email, phone number, or $cashtag to make a money request. If you like, you may include a note to remind them what it’s for.

- Then, in the top-right corner of the screen, hit the green “Request” button.

Make Payments

You’ll get the Cash Card when you join up for the Cash App and create an account. This is a Visa-branded debit card that you may use to spend the money in your Cash App account on items and services. The Cash Card is widely recognized and may be used everywhere Visa is accepted.

Advantages

The reality is that it isn’t like any other debit card you’ve ever seen. As a Cash App cardholder, you have access to a few benefits that are just available to you. The following is a list of some of them.

- Special Discounts on Coffee

Coffee and coffee shops are two of my favorite things. If you frequently visit coffee shops, you should obtain your Cash App card right now so you can save $1 on your coffee purchases.

- Other Sorts of Boosts

What if we told you that the $1 off each cup of coffee you get as a Cash App card member is only one of the many benefits you enjoy?

It’s worth noting that you may only have one Cash app boost active at a time, and boosts expire after 24 hours. You can exchange as much as you want if you need another boost.

You will, however, need to wait for a reset after utilizing a boost. It might take up to two hours for a reset to complete.

- Google and Apple Pay with Cash App

You can use your cash card to make Apple Pay and Google Pay payments if you have one. You may make Apple and Google Store payments after you’ve connected the cash card to your Apple Wallet and Google Pay.

Read: Can I Load my Cash App Card at Walgreens?

Disadvantages

- Low Limit on the First 30 Days

One of the most significant drawbacks of Cash App is that you are only allowed to send and receive $1,000 in the first 30 days. After that, you can request a rise in your limit. However, if you need to make large transactions right away, you may need to utilize another app.

Outside of the United States and the United Kingdom, the Cash App is not available. As a result, if you frequently travel internationally, you may need to utilize a different mobile payment service.

Conclusion

Connecting your bank account to a Cash App account allows you to simply load money onto a Cash App card via the mobile app without having to visit any of the retailers.

After transferring money from your bank to your card, you may check your Cash account balance.

The procedure is simple to follow. When you log in to your account, your balance will be displayed on the dashboard or home screen, or at the top center of the screen.